Abstract. The 2022‑23 Governor’s Funds proposes $1 billion Common Fund in 2022‑23 and $2 billion in 2023‑24 to make state funds on the federal Unemployment Insurance coverage (UI) loans the state acquired throughout the pandemic. The proposed state cost would scale back the excellent mortgage stability by about 15 p.c. On this publish, we replace earlier projections for the UI mortgage compensation and assess the Governor’s proposed funds. We estimate that the $3 billion cost would scale back Common Fund curiosity prices over the compensation interval by a complete of $550 million to $1.1 billion. The cost additionally may scale back employer payroll tax prices in roughly ten years. Ought to the Legislature as a substitute want to present instant tax reduction, one possibility to think about can be to offer employers state UI tax credit to offset their upcoming prices to repay the federal mortgage.

See our Might 2021 report for an in depth overview of the state’s UI system.

Table of Contents

Temporary Overview of UI

UI Program Assists Unemployed Staff. Overseen by the Employment Growth Division (EDD), the UI program supplies weekly funds to employees who misplaced their jobs by way of no fault of their very own. The common cost—excluding federal augmentations throughout the pandemic—is about $330 per week. Employers pay a payroll tax into the state’s UI belief fund to cowl cost prices. Employer UI payroll taxes common 3.6 p.c and are utilized to the primary $7,000 of every worker’s wages. The state’s tax base—$7,000—is the minimal allowable quantity below federal legislation.

States Borrow From Federal Authorities Throughout Financial Downturns. Underneath present state tax and profit guidelines, the UI belief fund doesn’t construct massive sufficient reserves in regular occasions to cowl the rise in claims throughout a recession. Throughout recessions, states could borrow from the federal authorities to proceed cost advantages if state UI funds are inadequate. These loans should be repaid, with curiosity (at present 1.6 p.c yearly), at a later time. The mortgage principal is repaid by automated will increase within the federal UI tax fee employers pay. The mortgage curiosity sometimes has been paid from states’ Common Funds.

Since Pandemic Started, State Has Acquired $20 Billion in Federal UI Loans. Previous to the pandemic, firstly of 2020, the state’s UI belief fund held $3.3 billion in reserves. Regardless of these reserves, the state’s UI belief fund turned bancrupt throughout the summer time of 2020, a number of months following the beginning of the pandemic and related job losses. California, like many different states, used federal loans to proceed paying advantages throughout the pandemic. In whole, the state wanted to borrow about $20 billion from the federal authorities, roughly twice the quantity the state borrowed for UI advantages throughout the Nice Recession.

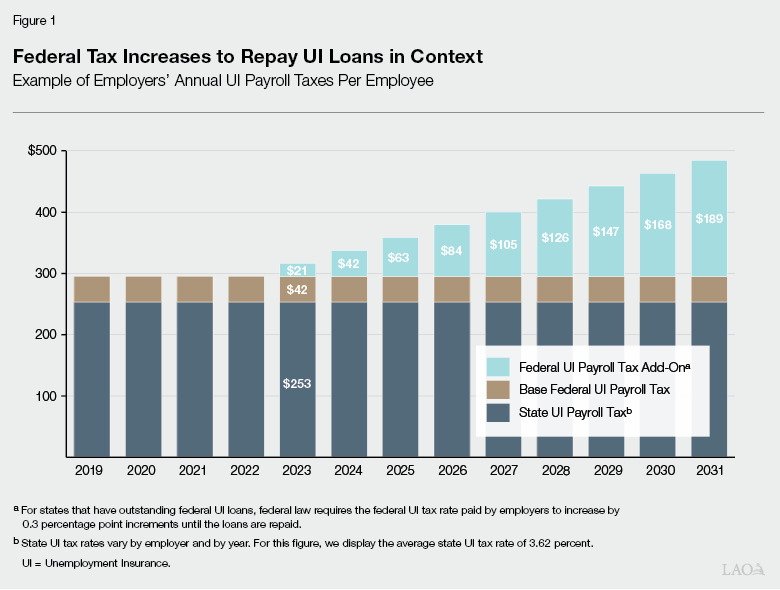

Companies Set to Pay Add‑On Federal UI Tax Starting in 2023. To repay the federal loans, the federal UI payroll tax fee on employers will improve by 0.3 p.c for tax yr 2022. Nevertheless, employers is not going to pay this larger fee till 2023 when employers remit their 2022 federal UI payroll taxes. To present some context to the scale of elevated federal UI taxes that employers can pay to repay the loans, Determine 1 reveals a hypothetical employer’s mixed state and federal UI tax legal responsibility for a single worker over the following a number of years.

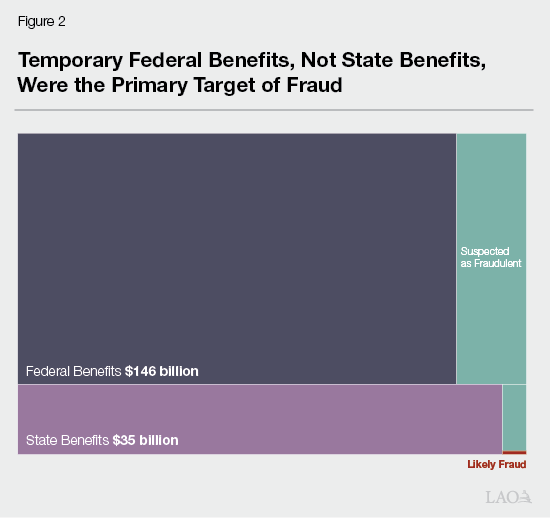

Latest Fraud Concentrated in Federal UI Advantages That Do Not Have an effect on Mortgage Compensation. Determine 2 reveals the administration’s estimate of attainable UI profit fraud that occurred throughout the pandemic. Nearly all pandemic‑period fraud occurred within the non permanent federal packages that now have ended. The federal authorities, not the state UI belief fund, paid these advantages. In consequence, the state didn’t use federal UI loans to pay these fraudulent advantages, which means California employers are usually not required to repay any of the fraudulent federal advantages.

State UI Fraud Does Not Seem to Be Main Think about Measurement of UI Loans to Be Repaid. Though the determine reveals the administration’s estimate of attainable state fraud throughout the pandemic, a extra dependable estimate of seemingly fraud in state UI advantages comes from an audit of claims in 2020. This evaluate suggests about $100 million of $35 billion in state advantages paid throughout the pandemic have been fraudulent. This estimate of seemingly fraud is way smaller than the $1.3 billion a separate EDD evaluation flagged as attainable fraud, however this $1.3 billion estimate seemingly is overstated. To reach on the estimate of $1.3 billion, EDD counts state UI claims as fraudulent if a employee didn’t reply to a request for extra identification paperwork after that they had began receiving advantages. There are a number of explanation why employees with professional claims could not have adopted up with EDD. Lots of the suspected claimants had already run out of advantages and thus had little cause to log in to verify their identification. Different claimants could have given up in frustration after attempting unsuccessfully to ship requested documentation to EDD. Since state UI fraud was much less widespread than fraud within the non permanent federal packages, state UI fraud doesn’t seem to have notably elevated the quantity of federal UI loans that the state and employers are to repay.

Trying Forward

Up to date Forecasts Underneath Two Financial Situations—Low Value and Excessive Value. To illustrate state and employer prices to repay the federal UI loans, this evaluation updates our earlier low‑ and excessive‑prices forecast eventualities for the state’s UI system based mostly on completely different underlying financial eventualities. Underneath the low‑value state of affairs, employment shortly returns to pre‑pandemic ranges and rates of interest stay traditionally low for your complete interval. Underneath the excessive‑value state of affairs, the state’s full financial restoration is delayed a number of years, and rates of interest paid on the UI loans improve step by step over the following a number of years.

Mortgage Will Take Many Years to Repay Underneath Both State of affairs. Underneath our low‑value state of affairs, the state and employers repay the federal mortgage in 2030. Underneath our excessive‑value state of affairs, the payoff happens in 2032. Neither of those eventualities seize the potential for one other recession someday this decade. Ought to that happen, payoff of the federal mortgage would prolong nicely past 2032.

Bigger State Curiosity Funds Start This 12 months. Determine 3 reveals our projections for upcoming state curiosity funds below two rate of interest eventualities. Underneath our low rate of interest state of affairs, the federal rate of interest charged on excellent federal UI loans rises barely from its present low and stays close to 2.5 p.c. Underneath the excessive rate of interest state of affairs, the federal rate of interest will increase from 2.2 p.c to 4.5 p.c over the following a number of years and stays at that degree.

Determine 3

Trying Forward at State Prices

to Repay the Federal UI Mortgage

LAO Projections (In Hundreds of thousands)

|

Fiscal 12 months |

Estimated State Curiosity Cost |

|

|

Low‑Value State of affairs |

Excessive‑Value State of affairs |

|

|

2021‑22 |

$36 |

$36 |

|

2022‑23 |

460 |

630 |

|

2023‑24 |

520 |

890 |

|

2024‑25 |

480 |

1,030 |

|

2025‑26 |

440 |

1,020 |

|

2026‑27 |

380 |

970 |

|

2027‑28 |

300 |

880 |

|

2028‑29 |

210 |

750 |

|

2029‑30 |

110 |

600 |

|

2030‑31 |

20 |

430 |

|

2031‑32 |

— |

240 |

|

2032‑33 |

— |

50 |

|

Totals |

$3,000 |

$7,200 |

Proposal

The 2022‑23 Governor’s Funds proposes to make a $1 billion Common Fund cost in 2022‑23 and an extra $2 billion Common Fund cost in 2023‑24 towards repaying the excellent stability on the state’s federal UI loans. The proposed supplemental cost would scale back the state’s excellent mortgage stability by about 15 p.c.

Evaluation

$3 Billion Compensation Would Decrease State Curiosity Prices and Employer Prices… The Governor’s proposal would scale back the quantity of excellent federal UI loans. In consequence, the proposal would scale back state curiosity prices instantly. The state additionally would face decrease curiosity funds annually the mortgage stays excellent. We estimate that the Governor’s proposed $3 billion cost seemingly would scale back Common Fund curiosity prices over the compensation interval by a complete of $550 million to $1.1 billion.

…However Present No Close to‑Time period Financial Reduction to Employers or Staff. The proposed state cost additionally would scale back employer prices sooner or later. Normally, the $3 billion deposit would scale back the quantity employers should repay by $3 billion. Nevertheless, employers wouldn’t profit from these decrease prices for a few years. It is because the federal tax will increase stay in place till the mortgage is absolutely repaid, which might nonetheless take a number of years even with the $3 billion cost. Additional, though the state cost may shorten the variety of years that employers pay the elevated federal tax charges, employers may even see no direct profit if the cost is just too small to cut back the compensation schedule by a full yr. (On this case, employers would however pay the upper federal UI tax charges, however the carryover income would as a substitute be deposited into the state UI belief fund. These funds can be out there to pay UI advantages in future years.)

To Present Speedy Profit, Legislature May As an alternative Present UI Tax Credit to Companies. Ought to the Legislature as a substitute want to present instant tax reduction to employers whereas the financial results of the pandemic linger, one possibility to think about can be to offer employers state UI tax credit to offset the upcoming federal UI tax improve. Tax credit could possibly be designed in varied methods to satisfy the Legislature’s coverage goals and priorities.