The author is a former funding banker in New York and former head of the Chilean wealth fund funding committee.

The deserves of portfolio diversification have been in all probability first acknowledged by the straightforward rule proposed within the Babylonian Talmud: one-third in actual property, one-third in merchandise (working capital) and the remaining third in liquid belongings.

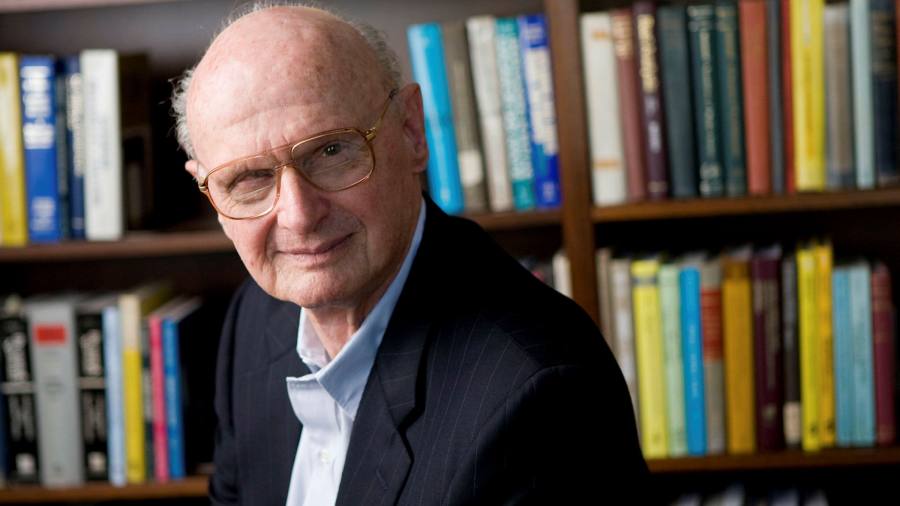

Nonetheless, a rigorous mathematical argument in favour of diversification was solely articulated by Harry Markowitz’s famend paper, “Portfolio Choice”, which appeared in March 1952 within the Journal of Finance. As we method the seventieth anniversary of its publication, it appears becoming to evaluate its affect.

Markowitz is universally recognised as the daddy of recent finance. The truth is, earlier than him, portfolio administration didn’t exist as a self-discipline. Funding choices have been pushed largely by advert hoc guidelines and intestine feeling somewhat than sound quantitative analyses. The truth that Markowitz continues to be alive is an affidavit of how younger this self-discipline is.

Did Markowitz get every thing proper? Sure and no. His massive contribution was to supply a quantitative framework to analyse the deserves of a bunch of investments (or a portfolio) as a complete. This framework allowed buyers to evaluate the diploma and advantages of diversification of a given portfolio. And it formally set out the thought of a risk-return trade-off; in different phrases, buyers wishing to acquire larger returns should be prepared to bear extra threat.

These ideas have survived effectively the take a look at of time. The truth is, they’re nonetheless the bedrock on which a lot of recent finance rests.

A robust offspring of those two ideas is the thought of the environment friendly frontier — that buyers ought to purpose for the candy spot of return and threat in portfolio development. The environment friendly frontier concept has not solely handed the take a look at of time effectively, it has grow to be — albeit with many modifications — the guideline for all critical buyers.

Markowitz’s framework, however, exhibited two weaknesses. One was its reliance on a mathematical assemble often called the correlation (of returns) matrix. In essence, this describes the extent to which any two belongings transfer collectively.

In any case these years, monetary analysts nonetheless don’t agree on which is one of the best ways to find out it. Worse but, small adjustments within the correlation values lead to main variations within the conclusions one derives. In sensible phrases, structuring an environment friendly portfolio primarily based on this method doesn’t work.

But, it’s one other challenge with Markowitz’s formulation that has been extra problematic — he confused threat and uncertainty. Threat is the chance that issues would possibly go flawed. Uncertainty will not be understanding what the longer term would possibly deliver.

By selecting the usual deviation of returns as a proxy for threat he made a conceptual mistake. Normal deviation — a primary statistical metric — focuses on dispersion. It doesn’t distinguish between good and dangerous situations, between getting a return larger than you anticipated and a return decrease than you anticipated. That’s, the usual deviation captures uncertainty, not threat. This conceptual fake pas despatched finance and economics down the flawed path for a few years.

Though this shortcoming was recognized about 30 years in the past with the introduction of threat metrics targeted on monetary losses such because the VaR (Worth-at-Threat), the tutorial neighborhood has been gradual to embrace these metrics. Practitioners, nevertheless, have moved a lot quicker. No critical asset supervisor depends on the usual deviation of returns or Markowitz’s correlation matrix for something.

Would this empirical failure quantity to an indictment of Markowitz’s concepts? Actually not. Maybe they could possibly be forgiven as youthful indiscretions; bear in mind, finance is a younger self-discipline. In sum, let’s imagine that Markowitz’s concepts have been a sensible failure (tough to implement in actuality) however a theoretical success (a set of stable ideas to information funding choices).

This would possibly sound like a harsh judgement; it isn’t. True, the numerical instruments advised by Markowitz have been progressively changed by higher algorithms, though to some extent that is nonetheless work in progress. Nonetheless, the environment friendly frontier, the risk-return trade-off, and the deserves of diversification have been the lighting rod behind just about every thing that has occurred in finance since 1952.

Nice concepts are sometimes marred by implementation difficulties. Assume democracy. Markowitz merely had a bunch of nice concepts. Monetary practitioners ought to be pleased about that. And the truth that many individuals are nonetheless working exhausting at implementing them is an affidavit of their timeless relevance.