(Bloomberg) — Editor’s Notice: Welcome to Credit score Weekly, the place Bloomberg’s international group of reporters will catch you up on the most popular tales of the previous week whereas additionally providing you a peek into what to anticipate in credit score markets for the times forward.

Most Learn from Bloomberg

One of many greatest shifts inside debt markets in the course of the previous decade has been the rise of personal credit score. That’s the place different asset managers like Blackstone, Ares and Apollo make loans on to corporations — often the small or less-creditworthy ones — after conventional banks pulled again amid strain to curb their riskier actions.

Personal credit score is now a $1.4 trillion business. It has funded acquisitions of corporations like Stamps.com and big-data agency Data Sources Inc. Now a lot of these banks need again within the motion.

The newest is JPMorgan Chase & Co. As Bloomberg’s Silas Brown and Will Louch wrote this previous week, the New York-based financial institution has put aside a minimum of $10 billion to again its transfer into personal credit score. And it’s ready to place up billions of {dollars} extra relying on the alternatives it finds.

JPMorgan definitely isn’t the primary huge financial institution in search of to reclaim the juicy charges and large yields that include lending on this house, and it probably received’t be the final.

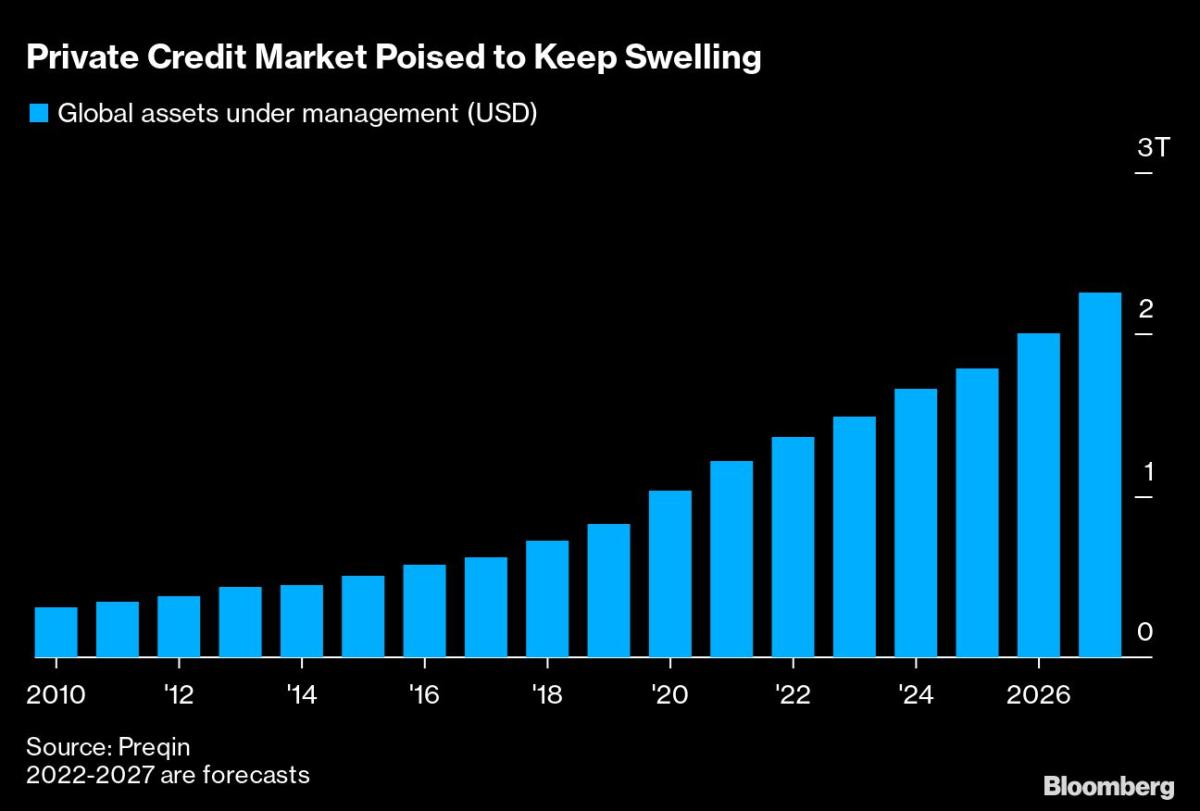

Preqin, which tracks different property, expects that personal credit score property beneath administration will add nearly one other trillion {dollars} within the subsequent 5 years to $2.3 trillion.

A lot of that development is anticipated to be pushed not by debtors that banks have been content material to let go — small and medium-sized corporations — however by loans to bigger companies. That would encroach upon Wall Road’s profitable leveraged finance enterprise.

“Pace, certainty, confidentiality, and the power of sure lenders to underwrite sizable financing options throughout the capital construction will proceed to drive market share for personal debt relative to the syndicated markets,” Ken Kencel, chief government officer of Churchill Asset Administration, stated in a current Q&A with Preqin.

Elsewhere:

-

China’s still-ailing property sector is getting a recent spherical of help. Monetary regulators and bad-debt managers plan to supply as a lot as 160 billion yuan ($24 billion) of refinancing assist to high-quality builders, Bloomberg reported. In the meantime, models of two builders bought their first state-guaranteed yuan bonds and defaulted peer CIFI Holdings is planning its second-such issuance after the Lunar New Yr vacation.

-

China’s most-indebted developer, China Evergrande Group, has been discussing a proposal with collectors that features two choices to increase cost deadlines on unsecured offshore debt, Bloomberg’s Jackie Cai reported. Credit score buyers cheered long-awaited particulars about Fantasia Holdings Group’s restructuring provide, which features a debt-to-equity swap.

-

French billionaire Patrick Drahi’s telecom firm Altice France is seeking to purchase extra time to repay its debt, providing a so-called amend and lengthen deal on about $8.4 billion of loans.

-

Pacific Funding Administration Co. is gearing as much as start issuing collateralized mortgage obligations in Europe, marking a return of the behemoth US funding agency after greater than a decade.

-

UBS analysts are recommending buyers purchase European credit score over US debt amid indicators of misery within the US mortgage markets, cracks rising in personal credit score and a doubtlessly extreme draw back threat in US high-yield debt.

–With help from Kevin Kingsbury, Yuling Yang, Silas Brown, Will Louch and Davide Scigliuzzo.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.