-

Warren Buffett and Cathie Wooden are polar opposites relating to their funding kinds.

-

A sector the 2 buyers cannot agree on is railroads, with Ark naming the sector amongst its listing of “unhealthy concepts.”

-

“I will enterprise a uncommon prediction: BNSF [Railway] shall be a key asset for Berkshire and our nation a century from now,” Buffett stated in his annual letter to shareholders.

It ought to be no shock that Berkshire Hathaway’s Warren Buffett and Ark Make investments’s Cathie Wooden are polar opposites relating to their funding kinds.

Buffett has a historical past of profitable value-based investing, judging an organization by its present fundamentals and revenue margins relatively than wanting far out into the long run for giant progress. In the meantime, Wooden has discovered nice success by concentrating her investments in disruptive innovation, corporations which can be laser-focused on progress on the expense of earnings.

This dynamic between the 2 was on full show final week after Berkshire Hathaway launched its annual letter to shareholders, which touted a sector that Wooden see’s no future in: railroads.

Buffett known as his agency’s possession of the Burlington North Santa Fe Railway one among its “4 giants” that has a promising future forward regardless of it being an old-economy enterprise that may hint its roots again to 1848.

“BNSF continues to be the primary artery of American commerce, which makes it an indispensable asset for America in addition to for Berkshire. If the numerous important merchandise BNSF carries had been as an alternative hauled by truck, America’s carbon emissions would soar,” Buffett stated in his annual letter.

BNSF Railway, which is the biggest railroad in America by income, reported report earnings of $6 billion in 2021. And Buffett expects that report to be frequently damaged for a few years into the long run.

“I will enterprise a uncommon prediction: BNSF shall be a key asset for Berkshire and our nation a century from now,” Buffett stated.

However Wooden’s Ark Make investments sees the railroad enterprise otherwise. Ark in its Dangerous Concepts Report known as it a “unhealthy concept” that buyers ought to keep away from as it’s ripe for disruption.

That disruption, in keeping with Wooden, shall be pushed by the adoption of autonomous electrical vans that can “compete cost-effectively with freight rail and can supply higher, extra handy service.”

The potential comfort and price effectiveness of autonomous electrical driving vans ought to assist reverse the market share positive aspects and pricing energy railroad corporations have gained from truckers for the reason that early 2000s, in keeping with the report, resulting in the potential worth destruction of $400 billion in fastened belongings.

“The mix of electrical and autonomous know-how will improve productiveness and decrease the prices of trucking dramatically,” the report stated. Wooden expects autonomous semi-trucks to cut back the price of trucking by 75% to three cents per ton-mile, “undercutting rail costs with the assistance of decrease electrical energy and upkeep.”

Mixed with the potential for autonomous automobiles to take totally different type components over time like drones and rolling sidewalk robots, “we imagine freight rail corporations can have bother competing with antiquated know-how tied to devoted infrastructure belongings,” the report stated.

“ARK wonders which, if any, freight rail operators will survive.”

Wooden expects the transition from rail to autonomous vans to occur inside the subsequent 4 to 9 years, in keeping with the report.

However that timeline might not pan out, on condition that Tesla’s electrical semi-truck, which was revealed in 2017 with a scheduled 2020 rollout, has since been delayed till 2023 on the earliest.

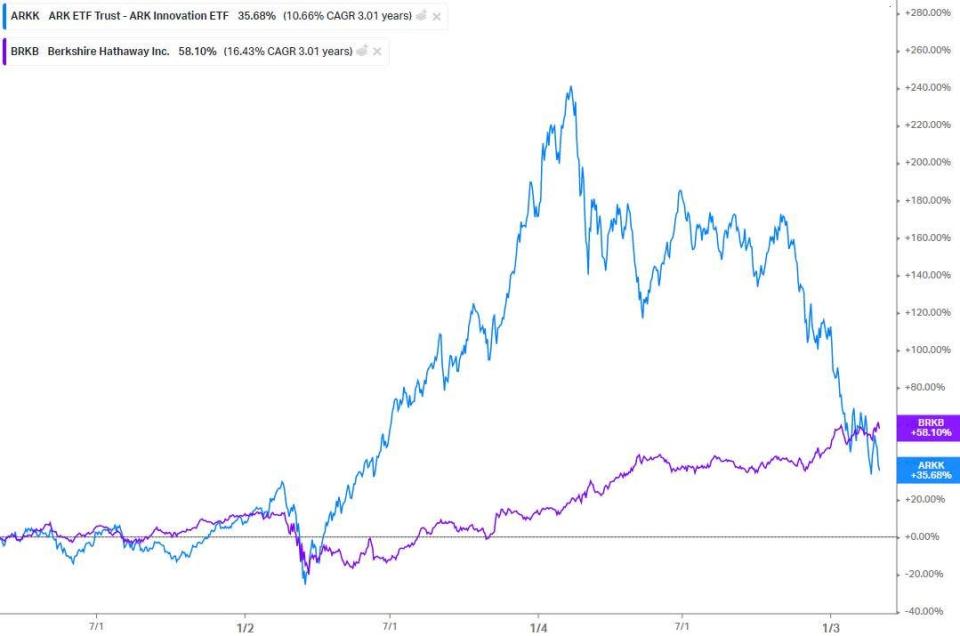

For now, buyers appear to be siding with Buffett over Wooden primarily based on Berkshire Hathaway’s efficiency relative to Ark’s flagship fund over the previous few years.

Learn the unique article on Enterprise Insider