Cryptocurrency area was buzzing all through 2021, with buyers more and more turning to crypto-based investments over conventional options. The rising recognition of cryptos inadvertently invited some doubtful scams and suspicious actions, urging authorities to take sooner motion.

In reality, regulatory motion has grow to be crucial in 2022 after the earlier yr laid a strong basis stone for cryptos. Regulators can no extra neglect crypto investments price hundreds of thousands of {dollars} made by people.

Nations eyeing cryptocurrency regulation

Curiously, some authorities have already recognised the necessity for regulatory measures, together with Australia. The Australian prudential regulator intends to plot a brand new rule that mandates banks to carry larger capital in opposition to publicity to unstable crypto property to guard monetary stability. On the identical time, the regulator continues to assist wholesome innovation within the business because it plans to maintain the prudential framework less complicated for smaller entities.

Along with Australia, a number of nations are leaping on the bandwagon to manage the crypto area, with just a few nations even banning the asset class fully. In September final yr, China banned all cryptocurrency transactions to stop financial instability and curtail monetary crime.

Following China’s ban, nations like Ecuador and Russia have determined to introduce home crypto rules. Stories are doing rounds that Russia is planning to manage cryptos as an analogue of currencies as a substitute of a monetary asset. In a method, cryptos might be handled as a overseas foreign money when the brand new rules will come into impact.

In the meantime, Ecuador may regulate cryptos this yr. The brand new regulation is not going to make any cryptocurrency authorized tender within the nation because of the volatility related to the asset. As a substitute, the regulation will deal with bringing extra readability to the standing of cryptocurrency within the nation.

Whereas related rumours of a ban had been widespread in India, the federal government lastly launched a hefty tax of 30 per cent on any earnings from the switch of digital property.

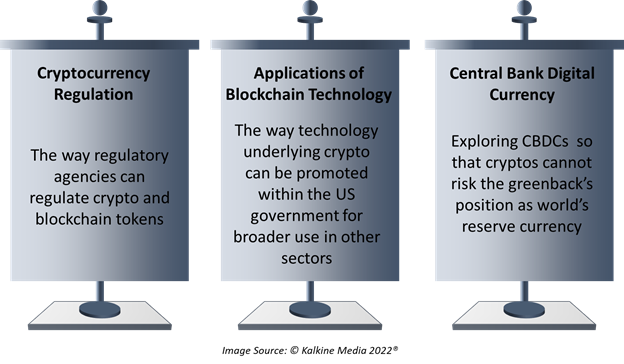

In the meantime, regulatory motion can also be underway within the US, with Congress introducing crypto-based payments targeted on three sections, that are highlighted within the determine under:

Will central financial institution digital foreign money clear up the aim?

Stringent regulatory motion within the crypto area has emerged at a time when speculations across the launch of central banks’ digital currencies are rife out there. To the uninitiated, a central financial institution digital foreign money or CBDC is a digital type of a nation’s fiat foreign money, which the central financial institution points.

In a number of nations, central banks have shared their intention to roll out their model of cryptos backed by a extremely secured know-how. The intention is to offer shoppers and companies with privateness, accessibility, comfort, transferability, and monetary safety. Nonetheless, this may increasingly invite additional restrictions on buying and selling in mainstream cryptocurrencies throughout nations.

In the meantime, this brings forth an attention-grabbing remark of policymakers’ potential to train their energy to manage buying and selling in crypto property. The potential launch of central banks-backed cryptos successfully goes in opposition to the muse of blockchain know-how and the aim with which cryptos had been launched.

Nonetheless, from a macro perspective, a extra protected ecosystem appears important in securing the extremely unstable cryptocurrency area, which is luring new buyers every passing day.