What You Must Know

- Life insurers are amassing much less fluid.

- Underwriting procedures are extra versatile.

- Shoppers who get in-person medical exams should still get extra protection.

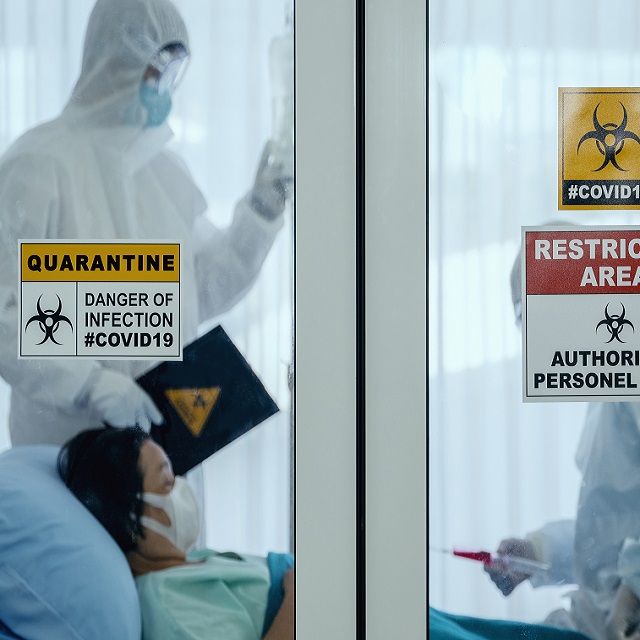

Whereas the month of March used to primarily be related to seasonal occasions like collegiate basketball tournaments and Ladies’s Historical past Month, this 12 months it bears a grim reminder: the two- 12 months anniversary of the COVID-19 pandemic.

Whereas a lot progress has been made within the combat in opposition to COVID-19, I don’t assume I’m alone in saying that it has been a life-altering expertise.

As we attempt towards a future the place masks are not required and we will all be in-person once more, it’s necessary to acknowledge that the pandemic has touched every of us in several methods.

As somebody steeped within the life insurance coverage enterprise, it’s no shock that I’ve witnessed a major change in how individuals take into consideration and focus on mortality. Whereas discussing end-of-life wants and dying stays an uncomfortable subject for a lot of, I’ve observed a sluggish, however regular, change in individuals’s willingness to debate.

How this dialog performs out and evolves is completely different for everybody. However, as a monetary advisor, it’s seemingly many purchasers are approaching you with corresponding questions on life insurance coverage.

It’s no secret that COVID-19 has led to an increase in life insurance coverage purposes: MIB reported a record-breaking 4% improve in year-over-year purposes in 2020 and an additional 3.4% year-over-year improve in 2021. However, what’s much less clear for monetary advisors and their purchasers is how accessible life insurance coverage choices have been impacted.

As a digital life insurance coverage company dedicated to working with companions to make life insurance coverage extra accessible to purchasers, let me give you a peek behind the scenes.

The Regulation of Massive Numbers

For the life insurance coverage business, mortality has traditionally been comparatively straightforward to foretell.

Whereas there are all the time distinctive concerns for each applicant, mortality charges have traditionally adopted the regulation of huge numbers and seen minimal volatility.

Enter COVID-19. Whereas each life insurance coverage group has been impacted by COVID-19 in several methods, there isn’t a denying the influence of the pandemic on claims.

In response to the American Council of Life Insurers, for instance, life insurance coverage dying profit funds rose 15.4% in 2020, principally because of the pandemic and the biggest improve because the 1918 influenza pandemic.

What does this imply for customers seeking to purchase life insurance coverage? Most significantly, there was no corresponding improve in coverage premiums. In actual fact, Haven Life really lowered our premiums throughout the pandemic.

What is occurring, nonetheless, is that the pandemic has accelerated how insurers leverage applicant knowledge.

That is manifesting itself in a couple of methods:

1. How Information Is Analyzed

Whereas underwriters have lengthy had entry to private knowledge like prescription historical past and driving report, the pandemic necessitated that such knowledge be utilized in new methods.