DKosig/E+ by way of Getty Photos

Funding Thesis: Progress in 5G subscriptions has resulted in sturdy income development and a strengthening money place. I take the view that 5G subscription development has additional room to run, and we might see additional upside within the inventory accordingly.

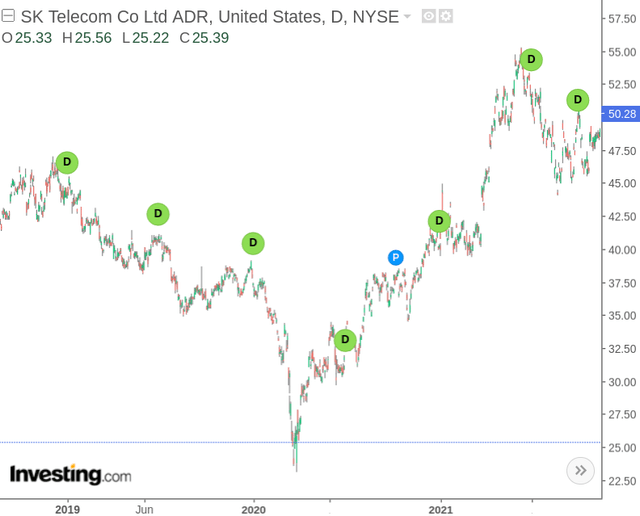

SK Telecom Co. Ltd. ADR (SKM) noticed a big rebound in worth after 2020 regardless of a difficult surroundings for telecommunications firms globally (worth displayed earlier than inventory cut up on the finish of November 2021):

One of many major obstacles for telecommunications firms throughout the pandemic was a big drop in roaming and overage income, attributable to decrease worldwide journey and mobility extra typically.

The aim of this text is to analyze whether or not SK Telecom might see extra upside from right here.

Table of Contents

Latest Efficiency

Let’s check out the corporate’s stability sheet over the previous yr. We will see that each the money to present liabilities ratio in addition to the money to long-term borrowings ratio has grown considerably from This fall 2020.

| This fall 2020 | Q1 2021 | Q2 2021 | Q3 2021 | This fall 2021 | |

| Money | 199.1 | 145.1 | 211.9 | 315.7 | 407.7 |

| Present Liabilities | 1306.8 | 1322.1 | 1240 | 1358.6 | 1433.8 |

| Lengthy-term borrowings and notes payable | 1528.6 | 1386.6 | 1376.6 | 1403.8 | 1255.1 |

| Money to present liabilities ratio | 15.24% | 10.97% | 17.09% | 23.24% | 28.43% |

| Money to long-term borrowings ratio | 13.02% | 10.46% | 15.39% | 22.49% | 32.48% |

Supply: Figures sourced from SK Telecom FY21 Earnings Launch – ratios calculated by writer

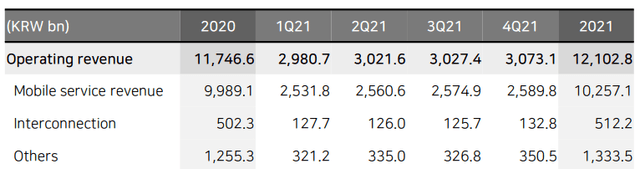

Moreover, we see that income throughout the corporate’s three enterprise segments has seen a lift in income from the identical interval final yr.

SK Telecom FY21 Earnings Launch

Whereas 5G continues to be in its industrial infancy globally and firms have but to completely recoup investments on this space, South Korea is on the forefront of this know-how, with the county having been the primary on the planet to launch a nationwide 5G community and commercialize 5G as a service.

5G Progress

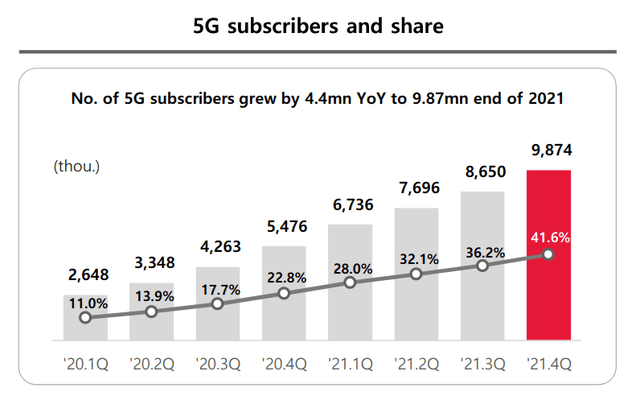

For SK Telecom, the expansion on this space has been very spectacular. We will see that development in share of 5G subscribers has grown from 11% originally of 2020 to over 41% within the final quarter of 2021:

SK Telecom FY21 Earnings Launch

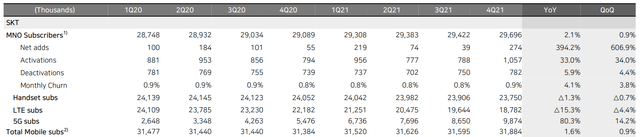

Furthermore, we see that with an 80% development in 5G subscriptions over the previous yr (which coincides with a 15% lower in LTE (4G) subscriptions), shoppers are clearly displaying a propensity to modify.

SK Telecom FY21 Earnings Launch

On this regard, after what has been a difficult surroundings for the telecommunications business globally – SK Telecom is displaying indicators of main the world by way of development in 5G. Because of this, I take the view that the inventory might see elevated curiosity as traders search to diversify from Western telecommunication firms the place 5G has been rising extra slowly.

Wanting Ahead

On a holistic foundation, 5G has been accountable for a good portion of the corporate’s income development. Invariably, there’ll come a degree at which development in 5G will begin to plateau. Nonetheless, I take the view {that a} 41% share of 5G subscribers within the final quarter, development throughout this know-how nonetheless has a lot room to run.

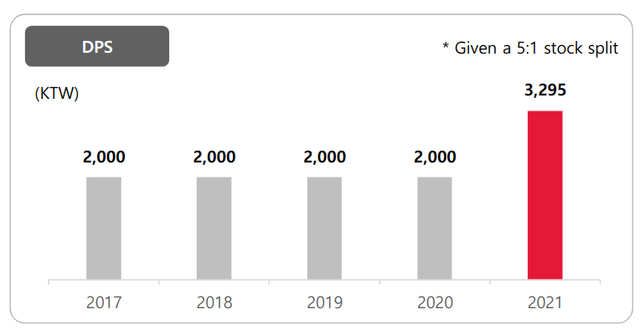

As well as, the money place of the corporate seems to be fairly engaging. Given a 5:1 inventory cut up, 2021 resulted in a 65% development of dividends per share year-on-year.

SK Telecom FY2021 Earnings Launch

From this standpoint, I foresee that the corporate might see additional development on the again of an increase in 5G subscribers, in addition to a robust stability sheet.

Conclusion

To conclude, I take the view that SK Telecom might show to be engaging going ahead, as the corporate has proven a robust money place and is in a great place to additional elevate its dividend whereas assembly short-term debt obligations. As well as, development in 5G doesn’t present indicators of slowing but, and the inventory might see greater ranges on this foundation.

Extra disclosure: This text is written on an “as is” foundation and with out guarantee. The content material represents my opinion solely and by no means constitutes skilled funding recommendation. It’s the accountability of the reader to conduct their due diligence and search funding recommendation from a licensed skilled earlier than making any funding choices. The writer disclaims all legal responsibility for any actions taken primarily based on the knowledge contained on this article.