The Reserve Financial institution of Australia was roiled immediately by the resignation of its Deputy Governor Man Debelle, who’s leaving with solely six days’ discover.

Dr Debelle stated that he was resigning to turn into chief monetary officer of Andrew Forrest’s Fortescue Future Industries, an organization investing in zero-emission applied sciences comparable to inexperienced hydrogen.

The transfer got here as a shock provided that, as deputy, Man Debelle was lengthy seen because the inheritor obvious to Reserve Financial institution Governor Philip Lowe, whose time period expires in September subsequent 12 months.

Dr Debelle was re-appointed deputy solely final 12 months.

Debelle was one of many brightest sparks, if not the brightest spark on the financial institution.

He managed the everyday response to the worldwide monetary disaster when he ran the financial institution’s monetary markets group and the financial response to the COVID disaster as deputy governor.

He’s recognised across the globe, from the halls of Massachusetts Institute of Know-how the place he has been a visiting professor, to the world of central banking, the place he chaired a number of worldwide committees.

What made Man go?

Why then did Debelle leap ship? As deputy governor he has proven a eager curiosity within the transition to a net-zero economic system, giving a number of speeches on how the transfer will have an effect on Australia’s economic system and its monetary system.

However as just lately as final month it appeared that he was nonetheless hoping to be given the keys to the Reserve Financial institution vault in Sydney’s Martin Place, testifying to parliament that he didn’t personal any monetary property in an effort to minimise perceived conflicts of curiosity.

Nonetheless, however his curiosity within the zero-emission transition, evidently his determination to go away was partly as a result of his standing as governor-in-waiting was now not a positive wager.

A drama named Succession

The Reserve Financial institution has confronted criticism for lacking its inflation goal 5 years in a row and for “group-think” – an unwillingness to concentrate to outdoors concepts.

No matter who wins the following federal election, either side of politics have promised an inquiry into the financial institution to research why it made such an obvious error and what wants to vary to ensure it doesn’t occur once more.

Given its obvious failure, it’s potential that the Treasury and its political masters felt that one other inner appointment can be inappropriate and that the following governor needs to be appointed from outdoors to shake issues up.

Learn extra:

RBA governor Philip Lowe’s harmful recreation on rates of interest

Man Debelle may additionally have seen writing on the wall about gender range.

The financial institution has not had a feminine governor within the 100 or extra years because it printed its first banknote.

In distinction, the Excessive Court docket of Australia appointed its first feminine justice in 1987, South Australia appointed the primary feminine state governor in 1991 and Victoria the primary feminine police commissioner in 2001.

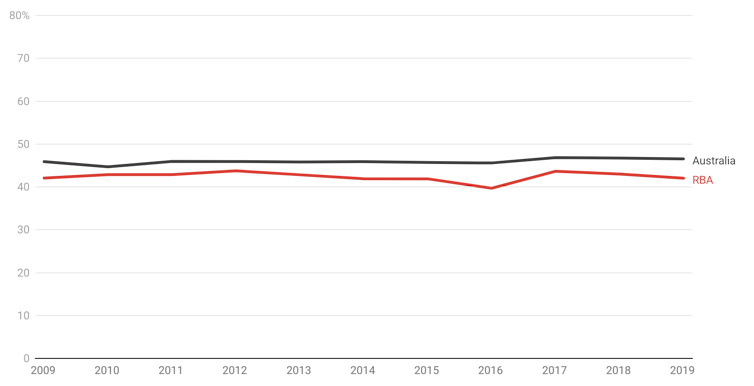

Whereas the RBA has made a concerted effort lately to encourage better range inside its workforce, in comparison with the remainder of Australia it stays male, pale and off – significantly on the greater ranges.

Feminine share of workforce

Reserve Financial institution of Australia

On this respect the Reserve Financial institution is behind the instances. Appointing Man Debelle governor would have stored it there for maybe one other decade.

Who will inherit the throne?

All eyes will now flip to who will probably be appointed deputy governor in Debelle’s place – and probably subsequent governor of the Reserve Financial institution.

If Treasurer Josh Frydenberg desires to maintain a level of continuity, he would possibly effectively select one of many assistant governors. The 2 almost certainly are Dr Luci Ellis and Dr Chris Kent, who collectively oversee the financial institution’s month-to-month coverage course of because the heads of the financial and monetary markets teams respectively.

Mick Tsikas/AAP

Alternatively, Frydenberg could select to inject some new blood forward of the post-election assessment.

Formidable economists comparable to Dr David Gruen, the present head of the Bureau of Statistics, and Jenny Wilkinson, present head of the Treasury’s fiscal group, would be capable to hit the bottom working.

Every has labored on the Reserve Financial institution and every has an outsider’s perspective.

Mick Tsikas/AAP

One factor that’s clear is that an orderly coronation has been thrown within the bin.

With a assessment looming on the horizon and a change in authorities probably, the deputy governorship could be a poisoned chalice – an not possible activity with little time to be taught on the job.

The one certainty on the financial institution is turbulent instances forward.