Excessive buy costs are a trademark of immediately’s housing market. However they don’t seem to be the explanation it’s possible you’ll must spend extra in your dwelling insurance coverage than you probably did earlier than the pandemic.

Altering dwelling costs even have surprisingly little impact on the quantity of insurance coverage a house wants, in accordance with Richard Lavey, president of Hanover Company Markets at The Hanover Insurance coverage Group, based mostly in Worcester, Mass.

“If the market worth goes up by 40%, it does not imply your insurance coverage protection wants go up by 40%. It may simply be the land worth, or the demand, or lack of provide in a specific zip code” driving the rise, he says.

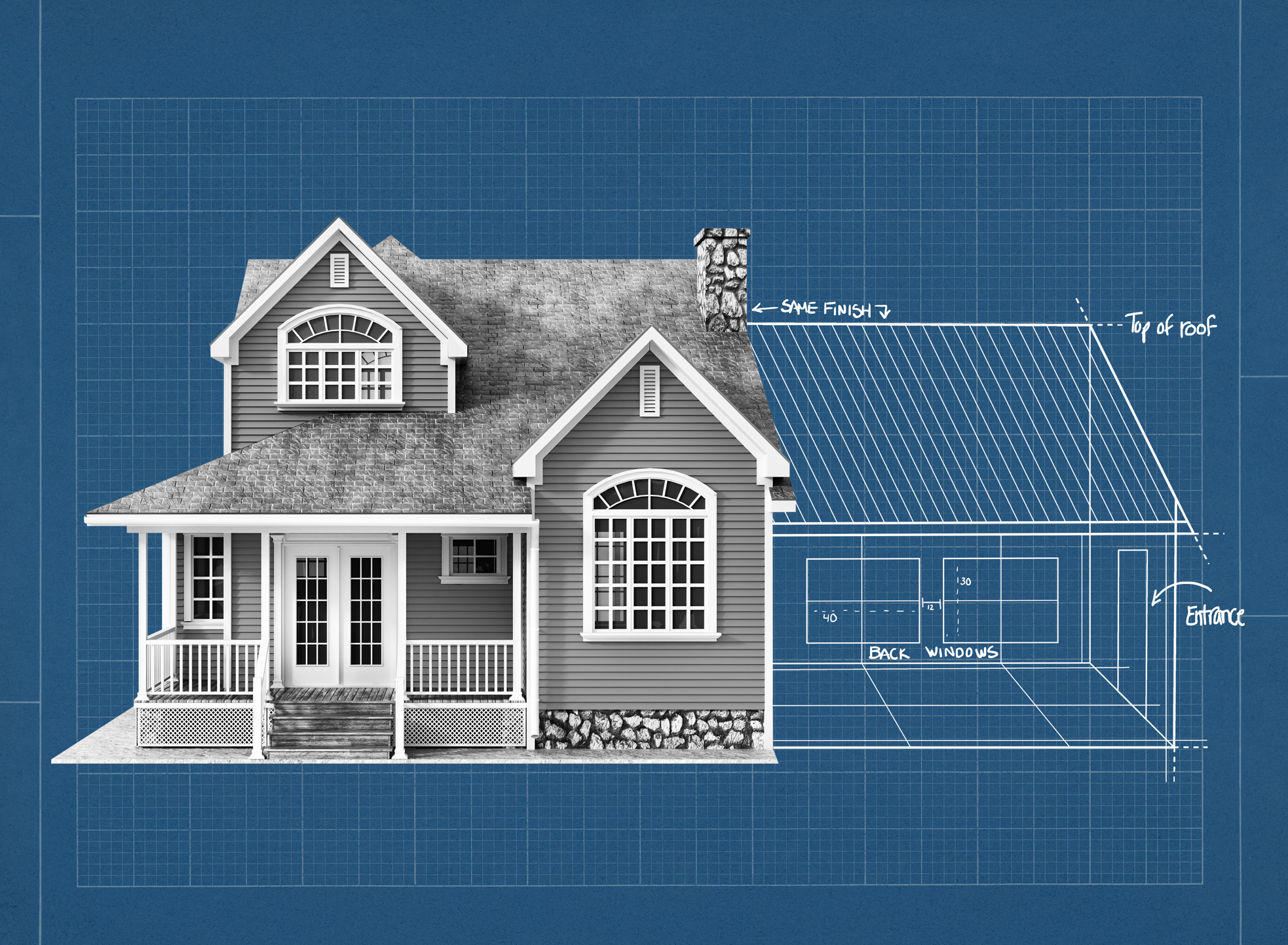

What does matter to your insurance coverage, Lavey explains, is whether or not the associated fee to switch the house has risen by greater than is customary. That’s as a result of your protection quantity is calculated in accordance with how a lot it might price to rebuild your private home — utilizing the identical or related supplies and workmanship — in case you have been to endure a total-loss disaster equivalent to a fireplace.

Two elements have triggered these prices to rise sharply in the course of the pandemic: pricier development prices and an explosion in dwelling renovation and growth.

Right here’s how a lot every might have affected the associated fee to rebuild your private home — and the attainable want to regulate your insurance coverage protection upwards.

Table of Contents

Excessive prices for supplies and labor

Most owners insurance coverage insurance policies have a provision that mechanically adjusts a house’s insured worth for inflation — elevating it, say, by 3% from 12 months to 12 months. However these commonplace hikes will not be sufficient in the intervening time, given how rebuilding prices have escalated.

“It’s in regards to the provides, the supplies — they’ve elevated significantly due to the pandemic,” says Robin Jaekel, vp of non-public traces at dealer Glenn Insurance coverage, based mostly in Absecon and Malaga, N.J.

Earlier this 12 months, it was estimated that then-higher lumber costs may add practically $36,000 to the price of constructing a brand new dwelling in contrast with typical years, in accordance with the Nationwide Affiliation of House Builders.

Whereas lumber costs have come down about 70% from the stratospheric ranges they hit in early 2021, they’re nonetheless elevated above pre-pandemic norms — and the prospect of additional will increase can’t be dominated out if the Delta variant triggers labor shortages or wildfires damage provide chains.

And lumber isn’t the one constructing materials for which brief provide is affecting costs. Since Might 2020, in accordance with the Nationwide Affiliation of House Builders, the price of metal mill merchandise has risen by over 75% and the price of ready asphalt and tar roofing and siding merchandise by practically 15%.

Labor prices have additionally risen, say specialists, as a consequence of demand from elevated renovations and, in some areas, from intensive rebuilding after wildfires and different pure disasters.

Development in dwelling renovation and growth

The pandemic has prompted many extra current owners to make renovations that improve or increase their residing area, particularly if the entire household resides, working and studying there.

In keeping with The Hanover Insurance coverage Group, a bit greater than half (54%) of house owners have made enhancements or undertaken renovations over the course of the pandemic, and greater than two thirds (69%) plan to take action throughout the subsequent 12 months.

That’s a number of funding into America’s properties, however protection underneath owners insurance coverage isn’t protecting tempo. “When individuals do these renovations, they’re rising their alternative prices,” Lavey says. But Hanover’s research discovered that solely 40% of the owners who undertook main renovation tasks contacted their insurance coverage corporations to regulate their protection ranges to mirror the worth of their dwelling factoring within the new enhancements.

Your insurance coverage improve choices

That is an opportune time to have a dialog along with your insurance coverage service or dealer to be sure you don’t have a protection hole in your owners coverage.

You may merely elevate the insured worth of your private home to cowl the hole. However relying on the kind of protection you have got, elevating the worth may nonetheless go away you weak to future price gaps.

Probably the most fundamental protection sort, often called an precise money worth coverage, elements in depreciation of the house’s elements — its roof, say, or kitchen home equipment. As a hedge towards depreciation, many owners purchase what’s often called enhanced alternative price protection, which permits the payout to exceed the house’s insured worth — sometimes by 25% to 50%. Naturally, that buffer comes at a worth — a ten% premium improve is typical, says Nancy Albanese, vp of non-public insurance coverage at BMT Insurance coverage Advisors.

Then come assured alternative price insurance policies, an extra enhancement that ensures your private home shall be restored to as near its authentic situation as attainable, with out regard for price. This final protection can add an extra 20% to 25% to your premiums, says Albanese, however protects those that have very high-end fixtures and finishes, equivalent to granite counter tops or marble flooring.

“We’d argue you actually need to speak to an expert and enable you to estimate the alternative price of your private home,” Lavey says. “As we speak with the development of analytics and availability of third-party knowledge, we’re getting smarter and higher about that subject.” And when you won’t be capable to do something about worth inflation, you can also make certain your private home is protected against its results in case you expertise a catastrophe.

Extra from Cash:

6 Finest House Insurance coverage Firms of August 2021

If Catastrophe Strikes, Your House Insurance coverage Might Not Cowl the Price of Rebuilding