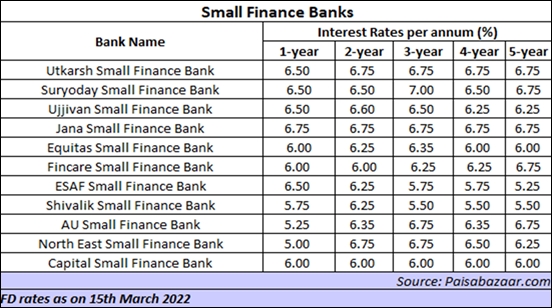

The best fastened deposit slab charges of most small finance banks have elevated by 25 bps or above during the last 6 months.

Saving account rates of interest and stuck deposits rates of interest of Small Finance banks are slowly inching upwards. A number of Small Finance banks have revised the rates of interest for Financial savings and Retail Time period Deposits in March. Some banks are providing 7 per cent to 7.5 per cent on 3-year deposits to depositors.

Suryoday Small Finance Financial institution, Equitas Small Finance Financial institution and Jana Small Finance Financial institution are a few of the Small Finance Banks which have revised their charges upwards. The FD charges in these banks have additionally been elevated in some instances thus offering alternative to senior residents to earn extra on their investments.

“The best FD slab charges of most small finance banks have elevated by 25 bps or above during the last 6 months. Tenure-wise, a lot of the charge modifications by these banks have been applied within the 1-year tenure,” says Gaurav Aggarwal – Senior Director, Paisabazaar.com.

Equitas Small Finance Financial institution, has introduced the revision of rates of interest for Financial savings and Retail Time period Deposits from twenty first March 2022. One can now avail 7% curiosity each year on Financial savings Account for balances above Rs 5 Lakhs as much as Rs 2 Crores. Senior residents can now earn a flat charge of .50% additional over present revised charges on deposits. For FD, senior residents can now earn an curiosity of seven.25% each year for 888 days and the others can get upto 6.75% each year.

Suryoday Small Finance Financial institution revises its FD charges for senior residents throughout all tenors by 20 to 50 foundation factors. One can now get a 7% rate of interest on 3-year deposits, whereas senior residents can get a 7.50 % rate of interest.

Jana Small Finance Financial institution has elevated rates of interest on the saving financial institution accounts, that are efficient as of March 4, 2022. Jana SFB is presently providing a 4.50 % rate of interest on financial savings account balances as much as Rs 1 lakh and providing 7 per cent rate of interest on financial savings account balances of greater than Rs 1 lakh and as much as Rs 50 lakh.

So far as security of cash in Small Finance Financial institution is anxious, right here’s what Aggarwal says – RBI has categorised 11 small finance banks as scheduled banks. This categorisation has introduced the depositors of those small finance banks underneath the quilt of depositor insurance coverage program supplied by DICGC, an RBI subsidiary. This insurance coverage program covers cumulative deposits of as much as Rs 5 lakh of every depositor, which incorporates their present account, financial savings account, fastened deposits and recurring deposits, in case of financial institution failure. Each curiosity in addition to principal elements of their deposits qualify for the insurance coverage cowl. Furthermore, the Rs 5 lakh cowl applies individually to the deposits held with every scheduled financial institution.