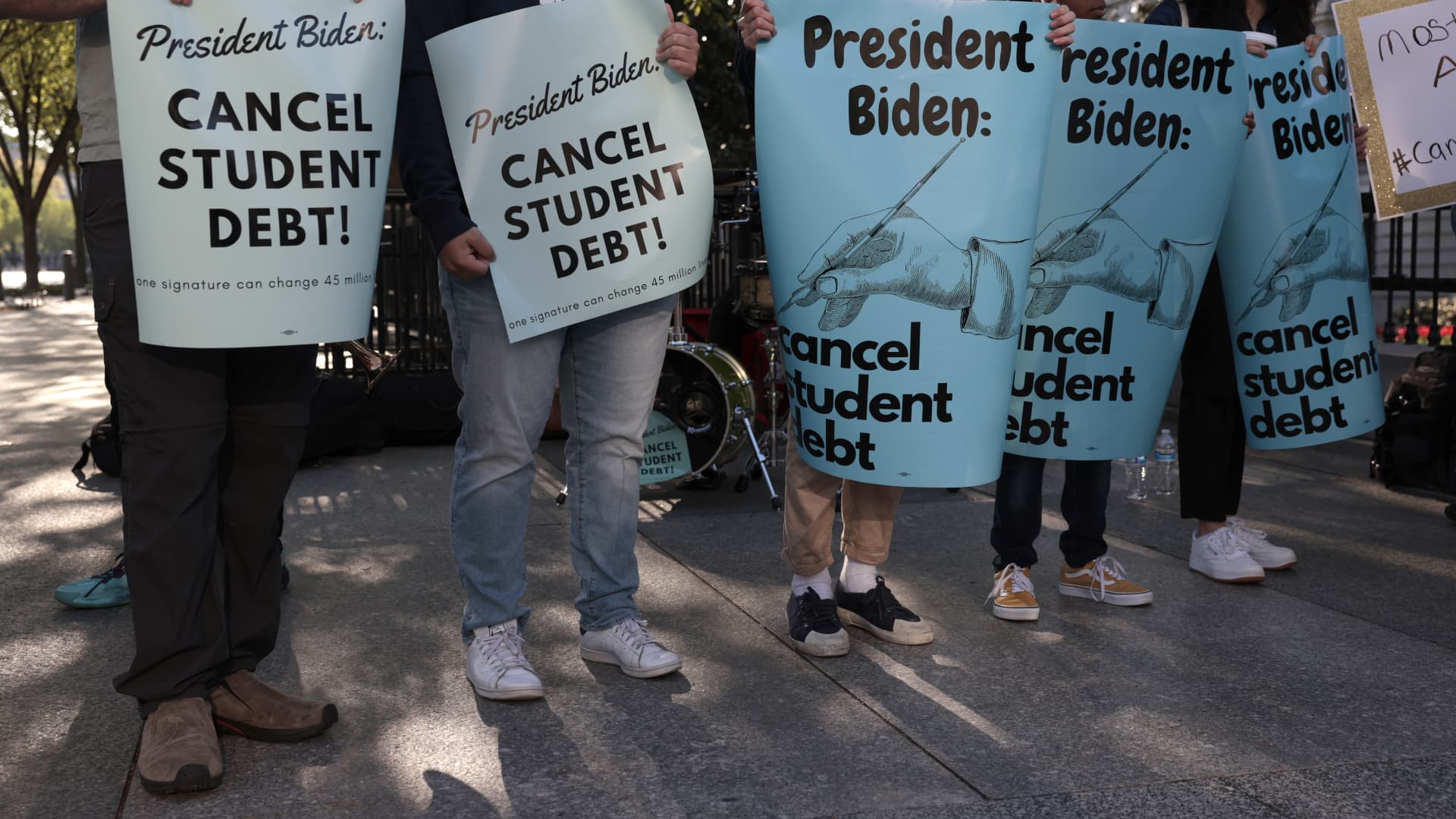

Activists maintain a scholar mortgage forgiveness rally close to the White Home on April 27, 2022.

Anna Moneymaker | Getty Pictures Information | Getty Pictures

The 9 justices of the U.S. Supreme Courtroom have scheduled high-profile arguments over President Joe Biden’s scholar mortgage forgiveness plan for Feb. 28, that means debtors suspended in uncertainty in regards to the destiny of their money owed will not less than know extra quickly.

Since Biden unveiled his plan to cancel as much as $20,000 in scholar debt for tens of tens of millions of People, Republicans and conservative teams have filed not less than six lawsuits to attempt to halt the coverage, arguing that it is an overreach of govt authority and unfair in quite a lot of methods.

Two of these authorized challenges have been profitable in not less than quickly stopping the president’s plan from going ahead. The Biden administration has appealed these choices, and the nation’s highest court docket has introduced it is going to have the ultimate say on the coverage, which can stay on maintain till then.

Extra from Private Finance:

63% of People reside paycheck to paycheck

Used automobile costs are down 3.3% from a yr in the past

The ten greatest metro areas for first-time dwelling patrons

The justices will take into account the lawsuits introduced by six GOP-led states, which argue that forgiveness will disrupt state entities that revenue from federal scholar loans, in addition to a lawsuit backed by the Job Creators Community Basis, a conservative advocacy group, that includes two debtors in Texas who’re partially or absolutely unnoticed of the president’s reduction.

The truth that the justices have agreed so rapidly to take each instances suggests that they are wanting to ship a decisive ruling on the coverage involving greater than 30 million People, mentioned Laurence Tribe, a Harvard legislation professor.

Like different authorized consultants, Tribe does not have a lot hope that the plan will survive the Supreme Courtroom.

“It is principally put this system in deep freeze till it proceeds to most definitely dismantle it,” Tribe mentioned.

Greater schooling skilled Mark Kantrowitz agreed that an eagerness to make a ruling does not bode properly for proponents of the president’s plan, “as a result of ruling towards forgiveness is easier.”

Dan Urman, a legislation professor at Northeastern College, additionally predicted the Supreme Courtroom will rule towards Biden. He mentioned the conservative justices imagine authorities businesses exert an excessive amount of authority and “violate the separation of powers.”

But Tribe mentioned the plaintiffs are dressing up their frustration with seeing college students get reduction in authorized arguments in regards to the separation of energy.

“They consider this as elite, egocentric youngsters getting on the head of the road when others have needed to repay their loans,” Tribe mentioned, including that Republicans haven’t challenged when different teams get reduction.

A report final month discovered that one of many plaintiffs within the Texas lawsuit was the beneficiary of greater than $45,000 in debt cancellation below the Paycheck Safety Program, which supplied loans to small companies hurting from the Covid pandemic.

The Biden administration insists that it is performing inside the legislation with its scholar mortgage forgiveness plan, mentioning that the Heroes Act of 2003 grants the schooling secretary the authority to waive rules associated to scholar loans throughout nationwide emergencies.

The U.S. has been working under an emergency declaration since March 2020.

By Jan. 4, the Biden administration must undergo the court docket its opening transient within the instances. Responses from the plaintiffs are due round a month later.