KLH49/iStock by way of Getty Pictures

After releasing an working replace on 1/18/23, Revolutionary Industrial (NYSE:IIPR) dropped about 16% on the nineteenth. I feel it’ll fall a lot additional as time goes on. A lot of their report could be described as kicking the can down the highway and throwing good cash after unhealthy. This text will dig into the true property fundamentals and clarify why I feel that is simply the tip of the iceberg of missed lease.

Listed below are their statements about lease assortment.

Lease assortment for IIP’s working portfolio (calculated as base lease and property administration charges collected over contractually due quantities) was as follows:

- 92% collected as of immediately for the month ending January 31, 2023 (together with roughly $324,000 of a safety deposit utilized for cost of lease for IIP’s lease with Holistic Industries Inc. (Holistic) at IIP’s Michigan property and receipt of the total lease cost from Sozo Well being, Inc. (Sozo))

- 94% collected for the three months ended December 31, 2022 (together with roughly $541,000 of safety deposits utilized for cost of lease for IIP’s lease with Sozo); and

- 97% collected for the 12 months ended December 31, 2022 (together with an combination of roughly $2.7 million of safety deposits utilized for cost of lease for IIP’s leases with Kings Backyard Inc. (Kings Backyard) and Sozo).

Consuming safety deposits doesn’t depend as amassing lease. Precise assortment figures must be considerably decrease.

Typically tenants run right into a little bit of operational hassle. It occurs in each business and most REITs sooner or later of their operations have intervals the place tenants default on leases. These defaults in themselves aren’t the issue. It’s IIPR’s acquisition course of that makes defaults so harmful.

Not all defaults are created equal

Earlier this month I wrote about the idea of the worth of a tenant to the owner. In that article I defined that if properties are fungible and the lease being paid is roughly market lease the owner is unlikely to be adversely affected by tenant default. The REIT can re-lease the area at related charges and would possibly incur some minor leasing bills in doing so, however total it is not a giant deal. I then went on to recommend that for IIPR particularly, lack of tenant is a devastating occasion. There are 3 points particular to IIPR that make tenant troubles exceedingly harmful.

- Leases are dramatically above market charges

- Property values are a fraction of costs paid

- Properties aren’t fungible at that value level

This all boils right down to IIPR’s sale leaseback technique functionally baking loans into the leases.

Over 90% of IIPR’s properties are industrial. They’re situated within the following areas.

S&P International Market Intelligence

In premier areas, industrial warehouses price about $100 per foot. In these areas you should buy warehouses for $50-$70 per sq. foot. Right here is the road from IIPR’s press launch that I discovered to be probably the most troubling:

Complete invested / dedicated capital per sq. foot: $274.

So the warehouse itself is price about $70 per foot. What’s the different $200 per foot that IIPR paid for the sale leaseback?

Formally it’s designated as landlord reimbursed capex on the property as these warehouses are outfitted to change into rising amenities.

I feel it’s extra precisely described as a mortgage that IIPR is paying to the tenant with hopes to make it again via lease over the very lengthy lease phrases. Right here is the opposite troubling line of IIPR’s report:

Weighted-average lease size: 15.3 years.

So IIPR offers someplace within the ballpark of $200 per sq. foot of TI or equal (tenant enchancment allowances) on a $70 per sq. foot constructing. In change, IIPR will get lease that’s many occasions greater than what is often paid on an industrial property.

If the tenant pays lease for the total 15 12 months time period, IIPR is made entire with a wholesome revenue on high. It’s a high-quality enterprise mannequin in case you have nice tenants, however similar to another mortgage kind of funding, you must be certain the counterparty is nice for the cash.

That is what differentiates IIPR from different REITs. Most REITs spend money on the property. The properties themselves are worthwhile such that the REIT doesn’t depend on its tenants as a result of the sheer worth of the property permits the REIT to search out new tenants and receives a commission lease.

IIPR as a substitute selected a enterprise mannequin the place it invests in its tenants. Bear in mind the numbers from above: $70 per sq. foot for the constructing. $200 per sq. foot to the tenant for TI.

That makes IIPR terribly reliant upon its tenants. If the tenants fail, that $200 is out the window.

Nicely, sadly the marijuana enterprise is a quite fragile and nascent business with inexperienced gamers and shaky financials. It was solely a matter of time earlier than no less than among the tenants ran out of cash.

Again in June of 2022 I warned about the weak point of IIPR’s tenants. I used to be swiftly vindicated as on June thirtieth a big tenant, Inexperienced Thumb, had difficulties.

Nonetheless, as time went available on the market appeared to overlook in regards to the threat concerned with IIPR and the inventory continued to commerce at a quite astronomical valuation relative to the worth of its properties.

With the current announcement, nonetheless, it appears as if the flood gates have opened. Tenant troubles can now not be considered an remoted incident. It’s business extensive with numerous tenants failing to pay lease. Once more from IIPR’s operations replace:

As of January 18, 2023:

SH Dad or mum, Inc. (Parallel) was in default on its obligations to pay lease at one in all IIP’s Pennsylvania properties (roughly 2.9% of invested / dedicated capital).

Inexperienced Peak Industries, Inc. (Skymint) was in default on its obligations to pay lease at one in all IIP’s Michigan properties underneath building (roughly 2.7% of invested / dedicated capital).

Associates of Medical Investor Holdings, LLC (Vertical) had been in default on their obligations to pay lease at IIP’s California properties (roughly 0.7% of invested / dedicated capital).

As of January 18, 2023, IIP had executed lease amendments to incorporate cross-default provisions and/or lengthen lease phrases in change for restricted base lease deferrals for the next three properties:

One California property and one Michigan property leased by Holistic (roughly 1.8% of invested / dedicated capital within the combination):

100% of base lease to be utilized from the safety deposits held by IIP for the 9 months ending September 30, 2023 with respect to the Michigan property and the eight months ending September 30, 2023 with respect to the California property, with professional rata payback of the safety deposits over 12 months beginning January 2024.

One Missouri property leased by Calyx Peak, Inc. (roughly 1.2% of invested / dedicated capital):

100% base lease deferral via March 31, 2023, with professional rata payback over the next 12 months.

The report goes on to element how IIPR continues to be placing more cash into these tenants.

Building in progress: two properties (beforehand leased to Kings Backyard), and an growth undertaking at a property the place Kings Backyard continues to occupy the property and pay lease, representing roughly 395,000 rentable sq. toes within the combination.

San Bernardino property (roughly 192,000 rentable sq. toes): IIP is actively evaluating various non-cannabis makes use of for the property as a result of market circumstances in California and adjustments within the zoning of the property.

Cathedral Metropolis property (roughly 23,000 rentable sq. toes): IIP executed a letter of intent to lease the property and is negotiating lease phrases with the potential tenant. There could be no assurance that IIP will lease the property on the phrases anticipated, or in any respect.

I discover the San Bernadino property to be notably telling of the dangers to IIPR as they’re now attempting to lease the property as a daily warehouse. Common warehouses generate lease per foot of about $7 and as I’m repeatedly stating IIPR is paying $274 per foot. $7 of income is previous to any bills.

At that charge it’ll take a really very long time simply to interrupt even.

The place is the underside?

IIPR has persistently operated at pretty low leverage financing most of their acquisitions with fairness. As such, I do not see chapter as an actual concern right here. Nonetheless, if sufficient tenants cease paying lease the worth of their leases goes away which leaves simply the worth of their properties.

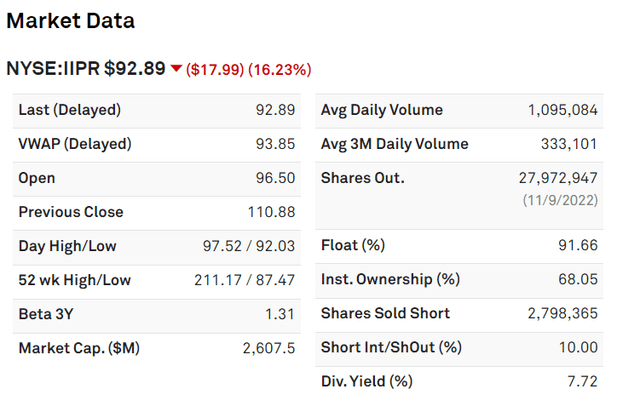

They’ve 110 properties with a complete of 8.7 million rentable sq. toes. In the event that they lose their marijuana associated tenants these are simply warehouses and would return to a warehouse valuation of about $70 per foot. That may be a property worth of simply over $600 million. That may be a quite important drop from their present market cap of $2.6B

S&P International Market Intelligence

I do not suppose each tenant will default so maybe they will retain among the worth of their leases, however I do suppose a good portion will fail.

As such, the honest worth of IIPR is someplace between $600 million and $2.6B relying on the severity of the tenant default wave.

There may be nonetheless time to get out

Even with the 16% or so drop because the operations replace, IIPR stays considerably overvalued. There may be nonetheless loads of time to promote and transfer on to raised issues.

Maybe capital could be higher invested in a distinct industrial REIT that invests in its properties quite than its tenants. There is just one different industrial REIT that invests in tenants quite than property and that’s LXP Industrial Belief (LXP). In any other case, throw a dart, the alternatives are fairly strong. Warehouses are performing nicely and industrial REITs broadly are undervalued.