84 Property/Casualty Insurers Be a part of Statistical Database in Previous Two Years, Acquire Entry to Verisk’s Business-Main Supply of Superior Insurance coverage Analytics

Verisk Graph

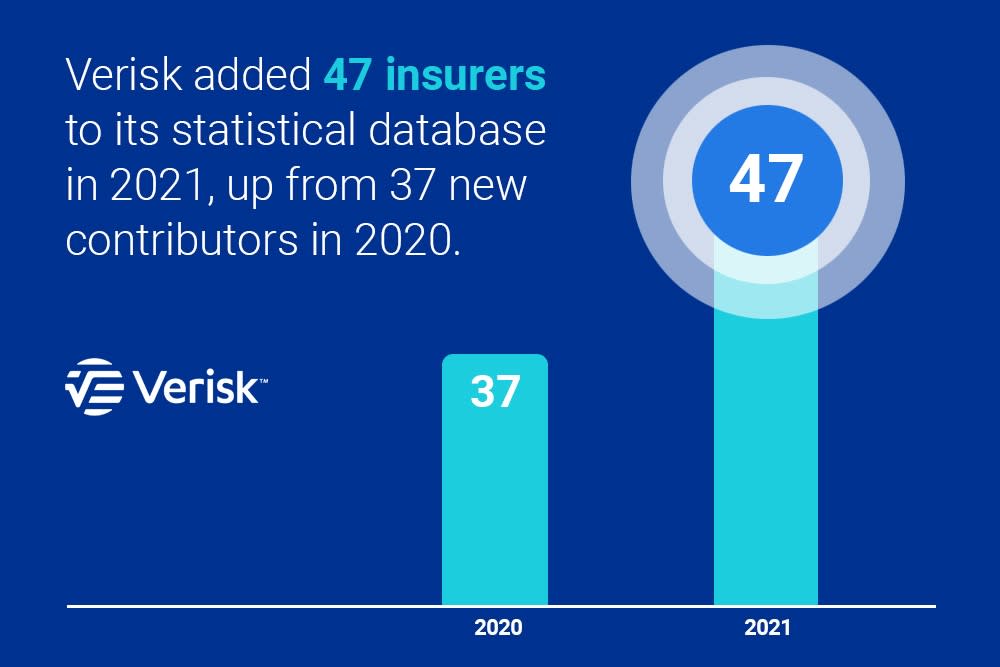

JERSEY CITY, N.J., Feb. 28, 2022 (GLOBE NEWSWIRE) — Verisk’s insurance coverage database has damaged its progress document for the second consecutive 12 months. A further 47 property/casualty insurers have dedicated to contributing their premium and loss information in 2022, getting access to essential analytics from Verisk’s industry-leading ISO Statistical Database.

In 2020, 37 insurers joined Verisk’s statistical database. Final 12 months, that quantity elevated to 47 new insurers, together with world, nationwide, super-regional and regional corporations—making it probably the most new contributors to affix over the previous 10 years. These new contributors are anticipated to considerably enhance the scale of the statistical database’s aggregated information throughout its big selection of non-public and business strains of enterprise.

Insurers Acquire Entry to Almost 30 Billion Data in Verisk’s Statistical Database

By sharing their information, contributing insurers can view combination premium and loss data from throughout the {industry} to assist enhance their selections throughout a variety of essential features, together with benchmarking, ratemaking, product growth and strategic planning. Verisk’s analytics allow contributing insurers to research information by state, geography, and protection, visualize loss growth developments and assist establish potential market alternatives.

“Our statistical database of premium and loss information – which now has near 30 billion information – is a essential supply of knowledge for a lot of P&C insurers,” mentioned Neil Spector, president of underwriting options at Verisk. “Because the database continues to develop, taking part insurers acquire entry to more and more precious analytics that may assist them innovate and develop within the quickly altering market.”

For greater than 50 years, Verisk has been a trusted supplier of information administration, reporting and analytics for insurers. In recent times, Verisk has accelerated enhancements to its statistical companies, making it much more environment friendly for insurers to contribute, entry and analyze information. These enhancements embrace extra versatile information contribution codecs, automated qc to assist insurers evaluation and proper their information submissions, in addition to ongoing entry to superior analytics which will be custom-made to an insurer’s exact specs.

About Verisk

Verisk (Nasdaq:VRSK) offers predictive analytics and decision-support options to clients within the insurance coverage, power and specialised markets, and monetary companies industries. Greater than 70 p.c of the FORTUNE 100 depends on the corporate’s superior applied sciences to handle dangers, make higher selections and enhance working effectivity. The corporate’s analytic options handle insurance coverage underwriting and claims, fraud, regulatory compliance, pure sources, catastrophes, financial forecasting, geopolitical dangers, in addition to environmental, social, and governance (ESG) issues. Celebrating its fiftieth anniversary, the corporate continues to make the world higher, safer and stronger, and fosters an inclusive and numerous tradition the place all group members really feel they belong. With greater than 100 places of work in almost 35 nations, Verisk constantly earns certification by Nice Place to Work. For extra: Verisk.com, LinkedIn, Twitter, Fb, and YouTube.

Attachment

CONTACT: Media Contact: Michelle Pantina Verisk 551-500-7327 michelle.pantina@verisk.com