Bitcoin is a posh expertise the place digital info is saved throughout the “blocks” and saved on a public database. The aim of blockchain is to permit digital knowledge to be recorded and distributed. To conduct transactions on the Bitcoin community, individuals should run a program referred to as a “pockets” Every pockets consists of two distinctive and distinct cryptographic keys: a public key and a non-public key. The general public secret is the placement the place transactions are deposited to and withdrawn from. That is additionally the general public key that seems on the blockchain ledger because the consumer’s digital signature.

Table of Contents

Alyze Sam, #WomenInBlockchain

A smiling survivor serving in moral tech Termed Stablecoin Queen & “the guts of social impression blockchain”

By Alyze Sam and Tech & Authors

First, Fiat

To know the place crypto got here from, one should begin on the historical past of fiat, yow will discover that weblog publish right here. After you’re versed in fiat, get pleasure from this unbiased and poetic overview of cryptocurrency, beginning with the beginning of blockchain expertise.

Blockchain Historical past

Blockchain is a posh expertise the place digital info is saved throughout the “blocks” and saved on a public database termed the “chain.” Inside every block, there’s a distinctive code termed “hash,” which is its identification. Hashes are cryptographic codes created by particular algorithms. The aim of blockchain is to permit digital knowledge to be recorded and distributed.

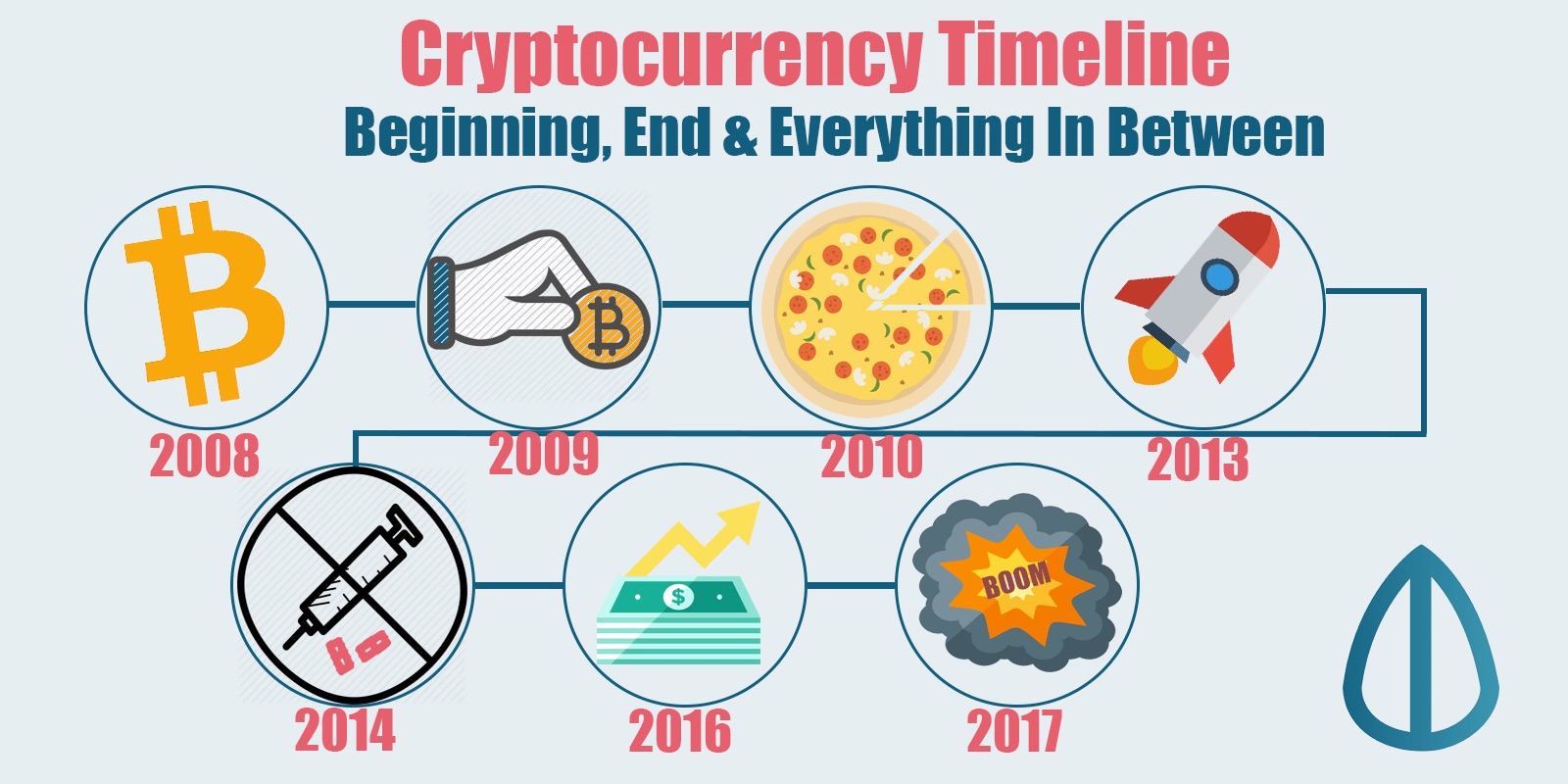

Blockchain expertise was essentially sketched in 1991 by Stuart Haber and W. Scott Stornetta, two researchers who aspired to execute a system the place doc timestamps couldn’t be tampered with. Roughly 20 years following in January 2009, the launch of Bitcoin birthed blockchain expertise’s preliminary real-world utility.

The Bitcoin protocol is constructed on blockchain expertise. Within the analysis paper, or ‘white paper’ introducing the digital cash, Bitcoin’s pseudonymous originator Satoshi Nakamoto launched it as “a brand new digital money system that’s totally peer-to-peer, with no trusted third celebration.”

Bitcoin, a correct blockchain utility, noticed success inside monetary expertise when different digital property failed to unravel the double-spending drawback.

The double-spending dilemma arises when digital transactions are mimicked, permitting property to be spent twice. Bitcoin has thrived because it solves this drawback.

The unique decentralized cryptocurrency, Bitcoin, was produced in 2009 by pseudonymous developer Satoshi Nakamoto. It used SHA-256, a cryptographic hash perform, as its proof-of-work system.

In April 2011, Namecoin was a decision to determine a decentralized DNS, making web censorship troublesome. Litecoin was launched six months later. It was the earliest profitable cryptocurrency to make use of a script as its hash perform various to SHA-256. One other notable cryptocurrency, Peercoin, was the preliminary venture to make use of a proof-of-work and proof-of-stake hybrid.

Blockchain Protocol

When one spends or trades Bitcoin, ASIC Miners, or laptop parts on the Bitcoin community, compete to validate transactions. To take action, customers run a program on their processors to unravel advanced mathematical puzzles referred to as a “hash.” When a processor resolves the issue by “hashing” a block, its algorithmic work will confirm the transactions.

As talked about, the completed transaction is brazenly documented and saved as a block of information on the blockchain, turning into immutable except 51% of miners agree to alter it. Bitcoin and lots of blockchain protocols make the most of machines that efficiently confirm blocks to acquire rewards for his or her labor paid in cryptocurrency. This methodology is termed “mining.”

Though occasions are publicly documented on the blockchain, consumer info shouldn’t be — or, at the least, not in maturity. To conduct transactions on the Bitcoin community, individuals should run a program referred to as a “pockets.”

Every pockets consists of two distinctive and distinct cryptographic keys: a public key and a non-public key. The general public secret is the placement the place transactions are deposited to and withdrawn from. That is additionally the important thing that seems on the blockchain ledger because the consumer’s digital signature. Even when a consumer receives a cost to their public key, they won’t be able to withdraw with out its personal counterpart.

A consumer’s public secret is a shortened model of their personal key, created by a sophisticated mathematical algorithm. Nevertheless, as a result of complexity of this equation, it’s virtually inconceivable to reverse the method and generate a non-public key from a public key. Because of this, blockchain is taken into account confidential.

Public and Personal Key Fundamentals

We will consider a public key as a faculty locker and a non-public key because the locker sequence.

Anybody can slip notes into the outlet in a locker. Nevertheless, the one character who can reclaim the contents is the entity with the person key or mixture.

However, it must be recorded that whereas faculty locker mixtures are saved within the principal’s workplace, there may be not a central server that retains a report of a blockchain community’s personal keys. Within the occasion somebody misplaces their personal keys, entry to their Bitcoin pockets can also be misplaced.

Single Public Chain

The Bitcoin blockchain is shared and maintained by a public community of customers and is a neighborhood consensus mannequin. When customers be part of the community, their processor obtains a reproduction of the blockchain that’s renewed every time a brand new block of occasions is computed. However, what if, by human error or a hacker’s efforts, one consumer’s copy of the blockchain was altered?

The blockchain protocol discourages the existence of a number of blockchains by a course of referred to as “consensus.” Within the presence of a number of, differing blockchain copies, the consensus protocol will undertake the longest chain accessible. Extra customers on a blockchain imply that blocks could be added to the top of the chain quicker. By that logic, the blockchain report will at all times be the one agreed upon by the vast majority of the individuals. The consensus protocol is considered one of blockchain expertise’s most vital strengths but additionally a possible weak spot.

Hacker-Proof Ecosystem

In principle, a hacker may achieve the place of the consensus protocol by a 51% assault. Right here is how it could occur.

Assume there are twenty million processors on the Bitcoin interface. To realize a preponderance on the community, a hacker would wish to manage at the least 10.5 million and a kind of ASIC Mining processors. An attacker or accumulation of antagonists may hinder the tactic of recording new occasions. They may ship a transaction after which reverse it, making it appear as if they nonetheless had the coin they simply spent. This vulnerability, often called double-spending, is the digital equal of an ideal counterfeit and would allow customers to spend their crypto twice.

Such an initiative is sophisticated to execute on a blockchain of Bitcoin’s dimension, as it could require an attacker to realize management of thousands and thousands of computer systems. It will have been far more manageable when Bitcoin was based in 2009 and its customers numbered within the dozens. This defining attribute of blockchain has been flagged as a weak spot for fledgling cryptocurrencies.

The concern of 51% assaults can restrict monopolies from forming on the blockchain. In “Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Making an attempt to Reinvent Cash,” New York Instances journalist Nathaniel Popper writes of how a gaggle of customers, referred to as “Bitfury,” pooled 1000’s of high-powered computer systems collectively to realize a aggressive edge on the blockchain. Their aim was to mine as many blocks as attainable to earn Bitcoin, which have been then roughly $700 every.

Harnessing Bitfury

By March 2014, nevertheless, Bitfury was poised to surpass 50% of the blockchain community’s computational functionality. As an alternative of strengthening its maintain over the community, the assemblage elected to self-regulate and declared by no means to transcend 40%. Bitfury acknowledged that in the event that they elected to proceed increasing their authority throughout the community, Bitcoin’s worth would lower as customers auctioned off their digital property in anticipation of a 51% assault.

In different phrases, if customers lose religion within the blockchain community, the data on that community runs the chance of turning into nugatory. Blockchain customers can then solely enhance their computational energy to some extent earlier than they start to lose cash.

Blockchain’s Sensible Software

Blocks on the blockchain retailer knowledge about financial transactions, as beforehand mentioned, but it surely seems that blockchain is a dependable means of storing knowledge about different varieties of transactions. Blockchain expertise could be utilized to retailer knowledge about property exchanges, medical data, faculty grades, lineage data, stops in a provide chain, votes for a candidate, and extra.

Deloitte, knowledgeable providers community, just lately surveyed 1,000 firms throughout seven international locations about integrating blockchain into their enterprise operations. Their survey discovered that 34% already had a blockchain system in manufacturing at the moment, whereas one other 41% anticipated to deploy a blockchain utility inside 12 months. As well as, almost 40% of the surveyed firms reported they’d make investments $5 million or extra on blockchain within the coming 12 months.

Listed below are a few of the hottest functions of blockchain use circumstances now.

Financial institution Use

Maybe no business stands to learn from integrating blockchain into its enterprise operations greater than banking. Monetary establishments solely function throughout enterprise hours, 5 days per week. Which means if somebody tries to deposit a examine on Friday at 6 p.m., they’ll seemingly have to attend till Monday morning to see the cash of their account.

Even when one makes deposits throughout enterprise hours, the transaction can nonetheless take one to a few days to confirm as a result of sheer quantity of transactions banks have to settle. Blockchain, however, by no means sleeps.

By integrating blockchain into banks, shoppers can see their transactions processed immediately within the time it takes so as to add a block to the blockchain.

Blockchain permits banks to alternate funds between establishments extra quickly and securely. In inventory buying and selling, the settlement and clearing course of can take as much as three days (or longer if banks are buying and selling internationally), that means the cash and shares stay frozen for that point.

Given the dimensions of the sums concerned, even the few days that the cash is in transit can carry excessive prices and dangers for banks. Santander, a European financial institution, estimated a possible financial savings of $20 billion a 12 months. Capgemini, a French consultancy, estimates that customers may save as much as $16 billion in banking and insurance coverage charges every year by blockchain-based functions.

Blockchain Use in Cryptocurrency and Open Finance

Blockchain is the bedrock of cryptocurrencies like Bitcoin. As we explored earlier, currencies just like the U.S. Greenback are regulated and verified by a government, normally a financial institution or authorities. Beneath the central authority system, a consumer’s knowledge and forex are on the whim of their financial institution or authorities. If a consumer’s financial institution collapses or is situated in a rustic with an unstable authorities, the worth of their forex could also be in danger, that are the solicitudes out of which Bitcoin was produced.

By spreading its operations throughout a community of computer systems, blockchain permits Bitcoin and different cryptocurrencies to function with out the necessity for a government. Decentralization abates dangers and omits most of the processing and transaction charges central authority is inheritor to. It additionally offers nations with unstable currencies a extra sturdy possibility, extra functions, and a extra intensive community of people and establishments they’ll do enterprise with, domestically and internationally, when appropriately applied.

DeFi, or ‘Open Finance’

Satoshi Nakamoto constructed a dream to make impervious cash and modern-day transactions possible to all, wherever they might reside. In the present day’s cryptocurrency neighborhood positioned that dream into motion once they noticed the potential in a sophisticated, modern-day financial system.

The “DeFi” Decentralized Finance, additionally described as ‘Open Finance,’ evolution takes our dream right into a tangible actuality.

Envision a world of impartial individuals logging into an open various to each monetary service utilized at the moment: not simply cost transactions, however financial savings, buying and selling, insurance coverage, loans, knowledge storage, and far more.

Blockchain initiatives, resembling Ethereum, enable the “future of cash” fantasy to breathe life into trendy society with “Sensible Contract” integration.

Blockgeeks.com states, “A sensible contract is a pc protocol meant to digitally facilitate, confirm, or implement the negotiation or efficiency of a contract. Sensible contracts enable the efficiency of credible transactions with out third events.”

A sensible contract program working on a blockchain can execute transactions robotically when coded circumstances are fulfilled. This technique permits builders to assemble way more refined functionalities than merely receiving and sending digital property. These applications are termed “DApps” or decentralized functions. DApps are functions constructed on decentralized expertise fairly than being constructed and controlled by a single, centralized entity or firm.

Technologists and economists envision a future full of decentralized functions working effortlessly whereas using these protocols; nevertheless, these ecosystems have been thriving since roughly 2018. One can witness automated loans negotiated immediately between two overseas entities globally, with out the need for a central banking system.

Some DeFi DApps exist to permit the creation of stablecoins.

What distinguishes these DeFi DApps from their typical banking establishment or Wall Road equivalents? 2020 U.S. presidential candidate Michael Bloomberg issued a monetary reform plan that, amongst different issues, advocates for extra strong and safe monetary practices. A part of the really useful reform additionally advocates the formulation of a regulatory sandbox for startups and “offering a transparent regulatory framework for cryptocurrencies.” Wall Road nonetheless regards the cryptocurrency business with a measure of skepticism. Nevertheless, stablecoins regularly present a extra direct path to mass-market adoption.

Stablecoins have develop into a big supply of liquidity within the cryptocurrency market. They supply an on-ramp to enter the crypto markets and an off-ramp to exit. The rising recognition of stablecoins is a perform of their inherent fidelity relative to different cryptocurrencies.

This piece addresses stablecoins being free from the standard volatility of cryptocurrencies and the way they’re rising to supply numerous kinds of on-and off-ramp potentialities that may make cryptocurrencies extra engaging to Wall Road.

Wall Road Testing

Wall Road will not be completely on board, however quite a few equities, ETFs, and classical devices implement some stage of publicity to the business. For instance, Nvidia Company (NASDAQ: NVDA) and Superior Micro Gadgets, Inc. (NASDAQ: AMD) produced important publicity to the crypto syndicate associated to the effectiveness of their graphics processors in crypto mining procedures. Each Nvidia and Superior Micro Techniques have delivered 23% within the year-to-date interval.

Different shares resembling Grayscale Bitcoin Funding Belief (GBTC) present a extra direct stage of publicity to the crypto business as a publicly-traded Bitcoin fund. Overstock.com, Inc. (NASDAQ: OSTK) is likely one of the first established firms to embrace crypto installments. It at present retains about 50% of those subsidies, which ties its future to the fortunes and vicissitudes of the crypto market. Consequently, each Grayscale Bitcoin Belief and Overstock have produced 56% and 25% will increase within the year-to-date interval.

When in comparison with the remainder of the U.S. market within the year-to-date interval, Wall Road property with publicity to the cryptocurrency market have delivered double-digit positive factors. In distinction, the S&P 500, NASDAQ Composite, and the Dow Jones Industrial Common have solely managed to ship single-digit positive factors in the identical interval.

There may be the rising recognition of stablecoins throughout totally different market segments.

Tether USDT is essentially the most sizable stablecoin in the marketplace; it has skilled a first-mover profit since its launch in 2015. Tether exceeds 80% of the market curiosity for stablecoins. It has managed to take care of parity with the U.S. greenback, regardless of the recurrent panic episodes that accompany important drops within the value of Bitcoin.

In 2019, the availability of USDT expanded from 2 billion tokens to 4.108 billion tokens to account for growing adoption. Furthermore, the token was relocated from the Omni-layer to the Ethereum community to expedite a faster and extra reasonably priced switch of worth. Most strikingly, a Chainalysis abstract reveals that “for Chinese language alternate customers, Tether has changed the yuan because the go-to fiat forex.” Information from exchanges confirmed that the majority fiat-crypto trades in Mainland China have been amid Yuan and USDT.

Greenback Neutrino USDN is an algorithmically secure USD-pegged digital asset. USDN is collateralized amidst the WAVES blockchain platform.

WAVES is swiftly stimulating the adoption of DeFi commodities, and they’re steadily maturing as a pilot within the enterprise.

Along with contributing stability, USDN grants token holders extra income streams by staking, much like conventional dividend shares offering earnings.

Originating on January 28, 2020, inside one month the token had greater than $3.2 million staked, because it accouches a staking reward of roughly 8.9% every year.

Fb meant to launch its cryptocurrency Libra, now often called Diem in 2020 but it surely was shelved till 2022. This prevalence resulted when corporations within the European Union and america queried if this could be worthwhile to society. Fb, the biggest social media platform on the planet, has 2.4 billion customers throughout this time.

Whereas administration our bodies globally battle to understand blockchain, laws, and legal guidelines on stablecoins are usually not being applied expeditiously sufficient, in response to the Monetary Stability Board (FSB), a watchdog in world banking.

In a February 2020 letter to finance ministers and central financial institution governors from the G-20 assembly in Riyadh, FSB Chair Randal Quarles voiced his issues concerning how shortly digital currencies have an effect on the worldwide financial system whereas regulatory motion struggles to maintain up.

“FSB members recognise the pace of innovation within the space of digital funds, together with so-called ‘stablecoins.’ We’re resolved to quicken the tempo of growing the mandatory regulatory and supervisory responses to those new devices.”

As Wall Road and regulatory organizations proceed to work on bridging the information hole, sentiments like this intensify the rising acknowledgment that these monetary improvements are right here to remain and can proceed to develop as a bulwark for the way forward for the worldwide financial system.

Need to learn extra on the historical past of fiat, crypto, Stablecoins and the way forward for cash? You possibly can take a look atStablecoin Evolution, #1 on Amazon Monetary Training & Pc and Science.

Writer

Alyze Sam is a refreshing blockchain strategist, a novel educator, multi-award-winning creator, serial co-founder, and a vehemently pushed advocate. Sam wrote the primary crypto dictionary and revealed the primary books on stablecoins. Don Tapscott revealed her e book ‘Stablecoin Economic system’ at The Blockchain Analysis Institute in January 2021. Sam’s latest e book, ‘Stablecoin Evolution’ is at present the primary new launch on Amazon in Computer systems & Know-how. The Dangerous Crypto Podcast developed a Blockchain Hero NFT impressed by her work: Mz. Stability. After almost dropping her life a number of occasions, Sam is a retired nurse and owns Tech & Authorstogether with her finest buddies and soulmates, the place they spend their days being grateful as they joyfully produce unbiased poetic technical schooling.

Enter the Blockchain Writing Contest

By Alyze Sam and Tech & Authors

First, Fiat

To know the place crypto got here from, one should begin on the historical past of fiat, yow will discover that weblog publish right here. After you’re versed in fiat, get pleasure from this unbiased and poetic overview of cryptocurrency, beginning with the beginning of blockchain expertise.

Blockchain Historical past

Blockchain is a posh expertise the place digital info is saved throughout the “blocks” and saved on a public database termed the “chain.” Inside every block, there’s a distinctive code termed “hash,” which is its identification. Hashes are cryptographic codes created by particular algorithms. The aim of blockchain is to permit digital knowledge to be recorded and distributed.

Blockchain expertise was essentially sketched in 1991 by Stuart Haber and W. Scott Stornetta, two researchers who aspired to execute a system the place doc timestamps couldn’t be tampered with. Roughly 20 years following in January 2009, the launch of Bitcoin birthed blockchain expertise’s preliminary real-world utility.

The Bitcoin protocol is constructed on blockchain expertise. Within the analysis paper, or ‘white paper’ introducing the digital cash, Bitcoin’s pseudonymous originator Satoshi Nakamoto launched it as “a brand new digital money system that’s totally peer-to-peer, with no trusted third celebration.”

Bitcoin, a correct blockchain utility, noticed success inside monetary expertise when different digital property failed to unravel the double-spending drawback.

The double-spending dilemma arises when digital transactions are mimicked, permitting property to be spent twice. Bitcoin has thrived because it solves this drawback.

The unique decentralized cryptocurrency, Bitcoin, was produced in 2009 by pseudonymous developer Satoshi Nakamoto. It used SHA-256, a cryptographic hash perform, as its proof-of-work system.

In April 2011, Namecoin was a decision to determine a decentralized DNS, making web censorship troublesome. Litecoin was launched six months later. It was the earliest profitable cryptocurrency to make use of a script as its hash perform various to SHA-256. One other notable cryptocurrency, Peercoin, was the preliminary venture to make use of a proof-of-work and proof-of-stake hybrid.

Blockchain Protocol

When one spends or trades Bitcoin, ASIC Miners, or laptop parts on the Bitcoin community, compete to validate transactions. To take action, customers run a program on their processors to unravel advanced mathematical puzzles referred to as a “hash.” When a processor resolves the issue by “hashing” a block, its algorithmic work will confirm the transactions.

As talked about, the completed transaction is brazenly documented and saved as a block of information on the blockchain, turning into immutable except 51% of miners agree to alter it. Bitcoin and lots of blockchain protocols make the most of machines that efficiently confirm blocks to acquire rewards for his or her labor paid in cryptocurrency. This methodology is termed “mining.”

Though occasions are publicly documented on the blockchain, consumer info shouldn’t be — or, at the least, not in maturity. To conduct transactions on the Bitcoin community, individuals should run a program referred to as a “pockets.”

Every pockets consists of two distinctive and distinct cryptographic keys: a public key and a non-public key. The general public secret is the placement the place transactions are deposited to and withdrawn from. That is additionally the important thing that seems on the blockchain ledger because the consumer’s digital signature. Even when a consumer receives a cost to their public key, they won’t be able to withdraw with out its personal counterpart.

A consumer’s public secret is a shortened model of their personal key, created by a sophisticated mathematical algorithm. Nevertheless, as a result of complexity of this equation, it’s virtually inconceivable to reverse the method and generate a non-public key from a public key. Because of this, blockchain is taken into account confidential.

Public and Personal Key Fundamentals

We will consider a public key as a faculty locker and a non-public key because the locker sequence.

Anybody can slip notes into the outlet in a locker. Nevertheless, the one character who can reclaim the contents is the entity with the person key or mixture.

However, it must be recorded that whereas faculty locker mixtures are saved within the principal’s workplace, there may be not a central server that retains a report of a blockchain community’s personal keys. Within the occasion somebody misplaces their personal keys, entry to their Bitcoin pockets can also be misplaced.

Single Public Chain

The Bitcoin blockchain is shared and maintained by a public community of customers and is a neighborhood consensus mannequin. When customers be part of the community, their processor obtains a reproduction of the blockchain that’s renewed every time a brand new block of occasions is computed. However, what if, by human error or a hacker’s efforts, one consumer’s copy of the blockchain was altered?

The blockchain protocol discourages the existence of a number of blockchains by a course of referred to as “consensus.” Within the presence of a number of, differing blockchain copies, the consensus protocol will undertake the longest chain accessible. Extra customers on a blockchain imply that blocks could be added to the top of the chain quicker. By that logic, the blockchain report will at all times be the one agreed upon by the vast majority of the individuals. The consensus protocol is considered one of blockchain expertise’s most vital strengths but additionally a possible weak spot.

Hacker-Proof Ecosystem

In principle, a hacker may achieve the place of the consensus protocol by a 51% assault. Right here is how it could occur.

Assume there are twenty million processors on the Bitcoin interface. To realize a preponderance on the community, a hacker would wish to manage at the least 10.5 million and a kind of ASIC Mining processors. An attacker or accumulation of antagonists may hinder the tactic of recording new occasions. They may ship a transaction after which reverse it, making it appear as if they nonetheless had the coin they simply spent. This vulnerability, often called double-spending, is the digital equal of an ideal counterfeit and would allow customers to spend their crypto twice.

Such an initiative is sophisticated to execute on a blockchain of Bitcoin’s dimension, as it could require an attacker to realize management of thousands and thousands of computer systems. It will have been far more manageable when Bitcoin was based in 2009 and its customers numbered within the dozens. This defining attribute of blockchain has been flagged as a weak spot for fledgling cryptocurrencies.

The concern of 51% assaults can restrict monopolies from forming on the blockchain. In “Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Making an attempt to Reinvent Cash,” New York Instances journalist Nathaniel Popper writes of how a gaggle of customers, referred to as “Bitfury,” pooled 1000’s of high-powered computer systems collectively to realize a aggressive edge on the blockchain. Their aim was to mine as many blocks as attainable to earn Bitcoin, which have been then roughly $700 every.

Harnessing Bitfury

By March 2014, nevertheless, Bitfury was poised to surpass 50% of the blockchain community’s computational functionality. As an alternative of strengthening its maintain over the community, the assemblage elected to self-regulate and declared by no means to transcend 40%. Bitfury acknowledged that in the event that they elected to proceed increasing their authority throughout the community, Bitcoin’s worth would lower as customers auctioned off their digital property in anticipation of a 51% assault.

In different phrases, if customers lose religion within the blockchain community, the data on that community runs the chance of turning into nugatory. Blockchain customers can then solely enhance their computational energy to some extent earlier than they start to lose cash.

Blockchain’s Sensible Software

Blocks on the blockchain retailer knowledge about financial transactions, as beforehand mentioned, but it surely seems that blockchain is a dependable means of storing knowledge about different varieties of transactions. Blockchain expertise could be utilized to retailer knowledge about property exchanges, medical data, faculty grades, lineage data, stops in a provide chain, votes for a candidate, and extra.

Deloitte, knowledgeable providers community, just lately surveyed 1,000 firms throughout seven international locations about integrating blockchain into their enterprise operations. Their survey discovered that 34% already had a blockchain system in manufacturing at the moment, whereas one other 41% anticipated to deploy a blockchain utility inside 12 months. As well as, almost 40% of the surveyed firms reported they’d make investments $5 million or extra on blockchain within the coming 12 months.

Listed below are a few of the hottest functions of blockchain use circumstances now.

Financial institution Use

Maybe no business stands to learn from integrating blockchain into its enterprise operations greater than banking. Monetary establishments solely function throughout enterprise hours, 5 days per week. Which means if somebody tries to deposit a examine on Friday at 6 p.m., they’ll seemingly have to attend till Monday morning to see the cash of their account.

Even when one makes deposits throughout enterprise hours, the transaction can nonetheless take one to a few days to confirm as a result of sheer quantity of transactions banks have to settle. Blockchain, however, by no means sleeps.

By integrating blockchain into banks, shoppers can see their transactions processed immediately within the time it takes so as to add a block to the blockchain.

Blockchain permits banks to alternate funds between establishments extra quickly and securely. In inventory buying and selling, the settlement and clearing course of can take as much as three days (or longer if banks are buying and selling internationally), that means the cash and shares stay frozen for that point.

Given the dimensions of the sums concerned, even the few days that the cash is in transit can carry excessive prices and dangers for banks. Santander, a European financial institution, estimated a possible financial savings of $20 billion a 12 months. Capgemini, a French consultancy, estimates that customers may save as much as $16 billion in banking and insurance coverage charges every year by blockchain-based functions.

Blockchain Use in Cryptocurrency and Open Finance

Blockchain is the bedrock of cryptocurrencies like Bitcoin. As we explored earlier, currencies just like the U.S. Greenback are regulated and verified by a government, normally a financial institution or authorities. Beneath the central authority system, a consumer’s knowledge and forex are on the whim of their financial institution or authorities. If a consumer’s financial institution collapses or is situated in a rustic with an unstable authorities, the worth of their forex could also be in danger, that are the solicitudes out of which Bitcoin was produced.

By spreading its operations throughout a community of computer systems, blockchain permits Bitcoin and different cryptocurrencies to function with out the necessity for a government. Decentralization abates dangers and omits most of the processing and transaction charges central authority is inheritor to. It additionally offers nations with unstable currencies a extra sturdy possibility, extra functions, and a extra intensive community of people and establishments they’ll do enterprise with, domestically and internationally, when appropriately applied.

DeFi, or ‘Open Finance’

Satoshi Nakamoto constructed a dream to make impervious cash and modern-day transactions possible to all, wherever they might reside. In the present day’s cryptocurrency neighborhood positioned that dream into motion once they noticed the potential in a sophisticated, modern-day financial system.

The “DeFi” Decentralized Finance, additionally described as ‘Open Finance,’ evolution takes our dream right into a tangible actuality.

Envision a world of impartial individuals logging into an open various to each monetary service utilized at the moment: not simply cost transactions, however financial savings, buying and selling, insurance coverage, loans, knowledge storage, and far more.

Blockchain initiatives, resembling Ethereum, enable the “future of cash” fantasy to breathe life into trendy society with “Sensible Contract” integration.

Blockgeeks.com states, “A sensible contract is a pc protocol meant to digitally facilitate, confirm, or implement the negotiation or efficiency of a contract. Sensible contracts enable the efficiency of credible transactions with out third events.”

A sensible contract program working on a blockchain can execute transactions robotically when coded circumstances are fulfilled. This technique permits builders to assemble way more refined functionalities than merely receiving and sending digital property. These applications are termed “DApps” or decentralized functions. DApps are functions constructed on decentralized expertise fairly than being constructed and controlled by a single, centralized entity or firm.

Technologists and economists envision a future full of decentralized functions working effortlessly whereas using these protocols; nevertheless, these ecosystems have been thriving since roughly 2018. One can witness automated loans negotiated immediately between two overseas entities globally, with out the need for a central banking system.

Some DeFi DApps exist to permit the creation of stablecoins.

What distinguishes these DeFi DApps from their typical banking establishment or Wall Road equivalents? 2020 U.S. presidential candidate Michael Bloomberg issued a monetary reform plan that, amongst different issues, advocates for extra strong and safe monetary practices. A part of the really useful reform additionally advocates the formulation of a regulatory sandbox for startups and “offering a transparent regulatory framework for cryptocurrencies.” Wall Road nonetheless regards the cryptocurrency business with a measure of skepticism. Nevertheless, stablecoins regularly present a extra direct path to mass-market adoption.

Stablecoins have develop into a big supply of liquidity within the cryptocurrency market. They supply an on-ramp to enter the crypto markets and an off-ramp to exit. The rising recognition of stablecoins is a perform of their inherent fidelity relative to different cryptocurrencies.

This piece addresses stablecoins being free from the standard volatility of cryptocurrencies and the way they’re rising to supply numerous kinds of on-and off-ramp potentialities that may make cryptocurrencies extra engaging to Wall Road.

Wall Road Testing

Wall Road will not be completely on board, however quite a few equities, ETFs, and classical devices implement some stage of publicity to the business. For instance, Nvidia Company (NASDAQ: NVDA) and Superior Micro Gadgets, Inc. (NASDAQ: AMD) produced important publicity to the crypto syndicate associated to the effectiveness of their graphics processors in crypto mining procedures. Each Nvidia and Superior Micro Techniques have delivered 23% within the year-to-date interval.

Different shares resembling Grayscale Bitcoin Funding Belief (GBTC) present a extra direct stage of publicity to the crypto business as a publicly-traded Bitcoin fund. Overstock.com, Inc. (NASDAQ: OSTK) is likely one of the first established firms to embrace crypto installments. It at present retains about 50% of those subsidies, which ties its future to the fortunes and vicissitudes of the crypto market. Consequently, each Grayscale Bitcoin Belief and Overstock have produced 56% and 25% will increase within the year-to-date interval.

When in comparison with the remainder of the U.S. market within the year-to-date interval, Wall Road property with publicity to the cryptocurrency market have delivered double-digit positive factors. In distinction, the S&P 500, NASDAQ Composite, and the Dow Jones Industrial Common have solely managed to ship single-digit positive factors in the identical interval.

There may be the rising recognition of stablecoins throughout totally different market segments.

Tether USDT is essentially the most sizable stablecoin in the marketplace; it has skilled a first-mover profit since its launch in 2015. Tether exceeds 80% of the market curiosity for stablecoins. It has managed to take care of parity with the U.S. greenback, regardless of the recurrent panic episodes that accompany important drops within the value of Bitcoin.

In 2019, the availability of USDT expanded from 2 billion tokens to 4.108 billion tokens to account for growing adoption. Furthermore, the token was relocated from the Omni-layer to the Ethereum community to expedite a faster and extra reasonably priced switch of worth. Most strikingly, a Chainalysis abstract reveals that “for Chinese language alternate customers, Tether has changed the yuan because the go-to fiat forex.” Information from exchanges confirmed that the majority fiat-crypto trades in Mainland China have been amid Yuan and USDT.

Greenback Neutrino USDN is an algorithmically secure USD-pegged digital asset. USDN is collateralized amidst the WAVES blockchain platform.

WAVES is swiftly stimulating the adoption of DeFi commodities, and they’re steadily maturing as a pilot within the enterprise.

Along with contributing stability, USDN grants token holders extra income streams by staking, much like conventional dividend shares offering earnings.

Originating on January 28, 2020, inside one month the token had greater than $3.2 million staked, because it accouches a staking reward of roughly 8.9% every year.

Fb meant to launch its cryptocurrency Libra, now often called Diem in 2020 but it surely was shelved till 2022. This prevalence resulted when corporations within the European Union and america queried if this could be worthwhile to society. Fb, the biggest social media platform on the planet, has 2.4 billion customers throughout this time.

Whereas administration our bodies globally battle to understand blockchain, laws, and legal guidelines on stablecoins are usually not being applied expeditiously sufficient, in response to the Monetary Stability Board (FSB), a watchdog in world banking.

In a February 2020 letter to finance ministers and central financial institution governors from the G-20 assembly in Riyadh, FSB Chair Randal Quarles voiced his issues concerning how shortly digital currencies have an effect on the worldwide financial system whereas regulatory motion struggles to maintain up.

“FSB members recognise the pace of innovation within the space of digital funds, together with so-called ‘stablecoins.’ We’re resolved to quicken the tempo of growing the mandatory regulatory and supervisory responses to those new devices.”

As Wall Road and regulatory organizations proceed to work on bridging the information hole, sentiments like this intensify the rising acknowledgment that these monetary improvements are right here to remain and can proceed to develop as a bulwark for the way forward for the worldwide financial system.

Need to learn extra on the historical past of fiat, crypto, Stablecoins and the way forward for cash? You possibly can take a look atStablecoin Evolution, #1 on Amazon Monetary Training & Pc and Science.

Writer

Alyze Sam is a refreshing blockchain strategist, a novel educator, multi-award-winning creator, serial co-founder, and a vehemently pushed advocate. Sam wrote the primary crypto dictionary and revealed the primary books on stablecoins. Don Tapscott revealed her e book ‘Stablecoin Economic system’ at The Blockchain Analysis Institute in January 2021. Sam’s latest e book, ‘Stablecoin Evolution’ is at present the primary new launch on Amazon in Computer systems & Know-how. The Dangerous Crypto Podcast developed a Blockchain Hero NFT impressed by her work: Mz. Stability. After almost dropping her life a number of occasions, Sam is a retired nurse and owns Tech & Authorstogether with her finest buddies and soulmates, the place they spend their days being grateful as they joyfully produce unbiased poetic technical schooling.