First revealed on Merely Wall St Information

When on the lookout for dividend shares, we wish to see excessive performing firms which have the facility to each maintain and probably improve their dividends. Financial institution of America Company ( NYSE:BAC ) appears to cross a few of these filters, and in the present day we’ll analyze its dividend efficiency.

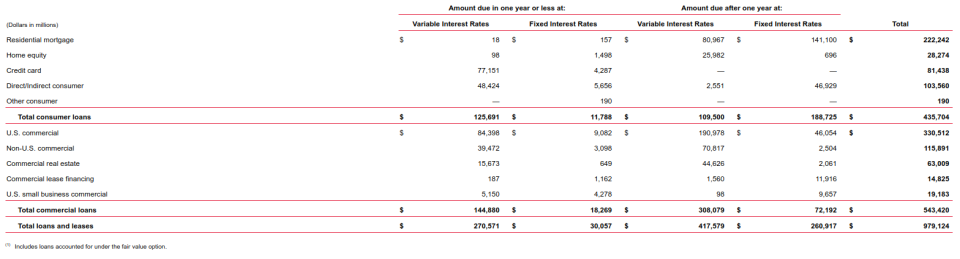

A part of the businesses that shall be coated from rising rates of interest are banks and monetary establishments which have plenty of shoppers holding variable charge debt. This shields them from rising rates of interest and permits them to cross on the speed prices to the mortgage holders. Financial institution of America is in a very good place to learn from this as a result of 70.3% of issued loans have variable rates of interest, and most of those loans are held by business shoppers.

Within the desk beneath, we will see the issued mortgage construction for BAC:

Whereas variable loans defend from charge hikes, traders have to be cautious as a result of as charges improve it’s possible that credit score danger additionally will increase and a few entities might not have the ability to repay their loans. This doesn’t imply that the company is in danger, however that there is perhaps elements offsetting future income progress.

Now that now we have set the image, we’ll see how Financial institution of America performs concerning dividends.

Table of Contents

Dividend Evaluation

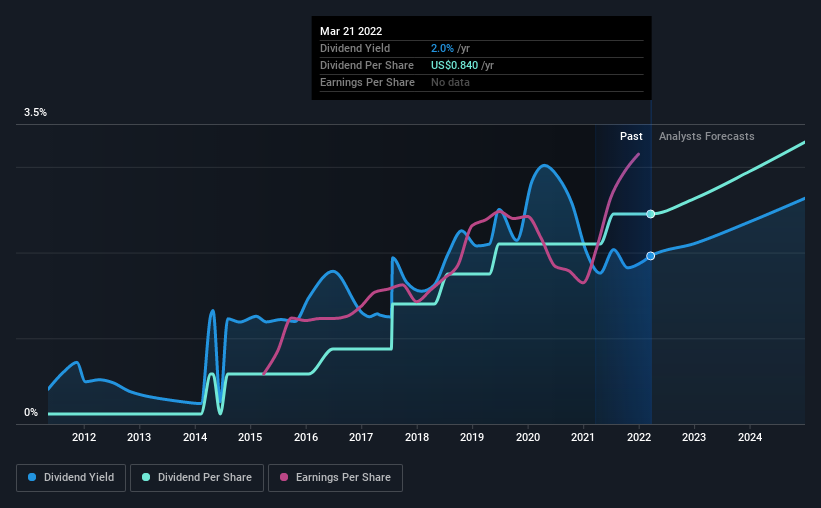

Whereas Financial institution of America’s 2.0% dividend yield will not be the best, we predict its prolonged cost historical past is sort of fascinating.The corporate additionally returned round 7.3% of its market capitalization to shareholders within the type of inventory buybacks over the previous yr.

Some easy analysis can scale back the chance of shopping for Financial institution of America for its dividend – learn on to study extra.

Discover this interactive chart for our newest evaluation on Financial institution of America!

It appears that evidently BofA has a monitor report of efficiently rising dividends put up 2008, that are properly coated by the expansion in web revenue. Whereas the present yield is near 2% as we talked about, traders can profit as the corporate maintains buybacks and probably will increase dividends in the long run.

Payout ratios

Dividends are normally paid out of firm earnings. If an organization is paying greater than it earns, then the dividend would possibly turn into unsustainable – hardly a super scenario.Consequently, we should always all the time examine whether or not an organization can afford its dividend, measured as a proportion of an organization’s web revenue after tax.Wanting on the information, we will see that 22% of Financial institution of America’s income had been paid out as dividends within the final 12 months.

The corporate additionally appears to be in a very good place to extend dividends per share, however is perhaps bracing forward of the uncertainty coming in 2022 and 2023.

Think about getting our newest evaluation on Financial institution of America’s monetary place right here.

Dividend Volatility & Development

Through the previous 10-year interval, the primary annual cost was US$0.04 in 2012, in comparison with US$0.8 final yr.This works out to be a compound annual progress charge (CAGR) of roughly 36% a yr over that point.

It is uncommon to discover a firm that has grown its dividends quickly over 10 years and never had any notable cuts, however Financial institution of America has accomplished it, which is sort of good.

Financial institution of America has been rising its earnings per share at 19% a yr over the previous 5 years.Speedy earnings progress and a low payout ratio suggests this firm has been successfully reinvesting in its enterprise.

Conclusion

Financial institution of America has markers of an organization that may stand up to future financial hurdles, and maintain their return to shareholders. That is observed in the truth that a majority of issued credit score is with variable charges, which passes on the prices of rising charges to the shoppers.

The dividend yield is modest, however shareholders are additionally a part of a steady firm participating in a long run buyback program.

The basics suggest that dividends are backed by web revenue and have been rising as the corporate grows earnings. The corporate has an total good efficiency on dividends, mortgage construction, and rising fundamentals.

On the lookout for extra high-yielding dividend concepts? Strive our curated record of dividend shares with a yield above 3%.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, e-mail editorial-team@simplywallst.com

Merely Wall St analyst Goran Damchevski and Merely Wall St don’t have any place in any of the businesses talked about. This text is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory and doesn’t take account of your targets, or your monetary scenario. We intention to convey you long-term targeted evaluation pushed by basic information. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials.