St. Johns Insurance coverage Co., one of many bigger property/casualty insurers primarily based in Florida, is now bancrupt and can quickly be liquidated.

The Florida Division of Monetary Companies posted a discover Friday {that a} choose in Leon County, Florida, had appointed the division as receiver for the corporate. DFS will now take steps to liquidate the service’s belongings.

The Florida Division of Monetary Companies posted a discover Friday {that a} choose in Leon County, Florida, had appointed the division as receiver for the corporate. DFS will now take steps to liquidate the service’s belongings.

The information comes lower than two weeks after the Demotech ranking company withdrew St. Johns’ monetary stability ranking, citing an absence of sufficient reserves. Slide, an insurtech firm primarily based in Tampa, has agreed to tackle most of the St. Johns insurance policies in Florida, and policyholders might be moved to Slide beginning this week, DFS stated.

“The division has motioned the courtroom to approve a transition plan that would supply transition insurance policies to Slide Insurance coverage Firm and supply policyholders with steady protection beginning on March 1, 2022,” DFS stated on its web site.

The liquidation order implies that the Florida Insurance coverage Warranty Affiliation will cowl present claims. St. Johns additionally wrote insurance policies in South Carolina and that state’s insurance coverage warranty affiliation will take motion to cowl present claims.

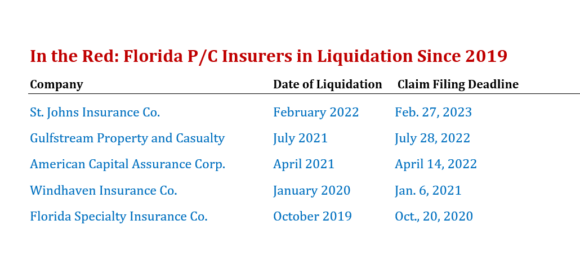

St. Johns is the fifth Florida P/C insurer to be put by means of the liquidation course of within the final three years. The insolvency is the surest indicator but of the state’s worsening insurance coverage market – a market that some longtime trade consultants have stated is now in meltdown, thanks partially to hurricane losses, fraudulent roof claims and extreme claims litigation.

St. Johns introduced earlier this month that it will cease writing new enterprise in Florida on Feb. 15. Six different carriers have introduced comparable plans. These embody United Property and Casualty, Florida Farm Bureau, Lighthouse Insurance coverage, Avatar and TypTap. Progressive stated it will not renew 1000’s of insurance policies within the state.

Including to the issues was the fourth quarter monetary report from Common Insurance coverage Holdings, mum or dad firm of Common Property & Casualty, Florida’s largest personal service. The corporate introduced a $64.5 million loss, earlier than taxes, for This fall 2021. The agency’s mixed ratio, thought of a key measure of profitability, additionally rose considerably for the quarter, to 131%, seven factors above the Q3 in 2020.

Common’s monetary report attributed that to a strengthening of its reserves, the results of inflationary pressures and better reinsurance prices. For the 12 months, Common’s mixed ratio improved over 2020’s quantity, however was nonetheless above 100%.

St. Johns is a couple of quarter the dimensions of Common and has been listed because the eighth-largest P/C insurer in Florida, with some 160,000 policyholders. The pinnacle of Demotech stated not too long ago that the belief of insurance policies by Slide, led by Slide CEO Bruce Lucas, previously with Heritage Insurance coverage, could have been sufficient to assist St. Johns survive.

However Friday’s information ended these hopes.

The Orlando Sentinel newspaper reported that Florida Insurance coverage Commissioner David Altmaier had despatched a letter final week to the state’s chief monetary officer, formally notifying DFS of the receivership.

“The referral of this firm to the DFS’ Division of Rehabilitation and Liquidation is step one in a complete plan to offer a seamless transition for all St. Johns Insurance coverage Firm policyholders,” Altmaier wrote final week.

Insurance coverage trade leaders are hoping that the state Legislature will now come to the rescue for different insurers swimming in troubled waters.

Senate Invoice 1728, by state Sen. Jim Boyd, has handed the Senate Banking and Insurance coverage Committee and an Appropriations subcommittee. If permitted by the total committee right this moment, Monday, Feb. 28, it should transfer to the Senate ground. The invoice would try and restrict some solicitation by roofers promising “free roofs” and would permit extra insurers to pay the precise money worth for broken roofs, not full alternative worth, as is now the case for a lot of home-owner insurance policies.

Subjects

Florida

Crucial insurance coverage information,in your inbox each enterprise day.

Get the insurance coverage trade’s trusted e-newsletter