Our aim right here at Credible Operations, Inc., NMLS Quantity 1681276, known as “Credible” under, is to provide the instruments and confidence it is advisable to enhance your funds. Though we do promote merchandise from our accomplice lenders who compensate us for our companies, all opinions are our personal.

The newest tendencies in rates of interest for pupil mortgage refinancing from the Credible market, up to date weekly. (iStock)

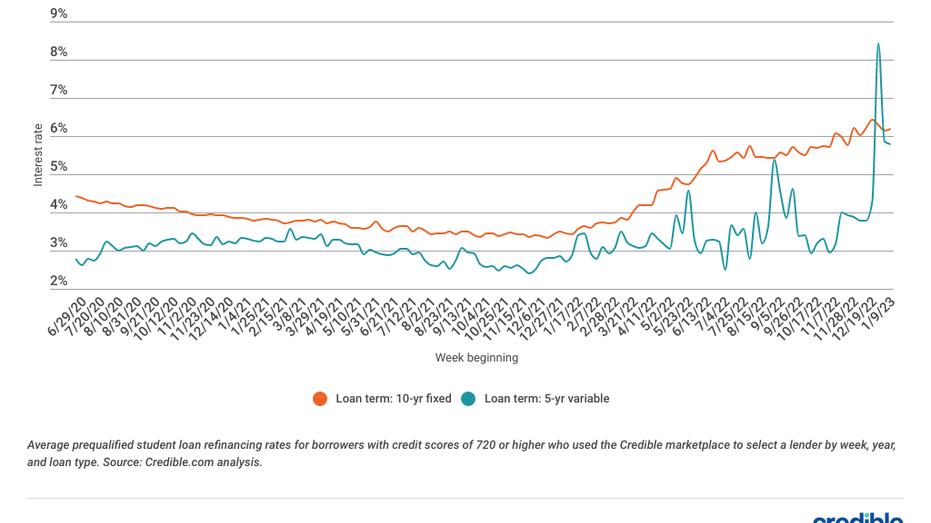

Charges for well-qualified debtors utilizing the Credible market to refinance pupil loans fell this week for 5-year variable-rate loans and rose for 10-year mounted fee loans.

For debtors with credit score scores of 720 or increased who used the Credible market to pick a lender through the week of Jan. 9, 2023:

- Charges on 10-year fixed-rate refinance loans averaged 6.18%, up from 6.15% the week earlier than and up from 3.78% a 12 months in the past. Charges for this time period hit their lowest level of 2022 through the week of Jan. 10, after they have been at 3.44%.

- Charges on 5-year variable-rate refinance loans averaged 5.79%, down from 5.85% the week earlier than and up from 3.27% a 12 months in the past. Charges for this time period hit their lowest level of 2022 through the week of July 4, after they have been at 2.51%.

Table of Contents

Pupil mortgage refinancing weekly fee tendencies

In case you’re interested by what sort of pupil mortgage refinance charges you might qualify for, you should use a web based software like Credible to check choices from completely different personal lenders. Checking your charges will not have an effect on your credit score rating.

Present pupil mortgage refinancing charges by FICO rating

To supply aid from the financial impacts of the COVID-19 pandemic, curiosity and funds on federal pupil loans have been suspended via this 12 months, presumably so long as 30 days previous June 30, 2023. So long as that aid is in place, there’s little incentive to refinance federal pupil loans. However many debtors with personal pupil loans are benefiting from the low rate of interest surroundings to refinance their training debt at decrease charges.

In case you qualify to refinance your pupil loans, the rate of interest you might be provided can depend upon elements like your FICO rating, the kind of mortgage you’re searching for (mounted or variable fee) and the mortgage compensation time period.

The chart above exhibits that good credit score may help you get a decrease fee and that charges are usually increased on loans with mounted rates of interest and longer compensation phrases. As a result of every lender has its personal technique of evaluating debtors, it’s a good suggestion to request charges from a number of lenders so you’ll be able to evaluate your choices. A pupil mortgage refinancing calculator may help you estimate how a lot you would possibly save.

If you wish to refinance with a bad credit score, you might want to use with a cosigner. Or, you’ll be able to work on bettering your credit score earlier than making use of. Many lenders will permit youngsters to refinance mother or father PLUS loans in their very own title after commencement.

You may use Credible to check charges from a number of personal lenders without delay with out affecting your credit score rating.

How charges for pupil mortgage refinancing are decided

The charges personal lenders cost to refinance pupil loans rely partly on the economic system and rate of interest surroundings, but additionally the mortgage time period, the kind of mortgage (fixed- or variable-rate), the borrower’s creditworthiness and the lender’s working prices and revenue margin.

About Credible

Credible is a multi-lender market that empowers customers to find monetary merchandise which are one of the best match for his or her distinctive circumstances. Credible’s integrations with main lenders and credit score bureaus permit customers to shortly evaluate correct, customized mortgage choices – with out placing their private data in danger or affecting their credit score rating. The Credible market supplies an unmatched buyer expertise, as mirrored by over 5,000+ optimistic Trustpilot opinions and a TrustScore of 4.7/5.