fazon1/iStock Editorial through Getty Photos

Within the previous Roadrunner cartoons, Wile E. Coyote would usually discover himself having run off the sting of a cliff however not really falling till he realized that he was not on strong floor. Not many individuals know that, simply as Mickey Mouse developed from the character Mortimer Mouse, Wile E. Coyote’s origins lie in a personality from the Nineteen Twenties referred to as Wall St. Coyote.

Wall St. Coyote’s gag was that, after having chased returns off the sting of a New York skyscraper, he would, like his later roadrunner-chasing reincarnation, notice he was not on terra firma, drop, after which, on the best way down, calculate how excessive he was more likely to bounce as he hit every ledge alongside the best way. His underlying assumption was that he would return to his earlier highs, and so with every ledge that he hit, he would turn out to be increasingly more excited, regardless of how badly bruised and damaged he turned with every new low.

By 1929, the character was massively standard, with children begging their bob-headed moms and dandified fathers to purchase them Wall St. Coyote’s signature straw hats and different such memorabilia. However, by 1931, the general public had turned in opposition to Wall St. Coyote, and he was retired to the American Southwest to be rebranded. By then, he had realized that when he had been outwitted by his prey, he would simply have to attend till he hit all-time low earlier than beginning yet again.

Over the past six months or so, the Communication Companies Choose Sector SPDR Fund (XLC) has constantly been the worst-performing of the key sector indices, and but I usually learn feedback about how the more and more poor efficiency of those shares signifies that they’re “low-cost” and have simply that rather more upside potential.

For XLC holders, a mirror? (Monetary Occasions)

After all, these optimists could also be confirmed proper. Not solely will there be the inevitable dead-coyote bounces alongside the best way, however markets, ultimately, do what they’re going to do. They don’t transfer in straight traces. They’ve their very own logic, and bodily rules like gravity make for very free metaphors (we must discover out about cartoons).

Chart A. Communication Companies shares had been held aloft by Media & Leisure shares (Stockcharts.com)

However, I’ll argue that, no matter bounces XLC and its constituents could expertise within the coming months, the sector possible has a lot farther to fall and can possible not start an actual turnaround till the top of the last decade. For a extra common outlook on tech shares, you may go to my article Massive Tech Has A Lot Farther To Fall, however on this piece I’m going to deal with the XLC and its parts.

As I’ve accomplished with latest items on industrials (XLI), primary supplies (XLB), power (XLE), and brokerages (IAI), I’ll analyze these parts utilizing Fama-French {industry} information going again to 1926. That information, or moderately my interpretation of it, means that XLC valuations have been unsustainable (“overvalued”, should you like) and the consequence has usually been depressed returns.

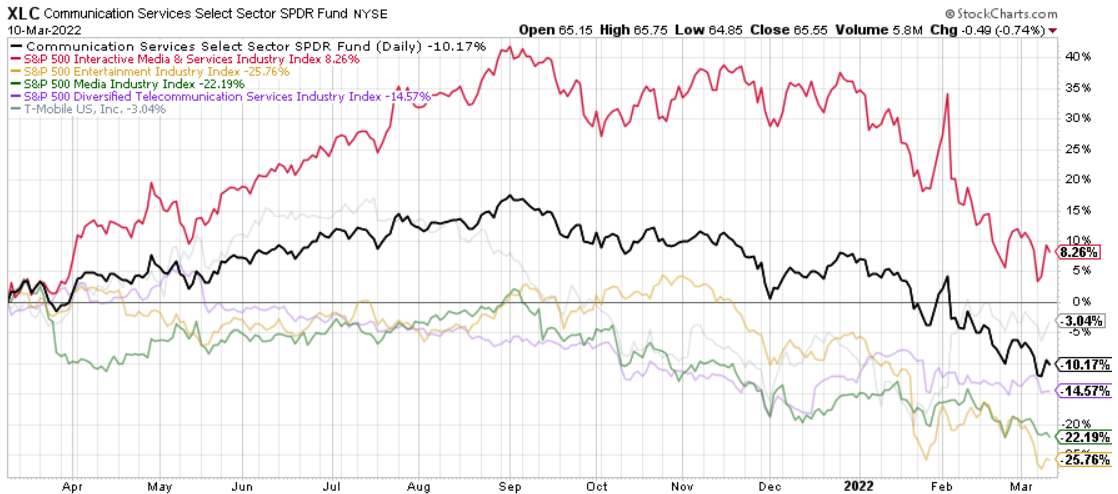

Chart A, above, reveals value indexes for the S&P 500, the Communication Companies Sector Index, and the 2 {industry} teams that comprise the sector, the Media & Leisure Trade Group and the Telecommunication Companies Trade Group. Telecommunications firms have struggled since 2019 and, considerably surprisingly, by no means recovered through the pandemic. The Media & Leisure group outperformed the S&P 500 and clearly made up for the weak spot in telecommunications.

Though every of the sector indexes that now we have lined in latest weeks incorporates a wide range of {industry} and {industry} teams, there’s significantly extra divergence right here, and this makes it troublesome to deal with a core grouping.

Corporations within the S&P 500 are positioned in one of many eleven sectors relying on their GICS codes, that are recurrently up to date and adjusted relying on a number of monetary standards. This text explains among the variations between the number of classifications, however the benefit of the Fama-French SIC groupings is that they permit us to look again farther than do different classifications.

The next desk reveals XLC’s holdings, weights, and GICS classification, alongside every firm’s Fama-French 49-industry classifications.

|

The Communication Companies Choose Sector SPDR® Fund holdings as of 09-Mar-2022 |

||||||

|

Title |

Ticker |

Weight |

Cumulative weight |

GICS Sector |

FF49 Trade(personal calculations) |

|

|

Meta Platforms Inc. Class A |

16.0 |

16.0 |

1 |

Interactive Media & Companies |

Software program |

|

|

Alphabet Inc. Class A |

12.4 |

28.5 |

2 |

Interactive Media & Companies |

Software program |

|

|

Alphabet Inc. Class C |

11.6 |

40.1 |

3 |

Interactive Media & Companies |

Software program |

|

|

Activision Blizzard Inc. |

5.6 |

45.6 |

4 |

Leisure |

Different* |

|

|

T-Cell US Inc. |

5.5 |

51.2 |

5 |

Wi-fi Telecommunication Companies |

Telecom |

|

|

Verizon Communications Inc. |

5.5 |

56.7 |

6 |

Diversified Telecommunication Companies |

Telecom |

|

|

AT&T Inc. |

5.3 |

62.0 |

7 |

Diversified Telecommunication Companies |

Telecom |

|

|

Comcast Company Class A |

5.0 |

67.0 |

8 |

Media |

Telecom |

|

|

Constitution Communications Inc. Class A |

4.8 |

71.7 |

9 |

Media |

Telecom |

|

|

Walt Disney Firm |

4.6 |

76.3 |

10 |

Leisure |

Leisure |

|

|

Digital Arts Inc. |

3.1 |

79.4 |

11 |

Leisure |

Different* |

|

|

Netflix Inc. |

3.1 |

82.5 |

12 |

Leisure |

Leisure |

|

|

Match Group Inc. |

2.5 |

85.0 |

13 |

Interactive Media & Companies |

Private providers |

|

|

Twitter Inc. |

2.4 |

87.4 |

14 |

Interactive Media & Companies |

Software program |

|

|

Paramount International Class B |

1.8 |

89.2 |

15 |

Media |

Telecom |

|

|

Take-Two Interactive Software program Inc. |

1.6 |

90.8 |

16 |

Leisure |

Different* |

|

|

Omnicom Group Inc |

1.4 |

92.3 |

17 |

Media |

Different |

|

|

Reside Nation Leisure Inc. |

1.3 |

93.6 |

18 |

Leisure |

Leisure |

|

|

Interpublic Group of Corporations Inc. |

1.2 |

94.7 |

19 |

Media |

Enterprise providers |

|

|

Fox Company Class A |

1.2 |

95.9 |

20 |

Media |

Telecom |

|

|

Lumen Applied sciences Inc. |

0.9 |

96.8 |

21 |

Diversified Telecommunication Companies |

Telecom |

|

|

Information Company Class A |

0.7 |

97.5 |

22 |

Media |

Printing & Publishing |

|

|

DISH Community Company Class A |

0.7 |

98.2 |

23 |

Media |

Telecom |

|

|

Discovery Inc. Class C |

0.7 |

98.9 |

24 |

Media |

Telecom |

|

|

Fox Company Class B |

0.5 |

99.3 |

25 |

Media |

Telecom |

|

|

Discovery Inc. Class A |

0.4 |

99.7 |

26 |

Media |

Telecom |

|

|

Information Company Class B |

0.2 |

99.9 |

27 |

Media |

Printing & Publishing |

|

The desk under reveals the XLB’s classification construction. From left to proper, there are two {industry} teams divided into a complete of 5 industries, that are then divided into ten subindustries.

XLC consists of two {industry} teams (International Trade Classification Normal – Wikipedia)

And the following one reveals the burden by {industry}.

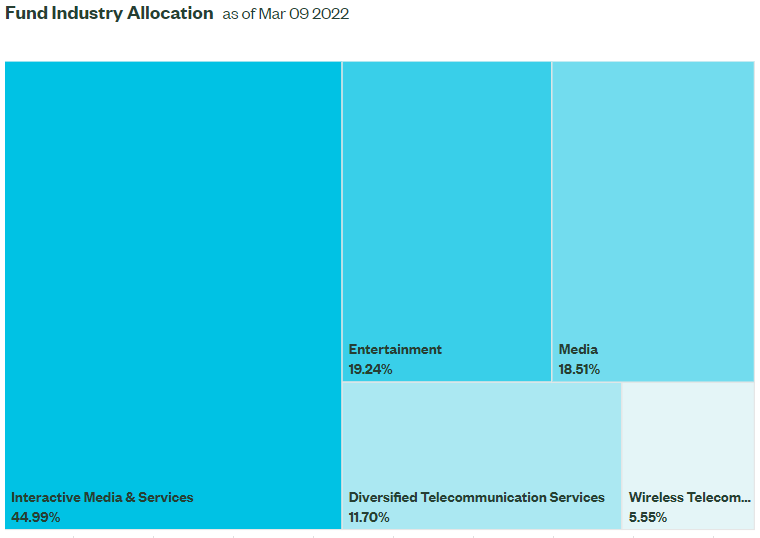

XLC is dominated by the three industries of the Media & Leisure Group (XLC: The Communication Companies Choose Sector SPDR® Fund (ssga.com))

The three industries of the Media & Leisure Group (that’s, Interactive Media & Companies, Leisure, and Media) make up the majority of the index (over 80%). The remaining, in fact, is Telecommunications Companies. The Wi-fi Telecommunications Companies {industry} is barely comprised of 1 firm in the meanwhile, T-Cell.

The next chart reveals the 52-week performances of those {industry} indexes, ranked by weight (I couldn’t discover the Wi-fi index, so simply used T-Cell as a substitute).

Chart B. The most important {industry}, Interactive Media & Companies, started contributing to the decline originally of the yr (Stockcharts.com)

In the event that they diverged through the pandemic, as we noticed in Chart A, they’re all singing from the identical hymnbook now. Every of them could be very close to its 52-week low. The weakest of those industries (by this measure) have really been comparatively secure the final two months. The weak spot in 2022 has come primarily from the Interactive Media & Companies Trade’s eagerness to shut the hole.

These are the GICS weightings and performances, however once more, for historic context, we have to take a look at Fama-French SIC information. Within the following desk, I present the proportion of shares throughout the XLC that match into these Fama-French 49 indexes.

|

FF49 Trade |

XLC % |

|

Software program |

42.5 |

|

Telecommunications |

32.2 |

|

Leisure |

8.9 |

A few notes of warning are so as. First, there are firms throughout the Fama-French indexes which can be not throughout the XLC. For instance, Microsoft (MSFT) is a Fama-French Software program firm, however it’s within the Info Expertise sector (XLK) moderately than XLC, as a result of the GICS methodology sees the corporate as being extra just like Apple than to Google or Fb. Second, these three industries account for about 83% of the index. Different Fama-French groupings embrace Private Companies, Enterprise Companies, Printing & Publishing, and Different. In Desk 1, I put an asterisk subsequent to these “Different” shares that would appear to match the “Leisure” class, primarily online game firms like Activision Blizzard. If these shares have been labeled as Leisure, that may increase the Leisure weighting from 8.9% to 19.2% and increase protection to just about 94%.

Usually, I’d deal with a single core {industry} or {industry} group when coping with these sprawling sector indices, however as a result of throughout the Fama-French classifications, there isn’t a single grouping that makes up the majority of the index, I’m going to take care of every of the three largest Fama-French industries one after the other and attempt to synthesize the findings on the finish.

As a result of the Software program {industry} is comparatively younger (information solely begins within the Sixties) and there seems to be extra similarity between Software program and Leisure (for which information goes again to 1926)–seemingly confirming the GICS {industry} group classifications to some degree–I’m going to start out with Leisure, proceed to Telecommunications (information right here additionally goes again to 1926), after which conclude with the Software program {industry}.

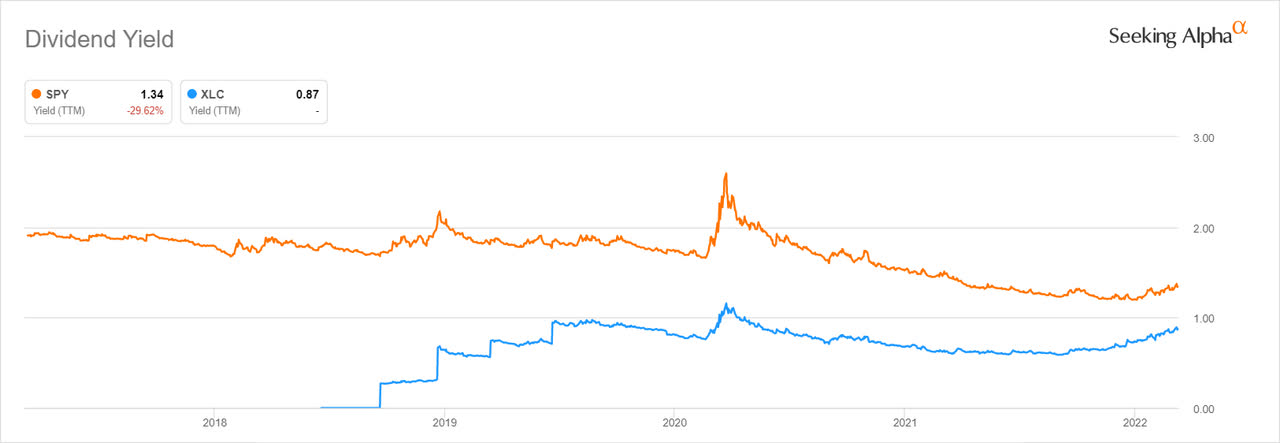

Earlier than doing that, nevertheless, let’s make a few easy observations about these teams and the way they evaluate to the broader market, starting with the dividend yield. A minimum of on this foundation, XLC continues to commerce at a premium relative to the S&P 500, in line with Searching for Alpha information.

Chart C. XLC’s dividend yield stays nicely under the S&P 500’s (Searching for Alpha)

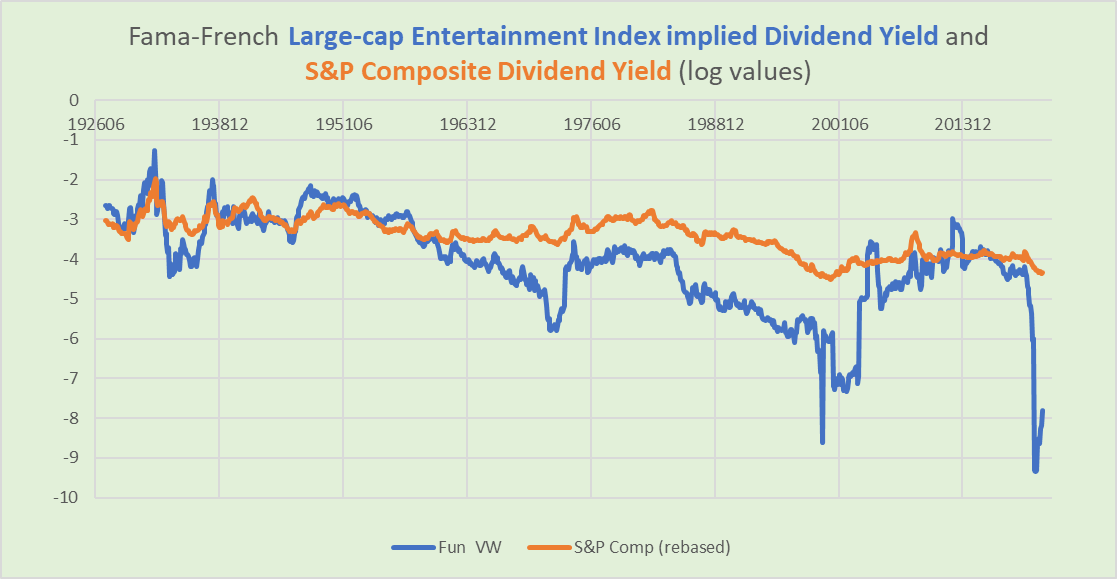

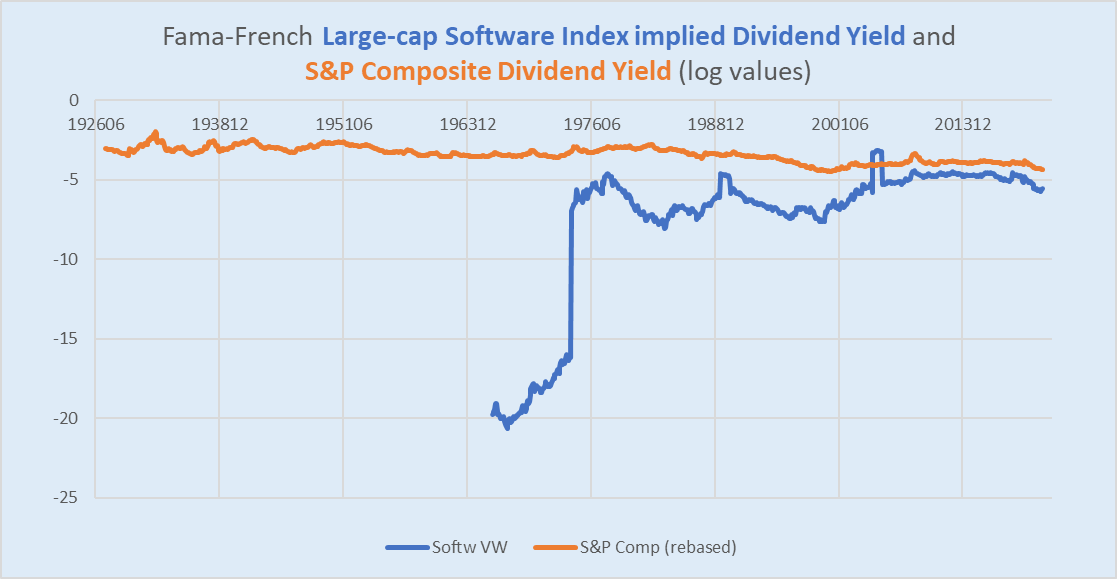

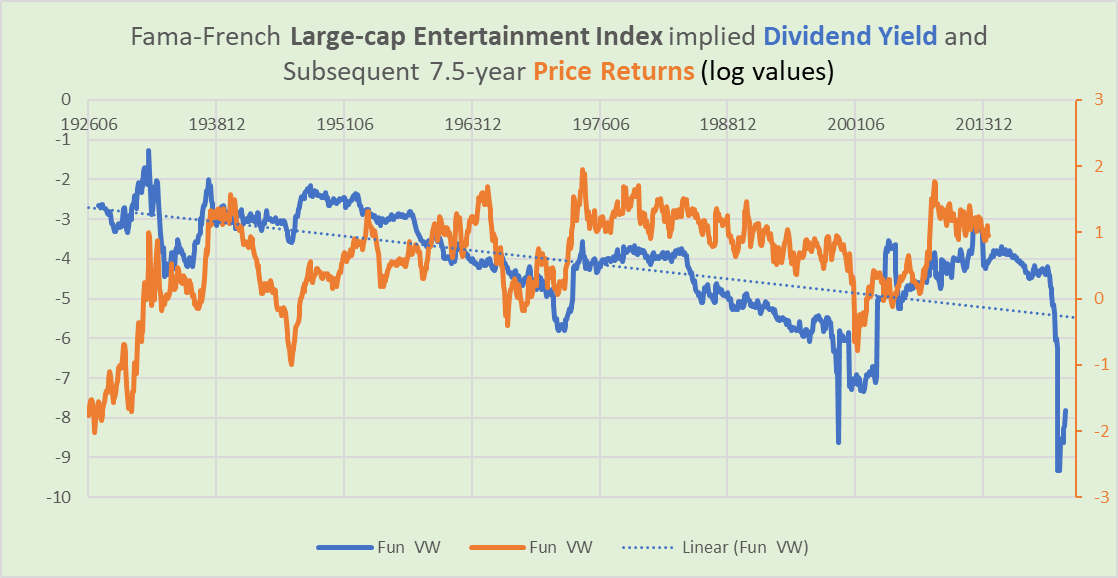

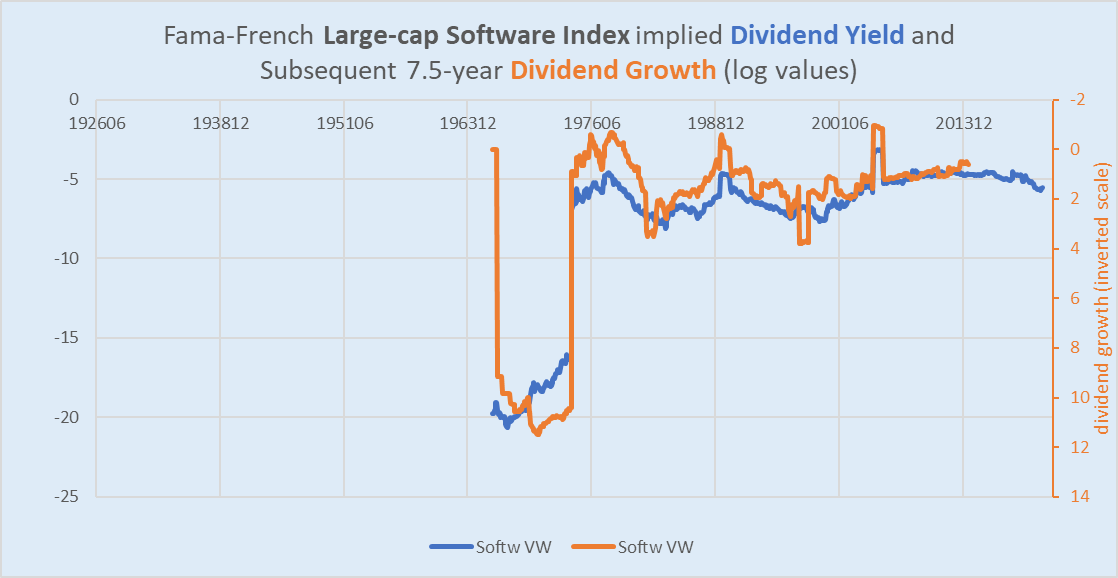

However, this has nearly all the time been the case for the Software program and Leisure industries. Within the following chart, I calculated historic dividend yields for these indexes by contrasting whole returns with value returns.

Chart D. Leisure dividend yields solely hardly ever exceed the S&P 500’s (Fama-French information, Shiller information)

Because the Sixties, a minimum of, Leisure yields have fallen to very low ranges close to tops in secular bull markets (1972, 1999, and 2021(?)).

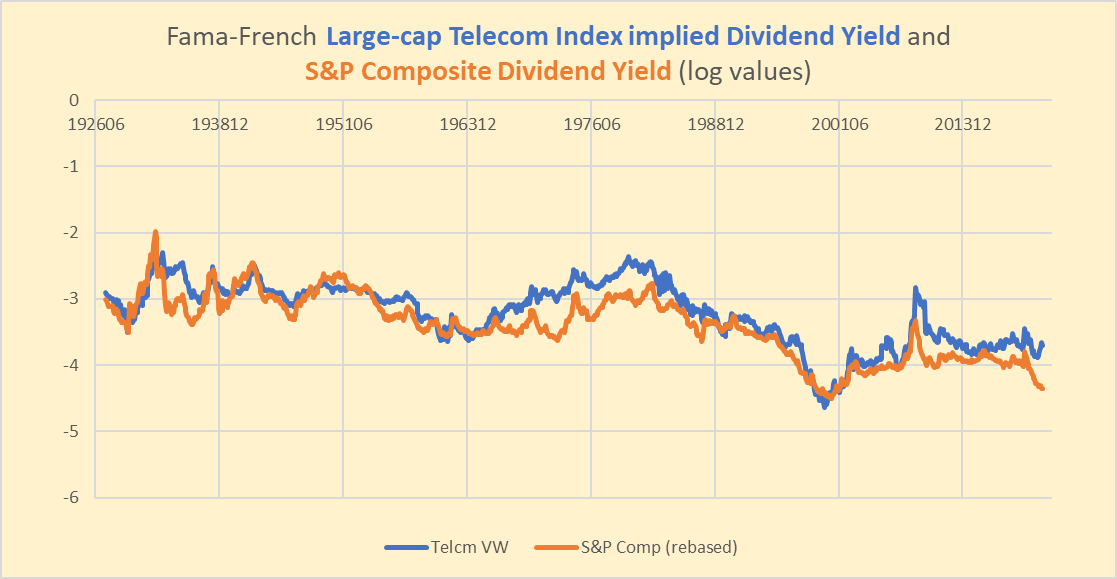

Telecommunications yields have solely hardly ever damaged under the S&P’s.

Chart E. The divided yield on Telecoms tends to barely exceed the S&P 500’s (Fama-French information, Shiller information)

For Software program and Leisure, the yields have all the time been each low and risky, the other of Telecoms.

Chart F. Actions within the software program shares’ dividend yields dwarf these of the S&P 500 (Fama-French information, Shiller information)

However, my argument is much less that they’re “overvalued” relative to the S&P 500 than that they’re possible overvalued inside their respective historic contexts.

So as to not put on the persistence of the readers an excessive amount of, I’m going to assessment their respective histories as effectively as I can. First, enjoyable.

Leisure vulnerable to extraordinarily low returns

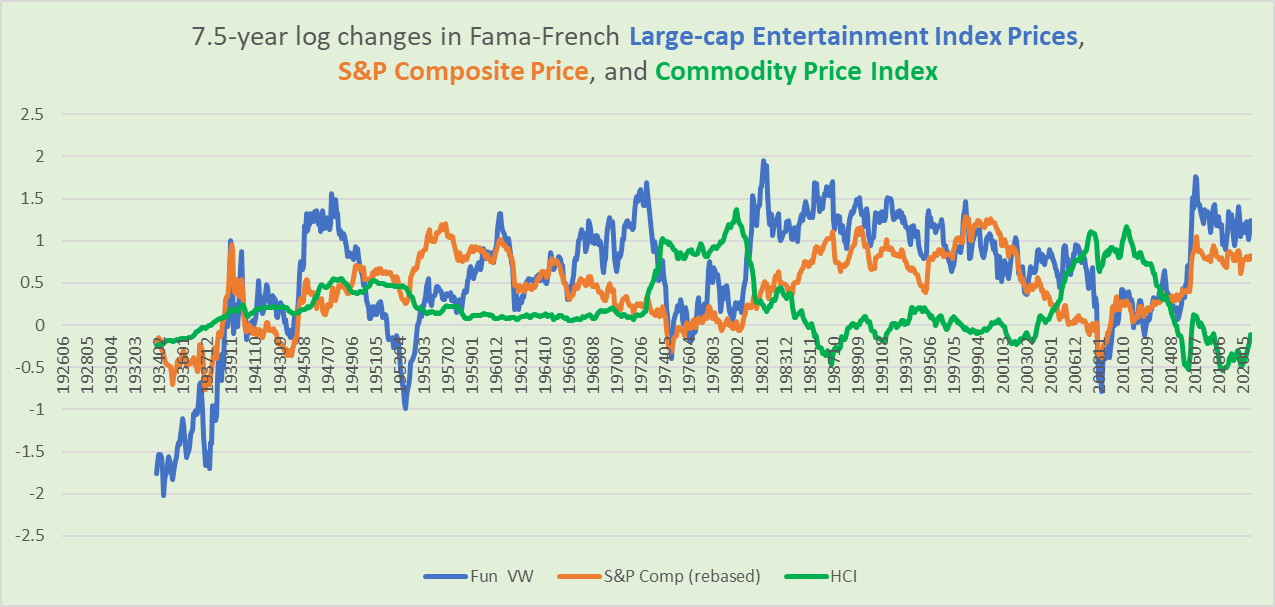

Leisure shares have had 4 “secular” bear markets by my depend: the Despair, the Fifties, the Seventies, and the early 2010s. Commodity information is a spliced index of Warren & Pearson wholesale information, the Fed’s PPIIDC index, and World Financial institution commodity costs.

Chart G. Leisure shares don’t like inflation, however they hate deflation (Fama-French, Shiller, World Financial institution, Warren & Pearson, & St Louis Fed)

The final three befell throughout comparatively excessive ranges of commodity inflation, however it isn’t clear from this vantage level what actually drove the poor efficiency within the Fifties. The index had accomplished fairly nicely through the preliminary bout of excessive inflation of the Forties. Clearly, the worst efficiency of the index was through the Despair. We are able to surmise {that a} simultaneous collapse in each progress and inflation is very arduous on the type of discretionary spending that may usually go to leisure.

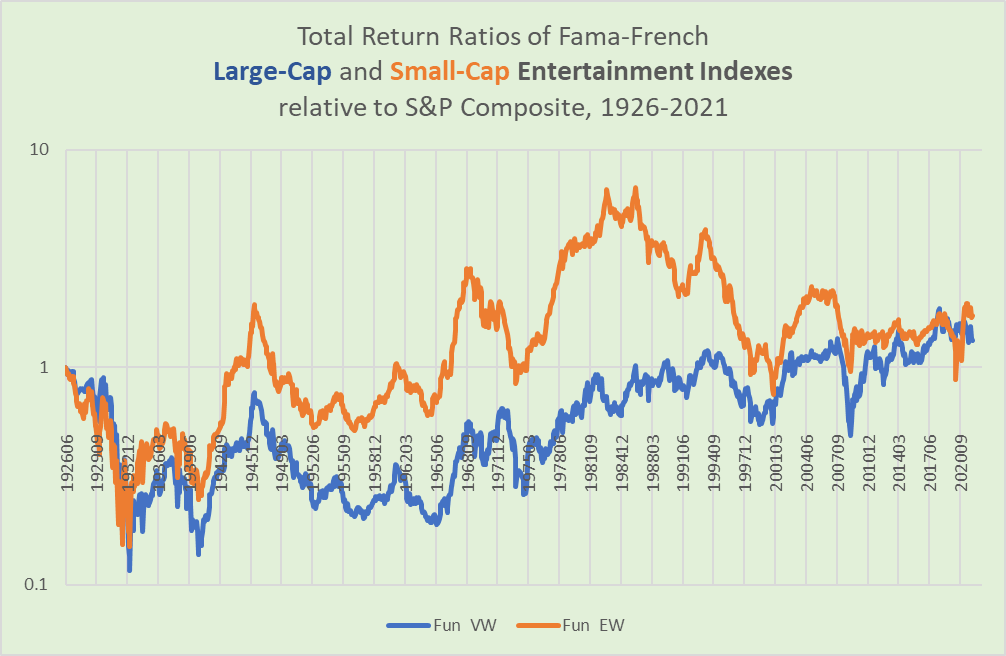

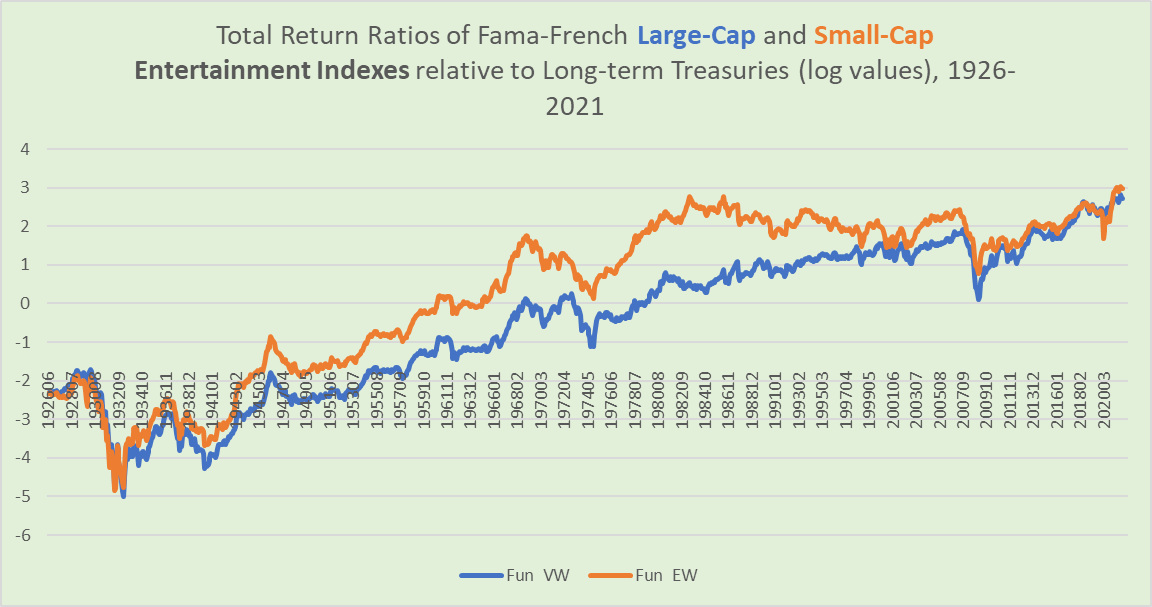

If we take a look at relative whole performances, we are able to see the injury accomplished to Leisure shares by the Nice Despair. Curiously, their relative underperformance was already underway earlier than the inventory market peak of September 1929.

Chart H. It took about 50 years for leisure shares to regain their pre-Despair place (Fama-French, Shiller)

We talked about above how, because the Sixties, drastic dips within the dividend yield usually occurred throughout market peaks. That situation coincided with the structural rise in Leisure inventory efficiency that started on the similar time.

We’re typically going to disregard small-caps on this article, however it’s attention-grabbing to notice the diploma to which small-cap Leisure shares have underperformed large-caps because the early Nineteen Eighties. Though I’ve but to do a research evaluating small-caps and large-caps by {industry}, this appears to be comparatively uncommon. The one comparable instance I can consider in the meanwhile is Software program shares, which we are going to take a look at later.

Massive-cap Leisure shares have constantly outperformed bonds because the Despair, but it surely did take practically 25 years for them to interrupt even relative to the 1929 excessive.

Chart I. Massive-cap Leisure shares have solely skilled two main shocks because the Despair (Fama-French, Shiller)

There have been two different damaging shocks, 1973 and 2008, which appear to have been generated by commodity inflation shocks.

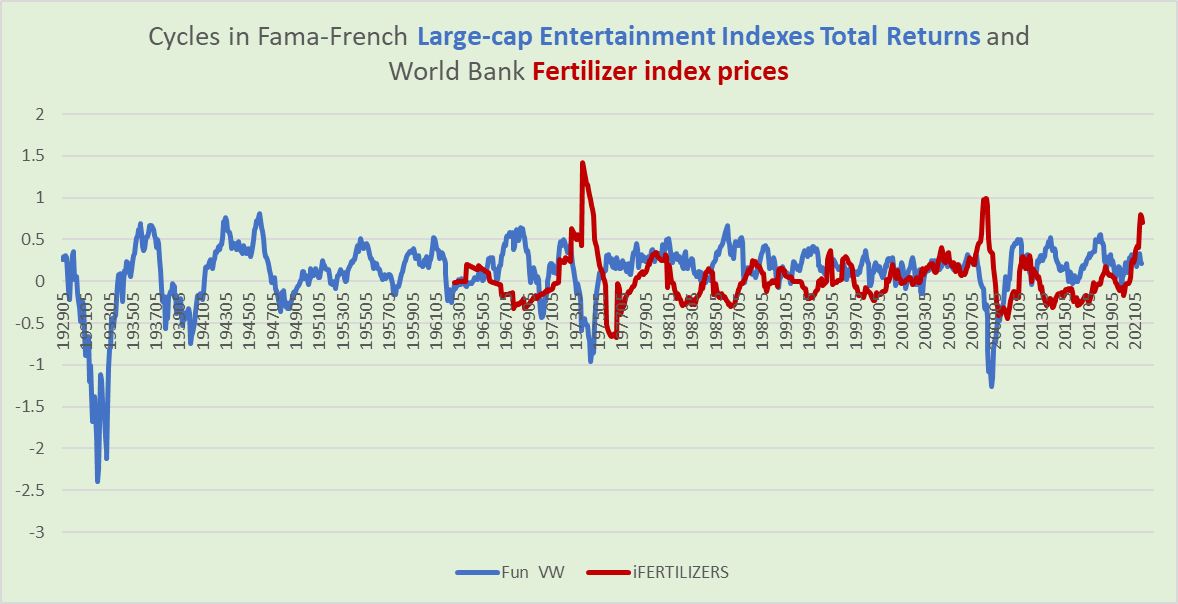

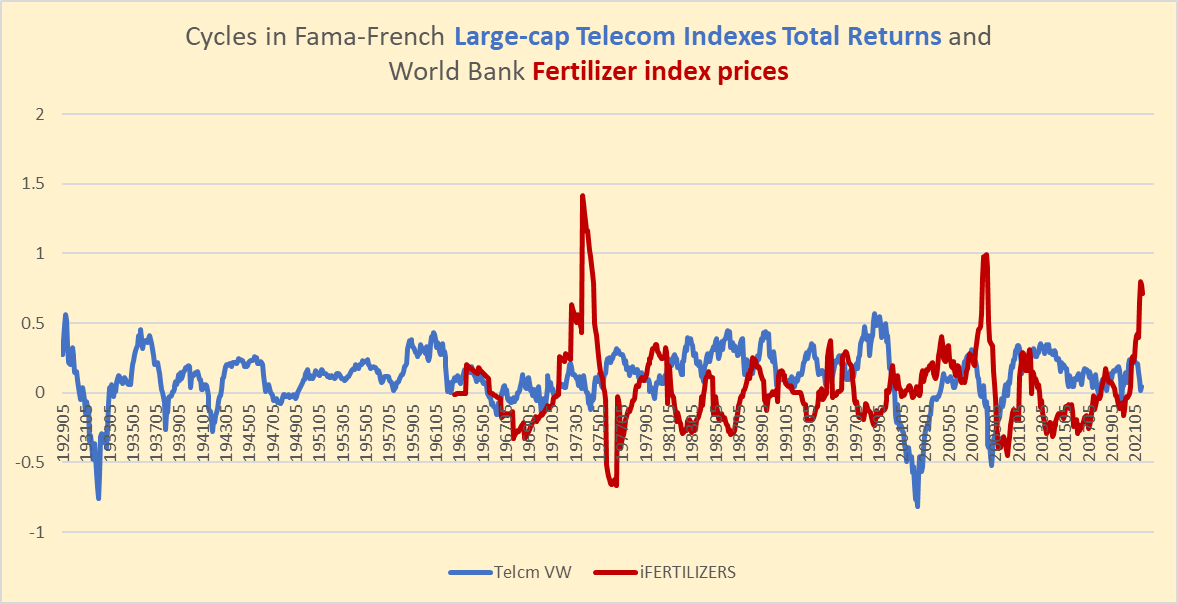

Though I believe power shocks are the almost certainly wrongdoer, probably the most ‘predictive’ commodity is fertilizers.

Chart J. Generally markets select leisure, typically they select fertilizer (Fama-French, Shiller)

Fertilizer shocks are likely to coincide with (and barely lead) crashes in these shares. The chart means that the present cycle is the third largest of the final sixty years. (The efficiency of fertilizer shares like MOS, NTR, and CF suggests it will not be over but).

If inflation shocks are unhealthy, deflationary progress shocks are in all probability worse.

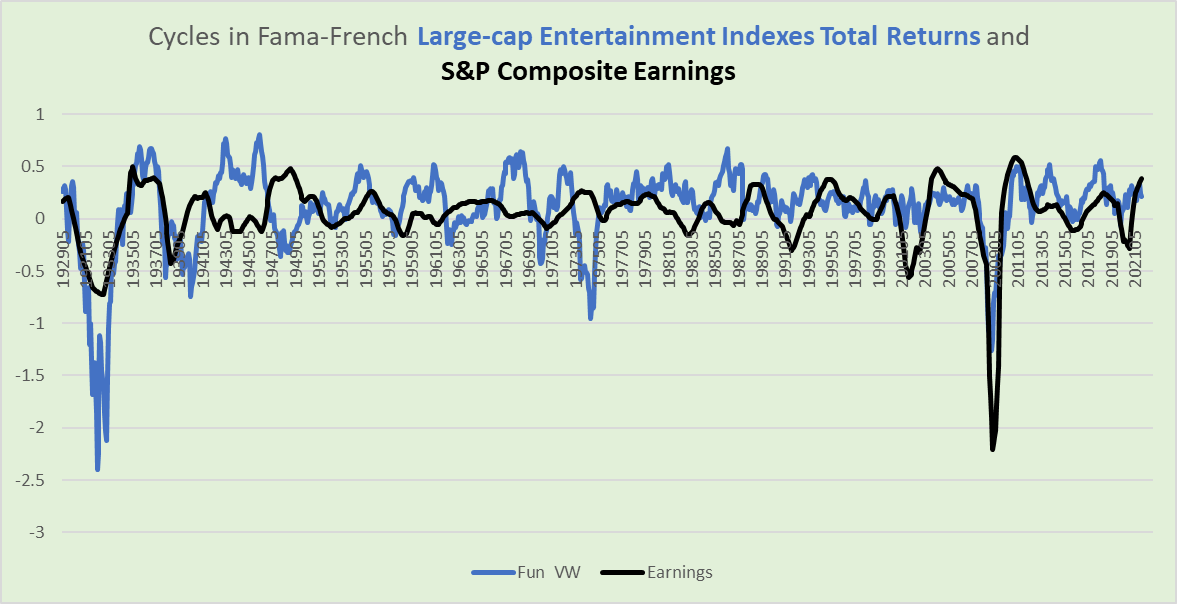

Chart Ok. Leisure shares are broken most by twin growth-deflation shocks. (Fama-French, Shiller)

Risky earnings cycles are likely to coincide with risky Leisure returns.

Over longer-term intervals, the dividend yield has been a considerably respectable predictor of the {industry}’s returns. Low yields are usually adopted by low returns.

Chart L. Leisure returns are considerably correlated with the dividend yield (Fama-French information)

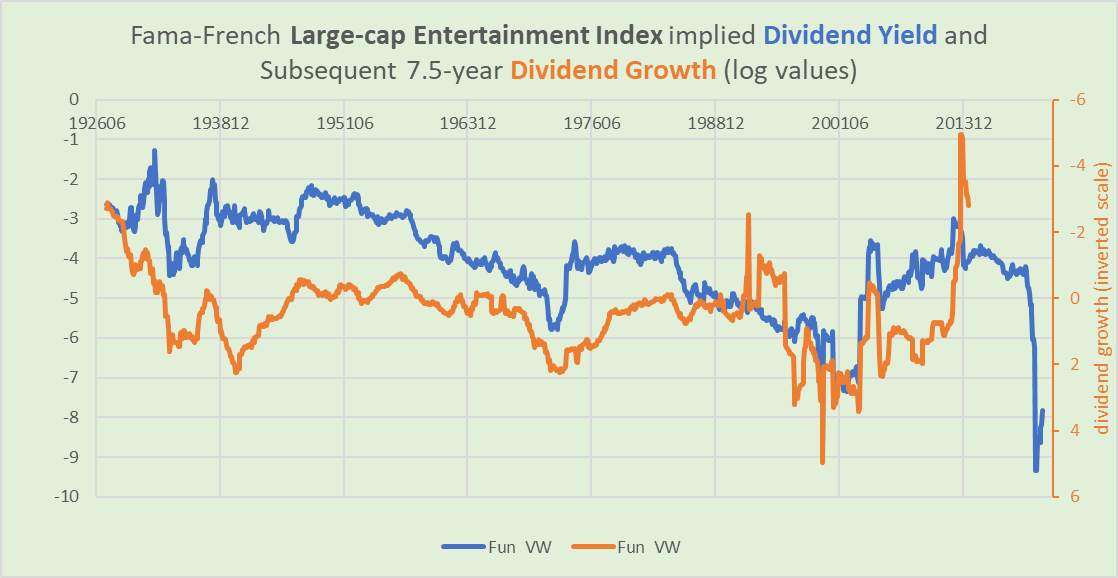

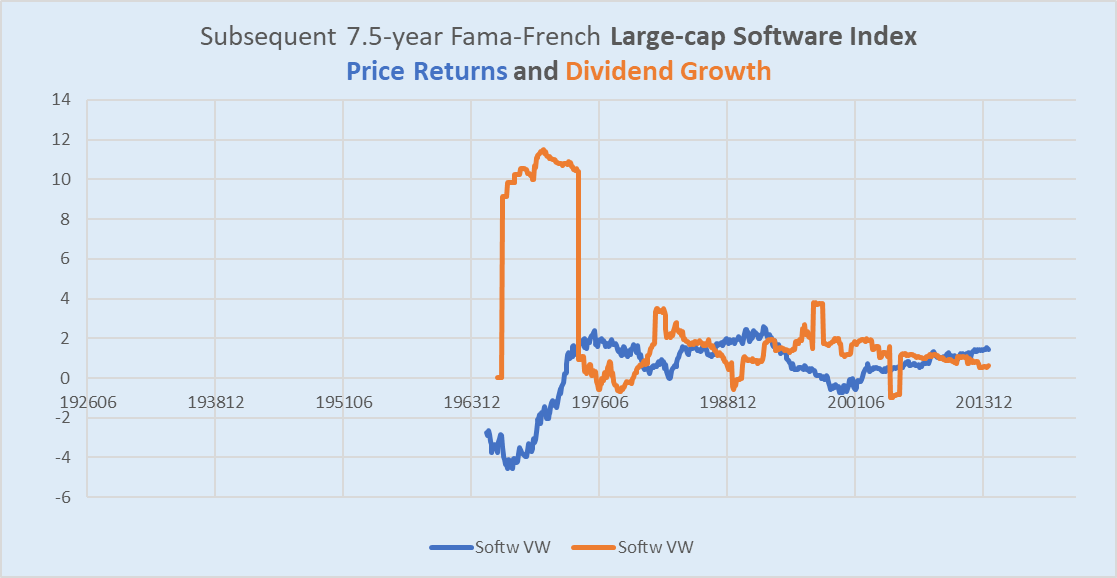

The dividend yield is definitely a greater predictor of dividend progress than it’s returns. Low yields usually end in excessive dividend progress, as may be seen within the following chart.

Chart M. Dividend progress is negatively correlated with the dividend yield. (Fama-French)

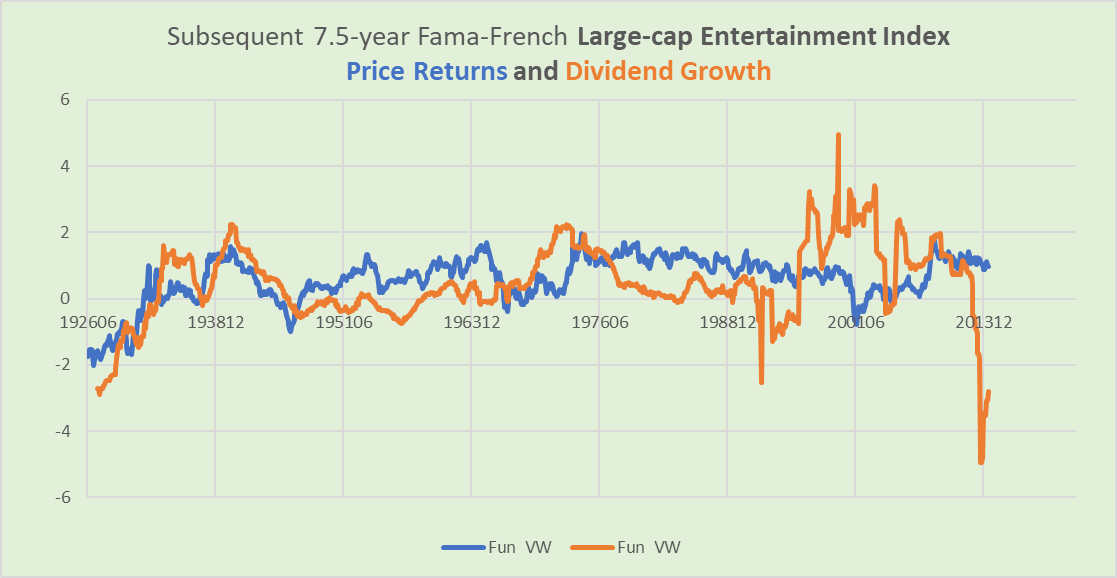

However, aside from the Despair and the restoration from the Despair, dividend progress and value returns are usually negatively correlated (-0.1 since World Warfare II).

Chart N. Value returns and dividend progress are usually negatively correlated (Fama-French)

Dividends go up throughout inflationary episodes, however costs don’t. Beneath depressionary circumstances, each go down, and in restoration, each rise. So historical past appears to counsel from the restricted proof now we have.

With yields low, there’s a threat of low long-term returns. On the optimistic aspect, dividends would possibly develop, however optimism must be checked by the excessive stage of cyclical inflation now we have. That inflation raises the likelihood of a deflationary shock. If it’s a non permanent shock, we’d see a pointy however “transitory” despair in Leisure shares. Have been progress to be extra persistently slowed, we’d see persistently damaging returns and damaging dividend progress within the 2020s.

That covers the Leisure {industry}. As talked about earlier, lots of the patterns now we have discovered listed here are discovered within the Software program {industry}, so it will likely be essential to maintain that in thoughts once we deal with these shares close to the top. However, let’s distinction what now we have discovered up to now with the Telecommunications {industry} first.

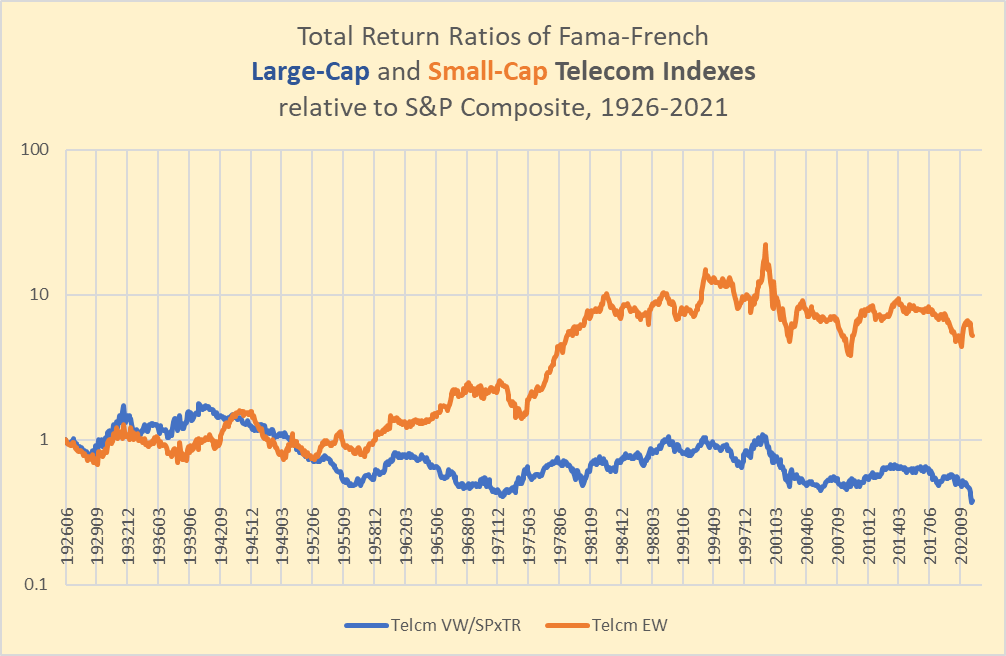

Telecommunications more likely to do poorly however higher than Leisure

If Leisure shares languished within the Nice Despair, Telecommunications shares held up fairly nicely after which did their greatest to maintain up with the broader market after that.

Chart O. Telecoms shined on a relative foundation through the Nice Despair. (Fama-French, Shiller)

Massive-caps have been practically pretty much as good as bonds within the Thirties.

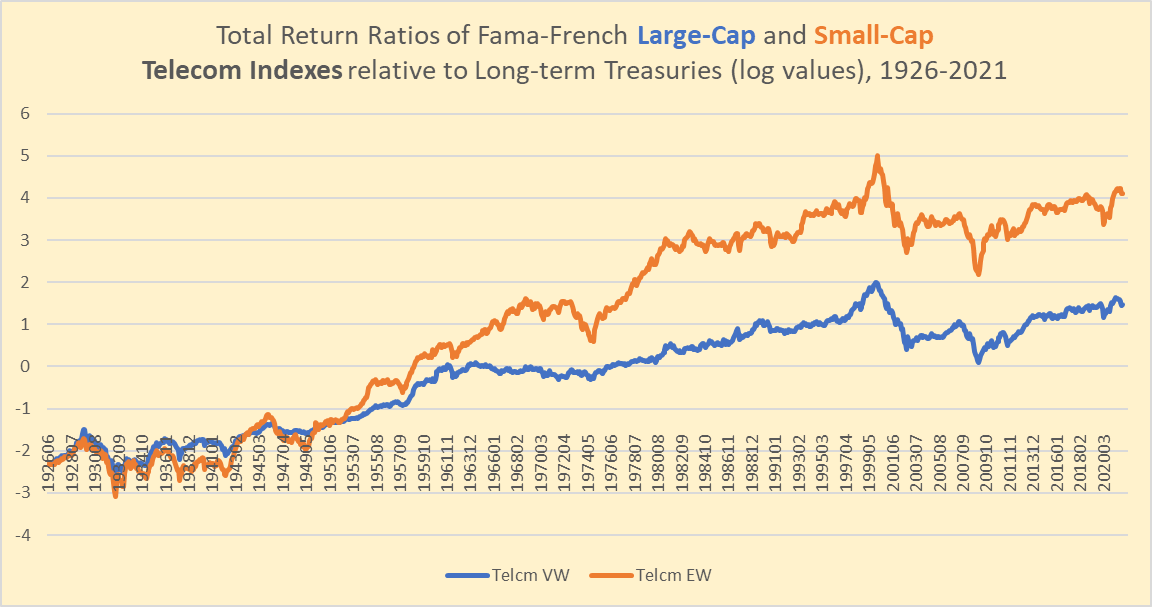

Chart P. Telecoms did practically in addition to bonds through the Despair, however have struggled to maintain up because the Dot.com bust. (Fama-French, Shiller, St Louis Fed)

Each charts counsel they’ve struggled particularly because the dot.com bust and by no means actually recovered their previous trajectory.

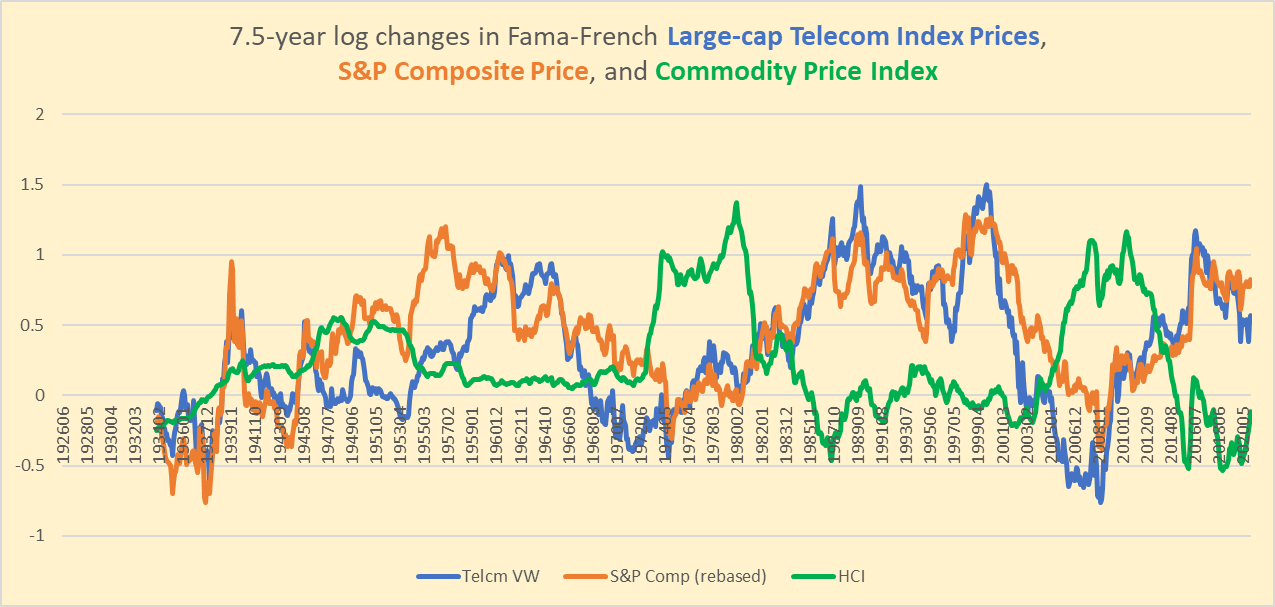

Telecoms costs typically observe the broader market. I’m not certain if “beta” is the appropriate categorization, however because the Sixties, there was one thing of a bent for telecom costs to peak and trough at extremes relative to the S&P. If we consider the Seventies and 2000s as being common bear markets, telecoms shares led the best way down in each instances.

Chart Q. Telecoms nearly appear to anticipate inflation. (Fama-French, Shiller, Warren & Pearson, St Louis Fed, World Financial institution)

Efficiency within the telecoms {industry} is often low during times of excessive commodity inflation, but it surely doesn’t specific the identical sensitivity to cyclical inflation that we present in Leisure or the broader market. The sharp cyclical falls since 2000 (see the next chart) appear to have been due primarily to telecom shares having gotten caught up within the dot.com growth and the following bust.

Chart R. Telecoms don’t appear as susceptible to cyclical inflation shocks. (Fama-French, World Financial institution)

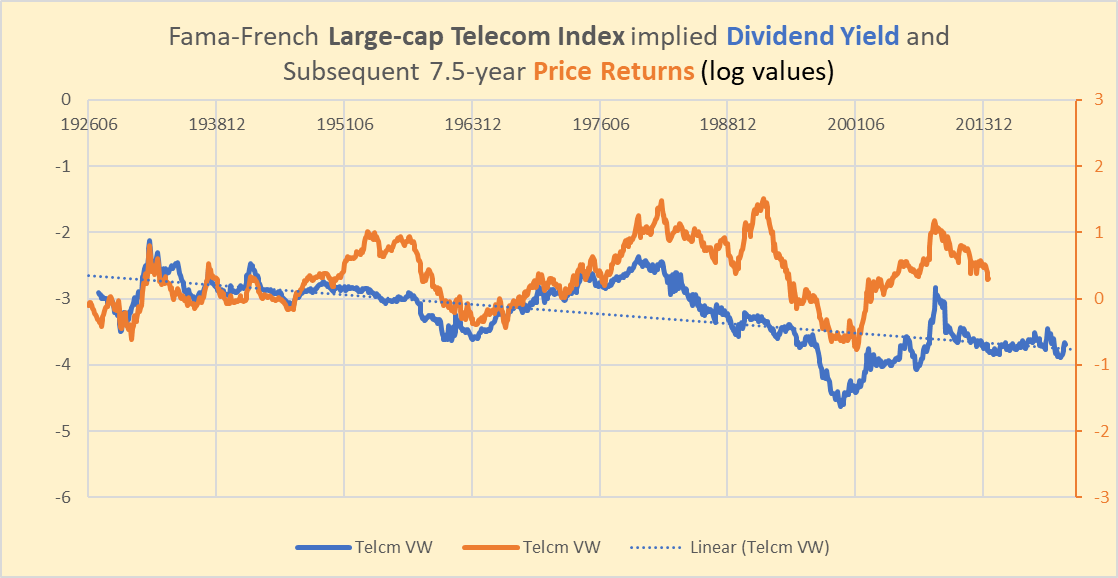

Telecoms returns have constantly been anticipated by the dividend yield.

Chart S. The dividend yield has been predictor of telecoms returns. (Fama-French)

The correlation between the yield and subsequent whole returns is 0.6.

With the dividend yield comparatively low and relative efficiency already having peaked, one would possibly count on returns in telecoms to be low however in all probability not as little as in Leisure shares. In case of a Despair-style final result, the Telecommunications index is likely to be anticipated to outperform Leisure by a large margin.

Software program shares more likely to do very poorly in the rest of decade

Software program shares have one of the crucial distinctive profiles within the Fama-French indexes, primarily within the three-way relationship between valuations, dividend progress, and returns.

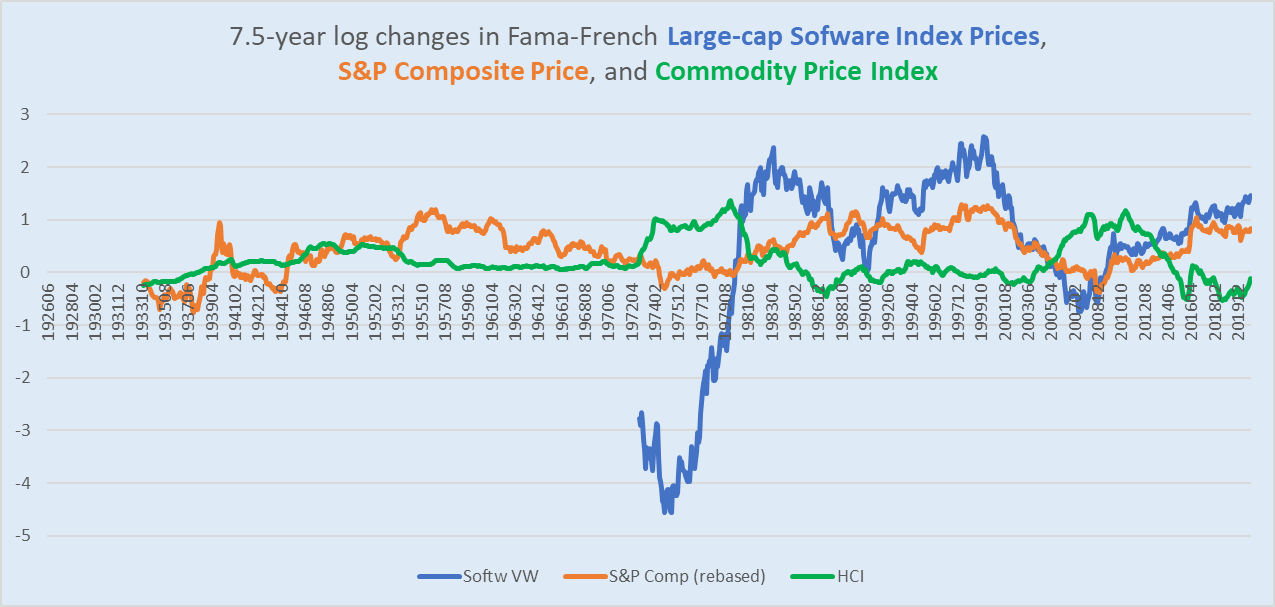

Recall from Chart H that dividend yields on Software program shares have all the time been considerably decrease than these for the S&P. Value strikes have additionally been rather more excessive, as you may see within the following chart.

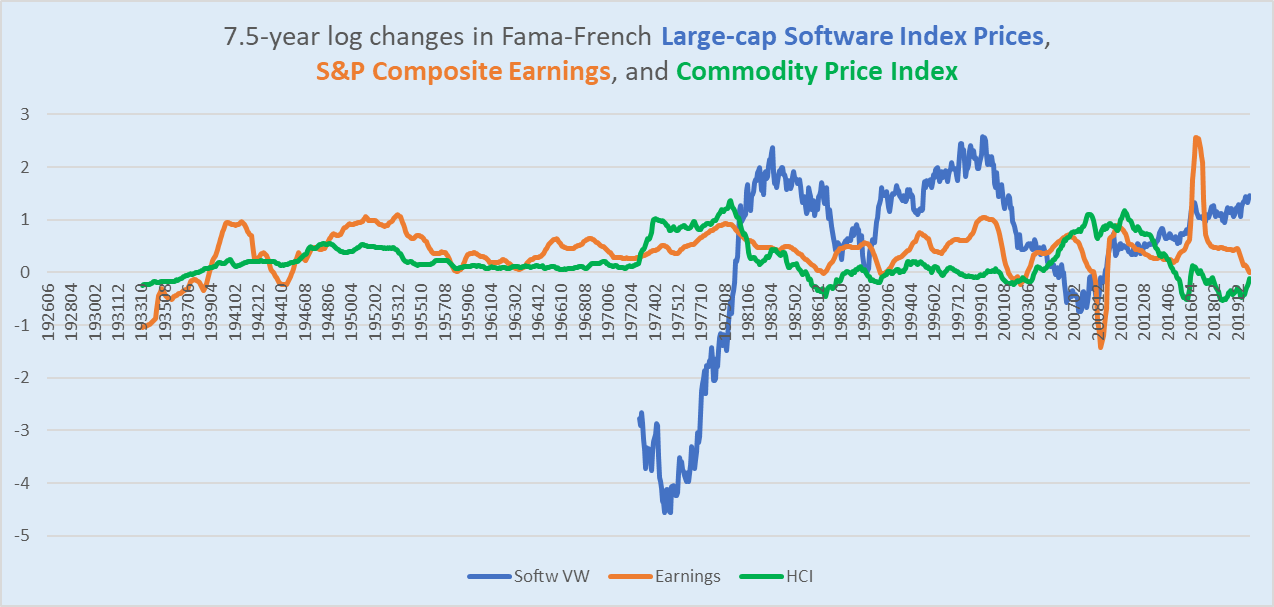

Chart T. Software program shares are extraordinarily risky over the long run. (Fama-French, Shiller, World Financial institution, St Louis Fed, Warren & Pearson)

As with most inventory indexes, Software program shares don’t like excessive and sustained commodity inflation.

The next chart reveals that when S&P earnings progress (orange) exceeds commodity inflation (inexperienced), software program shares (blue) explode greater.

Chart U. Software program shares are extraordinarily conscious of relative efficiency of S&P 500 earnings and commodities. (Fama-French, Shiller, World Financial institution, St Louis Fed, Warren & Pearson)

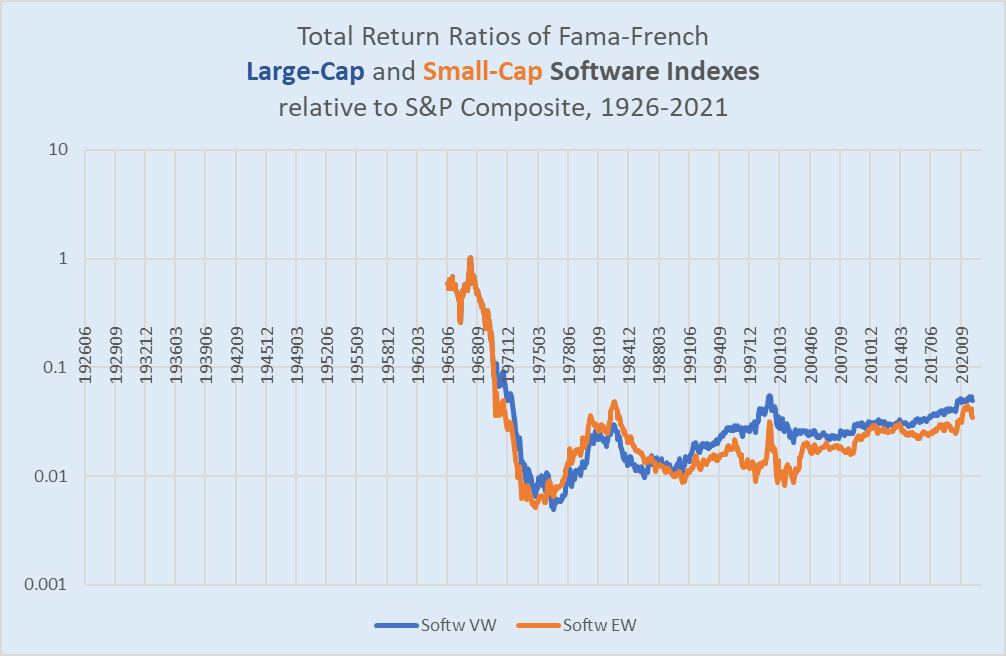

Considerably surprisingly, when it comes to relative efficiency, they’ve by no means caught up with the place they have been within the late Sixties.

Chart V. Software program shares are practically as excessive as they have been in 2000 on a relative foundation. (Fama-French, Shiller)

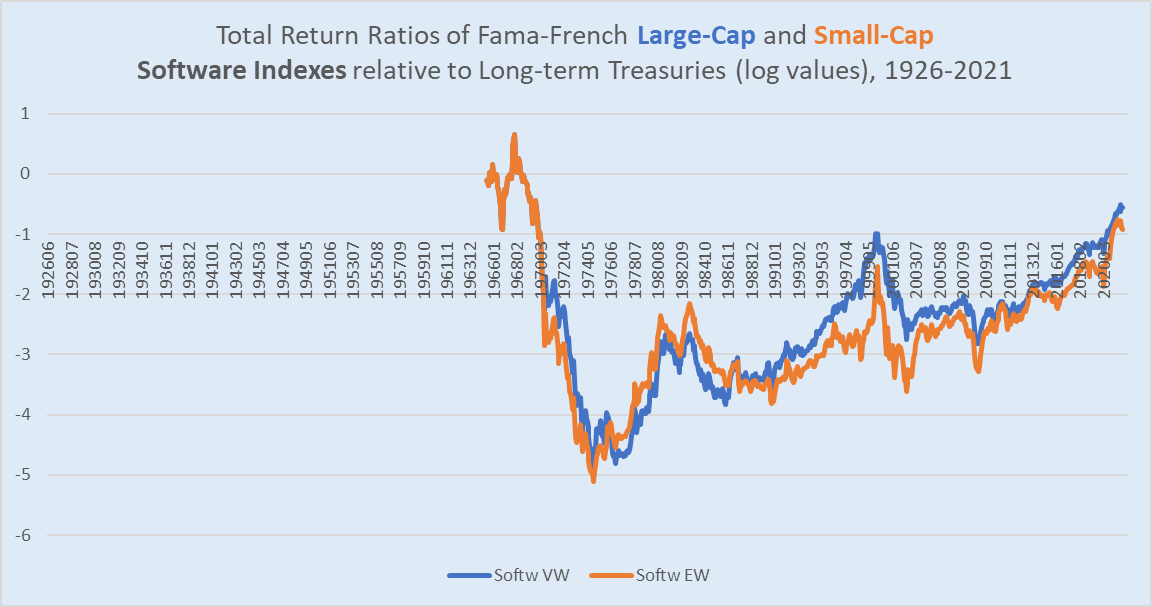

Even relative to Treasuries!

Chart W. Software program shares expertise nice swings in returns. (Fama-French, Shiller, St Louis Fed)

A few asides about this chart: First, discover that as with the Leisure {industry}, small caps have largely underperformed massive caps because the Nineteen Eighties. Second, I believe there could also be some form of distortion attributable to a small pattern measurement because the equal-weighted and value-weighted indexes carried out identically up till the Seventies (I believe the variety of shares was 1).

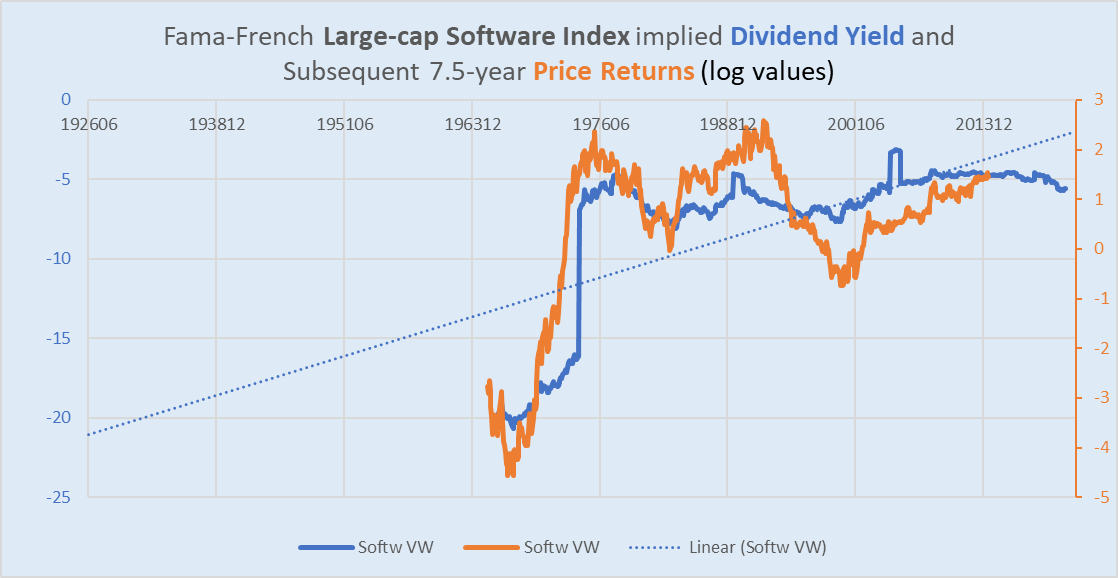

In any case, there was a powerful correlation between the dividend yield and returns.

Chart X. Dividend yields have been good predictors of software program returns. (Fama-French)

And, there was a powerful damaging correlation between the dividend yield and subsequent dividend progress.

Chart Y. Dividend yields have additionally been good predictors of dividend progress in software program shares. (Fama-French)

This then results in a powerful damaging correlation between dividend progress and value efficiency.

Chart Z. Dividend progress and value returns are negatively correlated in software program shares. (Fama-French)

The dividend progress doesn’t appreciably alter the correlation between the dividend yield and returns. The dividend yield has a -0.82 correlation with each value and whole returns.

It’s arduous to say if most of these correlations will maintain indefinitely. The proof appears to level to an {industry} that’s slowly converging with the broader market, notably when it comes to the degrees of the yields and the respective charges of return. But, convergence itself means that the damaging correlation between the dividend yield and returns will maintain since this seems to be a property of contemporary markets, as evidenced by the connection between the CAPE ratio and subsequent returns.

Briefly, though the dividend yield on Software program shares is close to its historic common, it’s the highest it has been in practically 20 years. Maturation of the sector ends in greater dividend progress and decrease returns suggesting maybe multiples which can be more likely to be decrease and decrease at every “secular” peak.

I believe this interpretation is backed by an evaluation of tech shares on the whole.

The Tech Sector

If we have been to categorize XLC’s holdings by Fama-French’s 12-sector information, we’d discover that 54% of the shares are categorized as Enterprise Tools and 32% as Telecoms. Primarily based on an evaluation of historic sector performances, I’ve discovered that Enterprise Tools shares are more likely to each underperform the broader market over the rest of the 2020s whereas cyclical sectors like Power are more likely to outperform. That is more likely to coincide with low returns for the market as an entire till the top of the last decade. On prime of that, an evaluation of the patterns in S&P Composite value and earnings suggests very low returns for markets each through the the rest of the 2020s and 2030s.

Tech booms, particularly once they coincide with depressed power performances (in each equities and the uncooked commodities), are usually adopted by considerably decrease market returns, particularly within the tech sector, regardless of subsequent actual technological progress (that is one thing I lined in my piece on electrical autos).

The factor that pops these bubbles or a minimum of alerts {that a} bubble is about to pop is a sudden, cyclical surge in commodities, particularly power costs, simply as now we have skilled because the oil costs recovered from their pandemic lows.

Conclusion

Tech shares are more likely to underperform within the 2020s—I suppose we are able to say “proceed underperforming”, at this level—and the patterns we discover there usually are not solely mirrored however amplified within the comparatively younger Software program {industry}.

Leisure shares are amongst these which I consult with as “Baumol shares”, shares that seem to learn from the method of “value illness”. In the actual financial system, William Baumol discovered that technological progress drives up relative costs within the providers sector (healthcare, training, leisure, authorities, and many others) whereas driving down relative costs within the sturdy items sector (computer systems, vehicles, telephones, and many others). However throughout the realm of equities, these sectors have outperformed cyclical (usually, industrial and commodity) sectors over the long run. This can be why tech shares (resembling Software program {industry} shares) and Leisure shares appear to have comparable profiles. The acute lows within the Leisure {industry}’s dividend yield counsel each a peak out there as an entire and considerably decrease returns within the 2020s.

That leaves the Telecommunications part. As with the S&P 500, the low dividend yield suggests low returns, particularly within the early phases of a secular slowdown, however it’s more likely to outperform each Leisure and Software program shares within the the rest of the last decade. Historical past means that, if a Despair-like final result have been to occur–and I imagine the possibilities of such an final result are high–telecoms may considerably outperform these two different industries, regardless that returns are nonetheless more likely to be damaging.

To place this again within the language of the GCIS classifications, XLC is more likely to underperform the S&P 500 over the rest of the last decade, and inside XLC, shares within the Telecommunications Companies Trade Group are more likely to outperform these within the Media & Leisure Trade Group.