New particulars have been launched a few invoice within the Maine legislature that might provide vital pupil debt reduction for first-time homebuyers within the state. (iStock)

Lawmakers in Maine are engaged on a invoice that might forgive as much as $40,000 value of pupil mortgage debt for eligible first-time homebuyers.

Democratic Senate President Troy Jackson revealed the small print of the Maine Good Purchase program throughout a public listening to on Feb. 22. He mentioned that this system would handle the state’s labor scarcity by attracting younger employees who’re looking for pupil debt reduction.

“We’re relying on youthful individuals to fill workforce shortages, preserve our heritage industries going, and lead our state into the longer term,” Jackson mentioned. “With this program, we are able to make it simpler for younger individuals to create a significant, fulfilling life right here.”

Preserve studying to be taught extra about pupil mortgage forgiveness in Maine, in addition to what you are able to do to handle your debt for those who’re not eligible. One technique is to refinance to a personal pupil mortgage at a decrease rate of interest. You possibly can examine pupil mortgage refinance charges on Credible without spending a dime with out impacting your credit score rating.

STUDY FINDS THE TOP 5 UNDERGRADUATE DEGREES THAT PAY OFF

Table of Contents

Maine Good Purchase proposes pupil debt reduction for first-time homebuyers

Final June, Maine Gov. Janet Mills (D) signed a invoice directing the Maine State Housing Authority (MaineHousing) and the Finance Authority of Maine (FAME) to develop a program that promotes homeownership by lowering pupil mortgage debt. After assembly a number of occasions through the third quarter of 2021, the businesses not too long ago unveiled this system’s particulars.

Maine Good Purchase is modeled after comparable present packages in Illinois and Maryland. To fulfill the eligibility necessities for pupil mortgage forgiveness beneath this proposal, it’s essential to:

- Buy a mortgage by the MaineHousing First House Mortgage Program. This first-time homebuyer program has an revenue restrict of as much as $131,100 and a most house buy value of $695,000, relying in your family measurement and the county the place you progress. You will additionally want a minimal credit score rating of 640 and a back-end debt-to-income ratio (DTI) of 45% or much less to qualify.

- Have an present pupil mortgage steadiness of at the least $5,000. Homebuyers who’re authorized for the Maine Good Purchase program will obtain an unsecured promissory be aware that is used to repay their pupil mortgage debt balances. The promissory be aware will probably be equal to the quantity of pupil mortgage debt you might have on the time of closing, as much as $40,000.

- Keep the house as a main residence. You would wish to reside within the house for at the least 5 years to qualify for the total quantity of debt forgiveness. The debt is forgiven at a fee of 20% per 12 months — however for those who promote the house earlier than the five-year interval expires, you will solely be liable for paying the remaining steadiness of the promissory be aware.

The Maine Good Purchase program nonetheless hinges on approval within the Maine legislature, which is in session till April. If authorized, the measure can be financed by a $10 million allocation from the state’s common fund and run by the subsequent fiscal 12 months, which ends on Sept. 30, 2023.

“Lawmakers have a possibility to draw and retain younger individuals by supporting this system to extend homeownership and supply pupil debt reduction,” Sen. Jackson mentioned.

For those who’re not eligible for this pupil mortgage forgiveness program, it’s possible you’ll be contemplating your various debt compensation methods like refinancing. You possibly can be taught extra about pupil mortgage refinancing by visiting Credible.

WHAT YOU NEED TO KNOW BEFORE MAKING A DOWN PAYMENT ON A HOME

What to do for those who do not qualify for pupil mortgage forgiveness

Though the Maine Good Purchase program might sometime provide pupil mortgage reduction for some debtors, it will profit only a small fraction of the tens of millions of Individuals with pupil loans. Listed here are some various pupil mortgage compensation choices to contemplate:

Learn extra about every technique within the sections under.

Earnings-driven compensation

Federal pupil mortgage debtors could possibly restrict their month-to-month funds to between 10% and 20% of their disposable revenue beneath one in all 4 income-driven compensation plans (IDR):

- Revised Pay As You Earn Compensation Plan (REPAYE Plan)

- Pay As You Earn Compensation Plan (PAYE Plan)

- Earnings-Based mostly Compensation Plan (IBR Plan)

- Earnings-Contingent Compensation Plan (ICR Plan)

The quantity of your month-to-month pupil mortgage cost will rely in your revenue and household measurement, amongst different elements. After making funds in your loans for 20 or 25 years, your remaining pupil debt steadiness will probably be discharged. You possibly can enroll in an IDR plan by signing in to your account on the Federal Pupil Assist (FSA) web site.

STATE OF THE UNION: BIDEN PUSHES FOR INVESTMENT IN ‘AMERICA’S BEST KEPT SECRET’

Federal pupil mortgage forgiveness packages

The Division of Training affords a number of pupil debt forgiveness packages to federal debtors who meet sure eligibility standards. These embrace however will not be restricted to Public Service Mortgage Forgiveness (PSLF), closed college discharges, borrower protection to compensation discharges and whole and everlasting incapacity discharges (TPD).

Whereas the Biden administration has canceled about $16 billion value of debt for greater than 680,000 debtors beneath these packages, President Joe Biden has but to enact widespread pupil mortgage reduction.

YOU COULD GET A SMALLER TAX REFUND IF YOU RECEIVED CHILD TAX CREDIT PAYMENTS IN 2021

Pupil mortgage refinancing

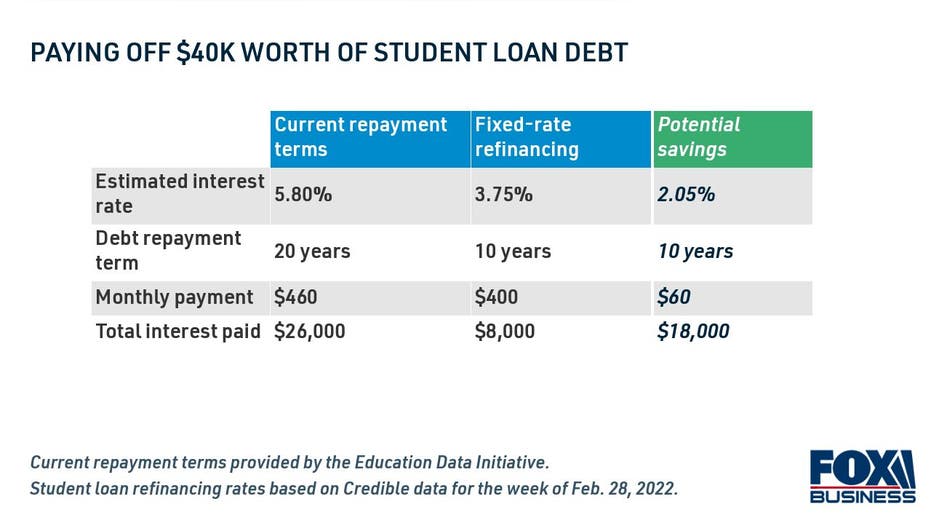

Pupil mortgage refinancing is whenever you take out a brand new personal mortgage to repay your present pupil debt beneath extra favorable phrases. It could be attainable to scale back your month-to-month funds, repay debt quicker and get monetary savings over time by refinancing your pupil loans at a decrease rate of interest.

Take into account that refinancing your federally held debt into a personal pupil mortgage would make you ineligible for choose protections like IDR plans, COVID-19 administrative forbearance and federal pupil mortgage forgiveness. However for those who do not plan on using these packages — or if you have already got personal pupil debt — then it might be worthwhile to refinance to a decrease fee.

You possibly can view present pupil mortgage refinance charges from personal lenders within the desk under. Then, you possibly can use Credible’s pupil mortgage refinancing calculator to estimate your potential financial savings and decide if this feature is true on your monetary state of affairs.

7 OF THE BEST GRADUATE STUDENT LOANS

Have a finance-related query, however do not know who to ask? E mail The Credible Cash Knowledgeable at moneyexpert@credible.com and your query could be answered by Credible in our Cash Knowledgeable column.