In April, we launched a report on the credit score well being of scholar mortgage debtors through the pandemic and recognized the forms of debtors who could battle when the federal cost suspension ends. Since that report was launched, inflation has risen and delinquencies and balances have elevated for customers throughout credit score merchandise. These developments could sign or contribute to potential cost difficulties for debtors going ahead.

On the similar time, the federal authorities prolonged the cost suspension by means of the top of 2022 and introduced a new plan to supply one-time focused scholar mortgage debt aid that would cut back the burden for a lot of scholar mortgage debtors and remove loans totally for some debtors. For debtors with incomes below $125,000 individually ($250,000 for households), the plan would offer as much as $20,000 in debt aid on federally held loans for Pell Grant recipients, and as much as $10,000 in debt aid for different debtors with federally held scholar loans.

On this put up, we offer up to date knowledge exhibiting that scholar mortgage debtors are more and more prone to battle and should face difficulties as soon as their month-to-month scholar mortgage funds are reinstated. We additionally present how scholar debt cancellation could considerably cut back the variety of debtors in danger when the cost suspension ends in January 2023.

Table of Contents

Rising charges of delinquency on non-student-loan credit score

Utilizing the CFPB’s Client Credit score Panel (CCP), a deidentified pattern of credit score information from one of many nationwide shopper reporting companies, we study customers who’re anticipated to have scheduled mortgage funds on the finish of the suspension, however we exclude customers who’ve totally repaid their loans—or had their loans forgiven—for the reason that final report.1 We additionally exclude debtors with defaulted scholar loans since they won’t have common scheduled funds after the suspension ends if their loans will not be rehabilitated. Many debtors with defaulted loans, nonetheless, could have their loans canceled. For instance, 39 % of debtors with a defaulted scholar mortgage on their credit score report within the CCP have balances lower than $10,000, and 23 % have balances between $10,000 and $20,000.2

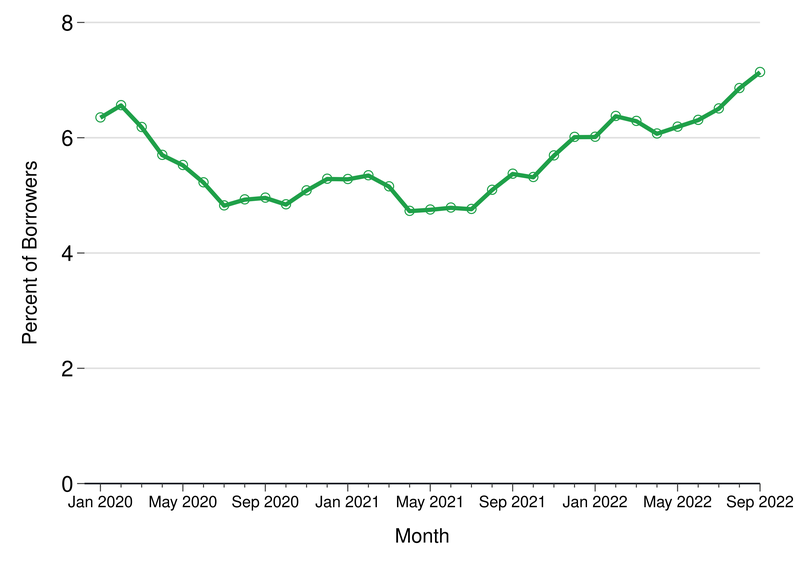

Firstly of the pandemic, a number of coverage interventions doubtless helped scholar mortgage debtors keep away from delinquencies on different credit score merchandise, however as these applications ended, delinquencies started to rise. The determine beneath reveals {that a} rising share of scholar mortgage debtors are 60 days or extra late on a non-student-loan credit score account since mid-2021. As of September 2022, 7.1 % of scholar mortgage debtors who weren’t in default on their loans at the beginning of the pandemic had been having problem repaying different money owed, as in comparison with 6.2 % of those debtors at the beginning of the pandemic. Delinquency charges have risen even additional for debtors with defaulted scholar loans, growing from 9.8 % at the beginning of the pandemic to 12.5 % as of September 2022 (not proven). If this rising delinquency pattern doesn’t change, extra debtors could battle as they face extra funds every month.

Determine: P.c of scholar mortgage debtors in pattern 60+ days delinquent on different credit score merchandise

Supply: CFPB CCP.

Whereas delinquencies have risen general, many debtors could have as much as $10,000 (or $20,000) in balances canceled below the debt aid coverage introduced in August. Whereas we will’t decide which debtors are eligible for this aid, this new coverage would very doubtless cut back the variety of scholar mortgage debtors in misery when the cost suspension ends.3 Debtors with decrease balances are considerably much less doubtless than these with greater balances to be behind on funds for different money owed, however 25 % of these with a non-student-loan delinquency have scholar mortgage balances of lower than $10,000. A further 19 % of those debtors have balances between $10,000 and $20,000. That’s, lots of the scholar mortgage debtors who’re at present battling compensation on different money owed would possibly now not have scholar mortgage debt to repay when the cost suspension ends. As famous above, an excellent bigger share of debtors with defaulted scholar loans have balances below the debt cancellation thresholds. And plenty of different eligible debtors in misery could face decrease month-to-month funds, even when they don’t enroll in an income-driven compensation plan, due to their lowered balances.

Month-to-month funds throughout credit score merchandise have elevated

Not solely has the share of scholar mortgage debtors with delinquencies on different money owed trended upward since mid-2021, however extra scholar mortgage debtors face greater month-to-month funds on non-student loans. In our earlier report, we discovered that, as of February 2022, 39 % of scholar mortgage debtors in our pattern had scheduled month-to-month funds for all credit score merchandise—aside from their scholar loans and mortgages—that elevated 10 % or extra relative to the beginning of the pandemic.4 As seen within the desk beneath, this has elevated to 46 % of scholar mortgage debtors as of September 2022.

Auto loans, the best balance-credit product after mortgages and scholar loans for a lot of debtors, drove a lot of the rise, however general, there was a 15 % improve in median month-to-month funds on non-student-loan money owed for scholar mortgage debtors in our pattern for the reason that begin of the pandemic.5 Whereas these greater funds could also be manageable for debtors who’ve seen their incomes develop over the pandemic, others could also be falling behind, as prompt by the rise in delinquencies proven within the determine above.

Notice: All statistics are calculated for scholar mortgage debtors who could have a cost due when the suspension ends and who had an impressive scholar mortgage in February 2020. Scheduled funds embody all minimal scheduled month-to-month funds for all credit score merchandise aside from scholar loans and mortgages. Prior scholar mortgage delinquency is outlined as having a scholar mortgage in February 2020 reported as 90 days or extra late whereas these labeled as by no means in compensation don’t have any reported prior funds as of February 2020. Census tract classes are outlined by adults within the tract with family revenue beneath 200 % of the Federal poverty threshold; “low” revenue is 40 % or extra of adults, “average” revenue is 20 % or extra however lower than 40 % of adults, and “excessive” revenue is lower than 20 % of adults. Supply: CFPB CCP.

Rising dangers for a lot of scholar mortgage debtors could also be alleviated by debt cancellation

In our April report, we additionally targeted on 5 potential danger elements that point out scholar mortgage debtors would possibly battle when the cost suspension ends: pre-pandemic delinquencies on scholar loans, pre-pandemic cost help on scholar loans, a number of scholar mortgage servicers, delinquencies on different credit score merchandise for the reason that begin of the pandemic, and new non-medical collections through the pandemic.

Since that report, delinquencies on non-student-loan merchandise have risen additional, as mentioned above. There has additionally been a small improve within the share of debtors with new non-medical collections reported on their credit score information (not proven). Total, this has led to a rise within the variety of debtors with two or extra danger elements from 5.1 million to five.5 million scholar mortgage debtors.

Nonetheless, as many as one-third of debtors with two or extra danger elements could have their balances utterly canceled. Particularly, 19 % of those debtors at present have balances below $10,000 and 16 % have balances between $10,000 and $20,000 (not proven). So, regardless of worsening credit score outcomes general, the cancellation of some scholar mortgage debt implies that fewer scholar mortgage debtors are prone to be liable to cost difficulties when federal scholar mortgage funds resume in January 2023 than they in any other case can be. And plenty of debtors with a number of danger elements who nonetheless have excellent balances when funds resume could have lowered balances going ahead.

As well as, at-risk debtors with loans remaining after the debt cancellation could keep away from cost difficulties by enrolling in an income-driven compensation plan . At present many debtors can qualify for plans that cap their month-to-month scholar mortgage funds at 10 % of their discretionary revenue every month. A proposed new plan would decrease that cap to five % whereas additionally categorizing extra revenue as non-discretionary. Previous to the pandemic, debtors with bigger balances had been extra prone to be enrolled in an income-driven compensation plan, so they might have extra expertise navigating the method. However they had been additionally extra prone to have a delinquent scholar mortgage or different credit score product and would nonetheless have substantial mortgage balances even after any debt cancellation.

The Workplace of Analysis will proceed to watch how scholar mortgage debtors are doing as scheduled funds resume and these new insurance policies are rolled out.

Roughly 0.8 million debtors with excellent federal or non-public loans in February 2022 now not have scholar loans as of the top of September 2022. That is along with the 4 million debtors who totally repaid their loans (or had them forgiven) between March 2020 and February 2022. Our evaluation excludes customers who first took out scholar loans after February 2020 or whose loans had been in default as of March 2020. For extra info on the coed mortgage debtors excluded from this evaluation, see the April report.

This estimate doesn’t embody all debtors with defaulted federal scholar loans as some loans have been in default for greater than seven years and now not seem on the borrower’s credit score report.

Our knowledge don’t embody info on revenue or whether or not customers acquired Pell grants which is critical to find out debt cancellation eligibility. Moreover, a number of the loans included on this evaluation will not be eligible for this debt cancellation (resembling privately held scholar loans).

Within the April report and right here, we exclude mortgage funds from this calculation to make comparisons throughout owners and renters extra constant.

A number of elements doubtless contribute to this improve, together with the ageing of debtors within the pattern and the comparable charges of general value and wage progress throughout this era (Bureau of Labor Statistics, obtainable at https://knowledge.bls.gov/cgi-bin/surveymost?bls ).