Petco Well being and Wellness Firm, Inc. (NASDAQ:WOOF) shareholders ought to be glad to see the share value up 15% within the final month. However that’s minimal compensation for the share value under-performance over the past 12 months. The chilly actuality is that the inventory has dropped 41% in a single 12 months, under-performing the market.

With that in thoughts, it is price seeing if the corporate’s underlying fundamentals have been the driving force of long run efficiency, or if there are some discrepancies.

Take a look at our newest evaluation for Petco Well being and Wellness Firm

Whereas the environment friendly markets speculation continues to be taught by some, it has been confirmed that markets are over-reactive dynamic programs, and traders will not be all the time rational. One flawed however cheap approach to assess how sentiment round an organization has modified is to match the earnings per share (EPS) with the share value.

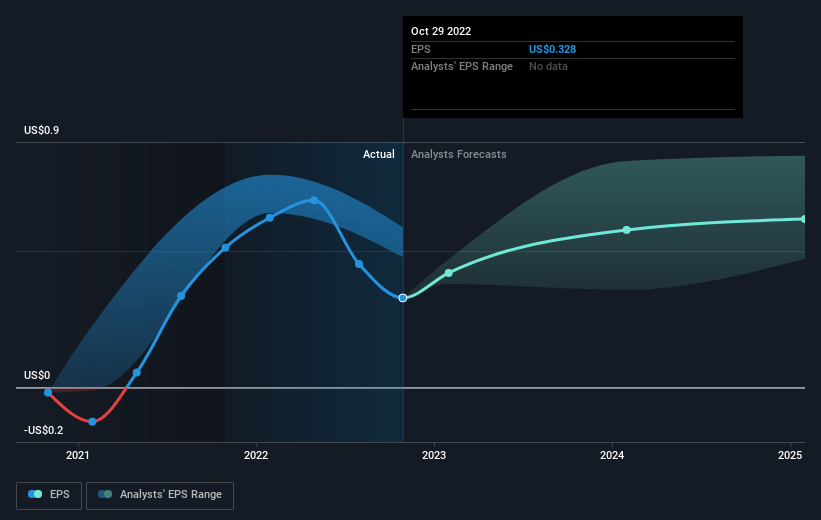

Sadly Petco Well being and Wellness Firm reported an EPS drop of 36% for the final 12 months. This proportional discount in earnings per share is not removed from the 41% lower within the share value. So plainly the market sentiment has not modified a lot, regardless of the weak outcomes. As an alternative, the change within the share value appears to discount in earnings per share, alone.

The corporate’s earnings per share (over time) is depicted within the picture beneath (click on to see the precise numbers).

It’s after all glorious to see how Petco Well being and Wellness Firm has grown income over time, however the future is extra vital for shareholders. Take a extra thorough have a look at Petco Well being and Wellness Firm’s monetary well being with this free report on its stability sheet.

A Completely different Perspective

We doubt Petco Well being and Wellness Firm shareholders are pleased with the lack of 41% over twelve months. That falls wanting the market, which misplaced 12%. There is no doubt that is a disappointment, however the inventory could effectively have fared higher in a stronger market. Placing apart the final twelve months, it is good to see the share value has rebounded by 13%, within the final ninety days. Let’s simply hope this is not the widely-feared ‘useless cat bounce’ (which might point out additional declines to return). I discover it very attention-grabbing to take a look at share value over the long run as a proxy for enterprise efficiency. However to really achieve perception, we have to think about different data, too. As an illustration, we have recognized 3 warning indicators for Petco Well being and Wellness Firm (1 should not be ignored) that you ought to be conscious of.

However be aware: Petco Well being and Wellness Firm might not be the very best inventory to purchase. So take a peek at this free record of attention-grabbing corporations with previous earnings progress (and additional progress forecast).

Please be aware, the market returns quoted on this article replicate the market weighted common returns of shares that at present commerce on US exchanges.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Petco Well being and Wellness Firm is probably over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to carry you long-term targeted evaluation pushed by elementary information. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.