Enterprise on Wall Road in Manhattan Pgiam/iStock through Getty Pictures

Table of Contents

Funding Thesis

This can be a comparison-analysis of securities’ costs ensuing from investor expectations already produced by cautious examinations of financial, aggressive, and managerial actions and influences both now beneath means or but to come back. The main focus is on the inventory costs, not on the underlying causative minutia effectively evaluated by these knowledgeable and able to coping with that degree of inputs.

We glance to see how precise market worth outcomes have adopted prior value determinations of the steadiness between worth dangers and worth reward the place that steadiness in every day comparisons in the course of the previous 5 years has been like it’s seen now particularly for Prudential Monetary, Inc. (NYSE:PRU) and for Lincoln Nationwide Company (LNC). Problems with forecast credibility, frequency, steadiness and measurement in every route all could have significance within the comparisons with various funding candidates having comparable aggressive circumstances and frequent investor references.

First firm description

“Prudential Monetary, Inc., along with its subsidiaries, supplies insurance coverage, funding administration, and different monetary services in the USA and internationally. It operates by eight segments: Retirement, Group Insurance coverage, Particular person Annuities, Particular person Life, Assurance IQ, Worldwide Companies, and Closed Block. The corporate gives funding administration providers and options associated to public mounted revenue, public fairness, actual property debt and fairness, personal credit score and different options. The corporate gives its services to particular person and institutional prospects by its proprietary and third-party distribution networks. Prudential Monetary, Inc. was based in 1875 and is headquartered in Newark, New Jersey.”

Supply: Yahoo Finance

Description of Different Funding Firm

“Lincoln Nationwide Company, by its subsidiaries, operates a number of insurance coverage and retirement companies in the USA. It operates by 4 segments: Annuities, Retirement Plan Companies, Life Insurance coverage, and Group Safety. The corporate distributes its merchandise by consultants, brokers, planners, brokers, monetary advisors, third-party directors, and different intermediaries. Lincoln Nationwide Company was based in 1905 and relies in Radnor, Pennsylvania.”

Supply: Yahoo Finance

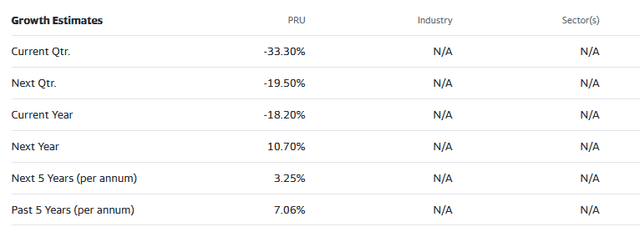

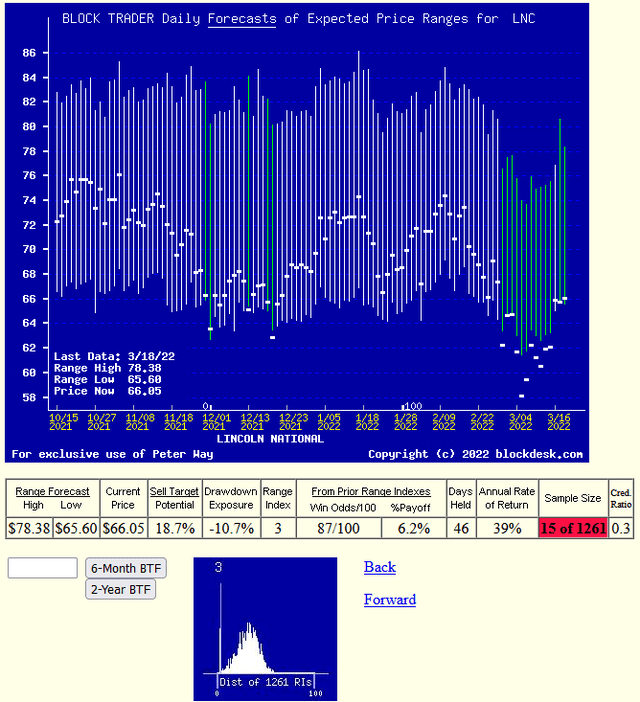

The Danger~Reward Balances of Funding Candidates

Determine 1

blockdesk.com

(Used with permission)

The tradeoffs listed below are between near-term upside worth features (inexperienced horizontal scale) seen price defending in opposition to by Market-makers with brief positions in every of the shares, and the prior precise worth drawdowns skilled throughout holdings of these shares (crimson vertical scale). Each scales are of % change from zero to 25%.

The intersection of these coordinates by the numbered positions is recognized by the inventory symbols within the blue subject to the correct.

The dotted diagonal line marks the factors of equal upside worth change forecasts derived from Market-Maker [MM] hedging actions and the precise worst-case worth drawdowns from positions that would have been taken following prior MM forecasts like at this time’s.

Our principal curiosity is in PRU at location [1] and secondary curiosity is in LNC at location [7]. A “market index” norm of reward~threat tradeoffs is obtainable by SPDR S&P500 index ETF (SPY) additionally at [9].

These forecasts are implied by the self-protective behaviors of MMs who should normally put agency capital at non permanent threat to steadiness purchaser and vendor pursuits in serving to big-money portfolio managers make quantity changes to multi-billion-dollar portfolios. Their protecting actions outline every day the extent of possible anticipated worth modifications for hundreds of shares and ETFs.

This map is an effective start line, however it may possibly solely cowl a few of the funding traits that usually ought to affect an investor’s alternative of the place to place his/her capital to work. The desk in Determine 2 covers the above issues and several other others.

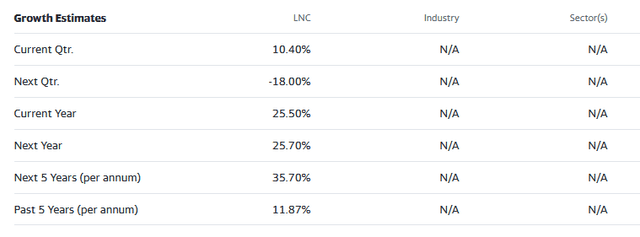

Evaluating Different Investments

Determine 2

(Used with permission)

The value-range forecast limits of columns [B] and [C] get outlined by MM hedging actions to guard agency capital required to be put susceptible to worth modifications from quantity commerce orders positioned by big-$ “institutional” shoppers.

[E] measures potential upside dangers for MM brief positions created to fill such orders, and reward potentials for the buy-side positions so created. Prior forecasts like the current present a historical past of related worth draw-down dangers for patrons. Probably the most extreme ones truly encountered are in [F], throughout holding durations in effort to achieve [E] features. These are the place patrons are most probably to just accept losses.

[H] tells what quantity of the [L] pattern of prior like forecasts have earned features by both having worth attain its [B] goal or be above its [D] entry price on the finish of a 3-month max-patience holding interval restrict. [I] offers the web gains-losses of these [L] experiences and [N] suggests how credible [E] could also be in comparison with [ I ].

The historic samples are particular to every inventory, at forecast dates of every one’s steadiness between upside and draw back being like that seen at this time. A minimal variety of prior experiences out of the previous 5 years’ attainable every day forecasts for significance is ready at 15. The pink backgrounds of [T] for AFL and MFC warn of their failure now at at this time’s RI ranges.

Additional Reward~Danger tradeoffs contain utilizing the [H] odds for features with the 100 – H loss odds as weights for N-conditioned [E] and for [F], for a combined-return rating [Q]. The everyday place holding interval [J] on [Q] supplies a determine of advantage [fom] rating measure [R] helpful in portfolio place preferencing. Determine 2 is row-ranked on R amongst candidate securities, with BRKR in prime rank.

Together with the candidate-specific shares these choice issues are offered for the averages of some 3300 shares for which MM price-range forecasts can be found at this time, and 20 of the best-ranked (by fom) of these forecasts, in addition to the forecast for S&P500 Index ETF (SPY) as an equity-market proxy.

What makes LNC most tasty within the group at this cut-off date is its means to supply earnings most persistently at its current working steadiness between share worth threat and reward. As proven in column [T] of determine 2, these ranges fluctuate considerably between shares. The Vary Index [G] tells the place at this time’s worth lies relative to the MM neighborhood’s forecast of higher and decrease limits of coming costs. With LNC at a RI of solely 3, 97% of the vary is to the upside, and the English (UK) model of PRU (PUK) the imbalance benefit is even higher with a present market 2% under the underside of its forecast vary for a RI of -2.

What issues is the web acquire between funding features and losses truly achieved following the forecasts, proven in column [I]. The Win Odds of [H] tells what quantity of the Pattern RIs of every inventory had been worthwhile; 87% by LNC, 62% by PUK, and solely 61% by PRU. The web payoffs [I] produced CAGRs [K] of 39% by LNC, 26% PUK, and solely 14% by PRU when common holding durations [J] of these sample-induced forecasts are included.

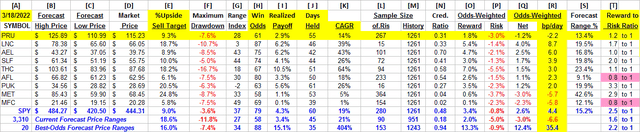

Latest Developments in MM Worth-Vary Forecasts for PRU

Determine 3

(Used with permission)

This image is not a “technical chart” of previous costs for PRU. As an alternative, it’s the previous 6 months of every day worth vary forecasts of market actions but to come back within the subsequent few months. The one previous info there’s the closing inventory worth dot on the day of every forecast.

That information splits the worth vary’s reverse forecasts into upside and draw back prospects. Their tendencies over time present extra insights into coming potentials, and helps preserve perspective on what could also be coming.

The small image on the backside of Determine 3 is a frequency distribution of the Vary Index’s look every day in the course of the previous 5 years of every day forecasts. The Vary Index [RI] tells how a lot the draw back of the forecast vary occupies that share of your entire vary every day, and its frequency suggests what could seem “regular” for that inventory, within the expectations of its evaluators’ eyes.

Right here the current RI degree is close to mid-range, indicating greater ranges (and costs) would possibly realistically be anticipated. Ought to that start to occur, its progress would possibly finally attain a degree the place PRU worth is beginning to “swim upstream” as a extra frequent future occasion.

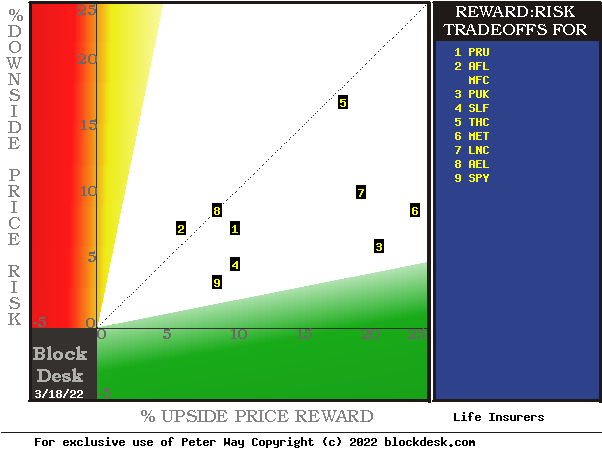

The parallel image now for LNC in Determine 4 supplies a state of affairs the place robust upside expectations have risen and nonetheless have appreciable room for achievement.

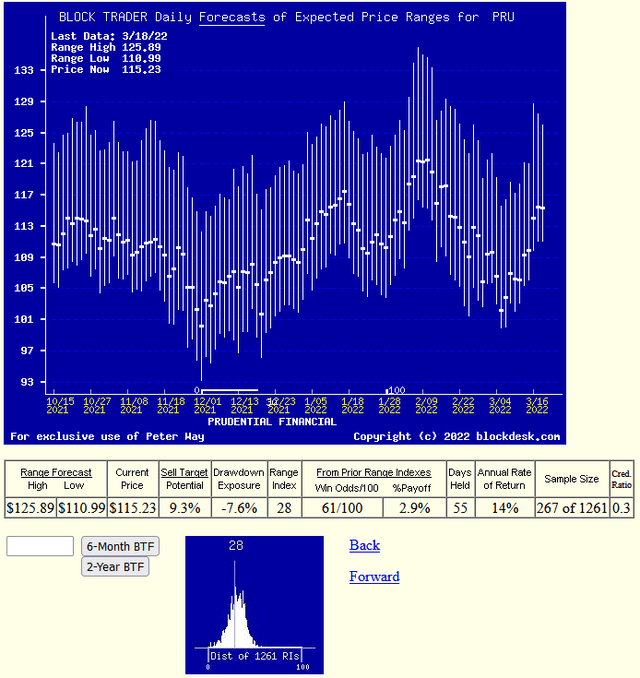

Determine 4

(Used with permission)

The small, decrease image right here of Determine 4 reveals the robust previous incidence of bigger Vary Indexes, sometimes with greater market costs.

Conclusion

Amongst these various investments explicitly in contrast Lincoln Nationwide Company seems to be a logical purchase desire over Prudential Monetary, Inc. for buyers looking for near-term capital acquire.