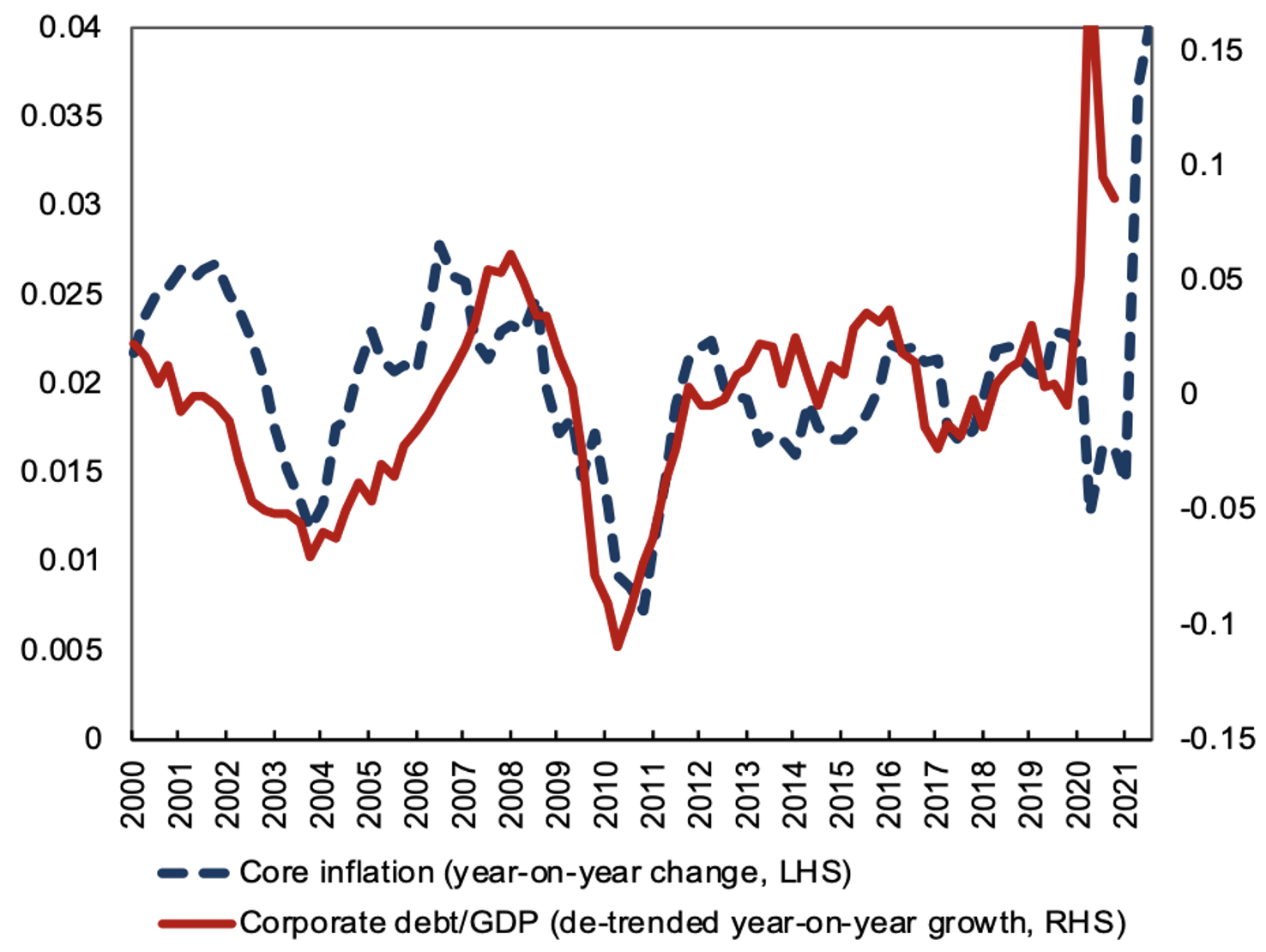

The COVID-19 pandemic has seen public sector debt ranges rise to historic ranges and concern has been expressed concerning the implications of this each for public finance and inflation. Nevertheless, alongside the rise in public debt has been a rise in company debt – the implications of which has obtained far much less consideration. Company debt has been growing globally since 2007,1 however the pandemic disaster has led to an extra sharp improve.2 US company indebtedness rose by 12.5% between December 2018 and December 2020, far more than its whole improve in your entire decade main as much as COVID-19 (see additionally Abraham et al. 2020 and Jordà et al. 2020 on the rising company indebtedness). Towards this backdrop, inflation has risen. In Q2 2021, US CPI inflation has jumped to a 13-year excessive and the US economic system noticed the best price of core inflation since 1991, and UK inflation has topped the Financial institution of England’s inflation goal. (See Desk 1 for company indebtedness and Determine 1 for US company indebtedness and core inflation.). Whereas the hyperlink between public debt and inflation may be analysed by fashions reminiscent of set out within the Fiscal Concept of the Value Degree, there’s little accessible on the function that company debt would possibly play in hindering the management of inflation.3

In a current paper (Goodhart et al. 2021), we argue that company indebtedness poses a problem for financial coverage in two methods. First, it introduces a further revenue impact throughout heterogenous households that shifts the mixture provide curve and renders it extra elastic. This impact counteracts the normal substitution impact on dampening mixture demand, thus affecting the general effectiveness of elevating the coverage price. Second, it creates a higher trade-off between output and inflation stabilisation that requires a reassessment of coverage priorities.

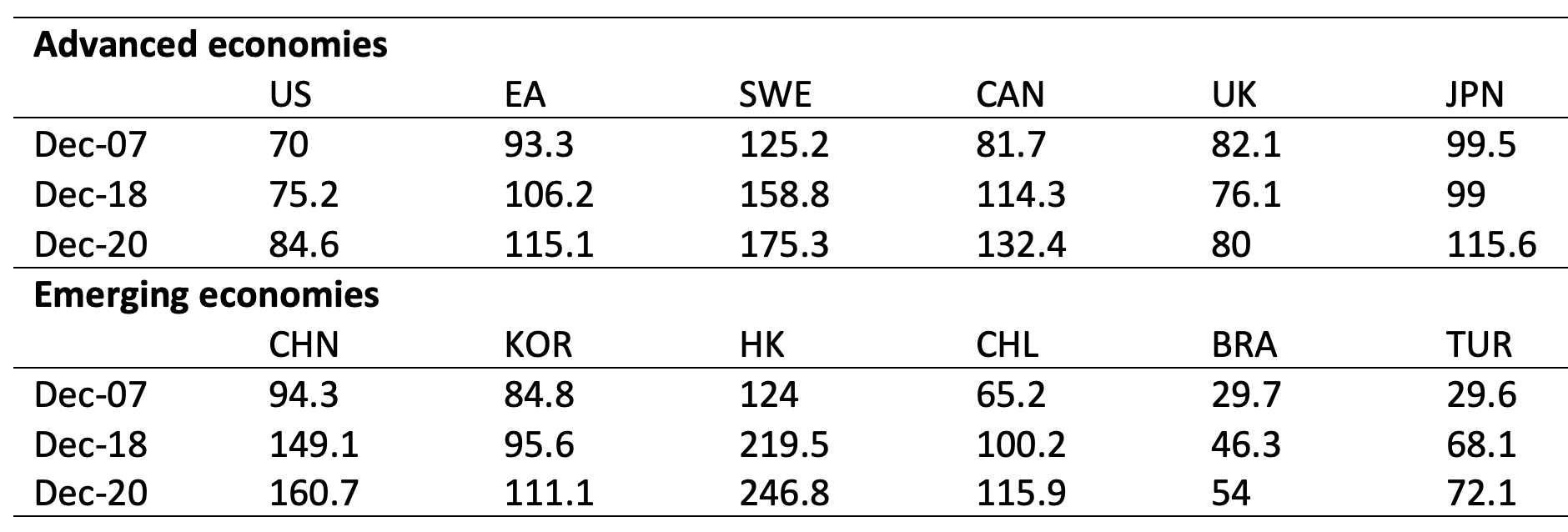

Desk 1 Indebtedness of non-financial firms

Supply: BIS, Goodhart and Pradhan (2020).

Word: Numbers specific non-financial company debt as a proportion of GDP.

Determine 1 US Core inflation and de-trended company debt/GDP

Supply: Board of Governors of the Federal Reserve System and US Bureau of Financial Evaluation, retrieved from FRED, Federal Reserve Financial institution of St. Louis, and authors’ calculation.

Table of Contents

The impact of elevating rates of interest for controlling inflation

The presence of debt necessitates the excellence between key savers and lenders of the macroeconomy. Thus, the economic system in Goodhart et al. (2021) options two sorts of households: (1) lender households, i.e. the bondholders that accumulate protected company debt to save lots of (in apply they maintain company debt by monetary intermediaries or mutual funds within the type of varied sorts of nominal monetary belongings); and (2) proprietor households, i.e. the fairness holders that personal companies that in flip challenge the company debt. The differentiation between these two sorts of households is per Fisher’s (1910) narrative on the ‘enterpriser-borrower’ and the ‘creditor, the salaried man, or the labourer’.4 The revenue impact by debt that we determine impacts each mixture demand and mixture provide. On mixture demand, because the financial contraction will increase the financing prices of wage payments, there’s a downward strain on mixture demand. That is the standard substitution impact. Nevertheless, when the mounted value of the legacy debt is excessive, companies really feel the necessity to unfold the mounted value over a bigger manufacturing scale and demand extra labour, which results in an upward strain on mixture demand. That is the revenue impact by debt.

On mixture provide, the financial contraction reduces the true wage and market worth of company bond, resulting in a deterioration of the lender households’ wealth. Nevertheless, the bond worth goes down much less relative to actual wages in a high-debt situation than in a low-debt situation. It is because the financial contraction doesn’t result in a parallel shift of the time period construction of the rate of interest. Despite the fact that each the brief price and lengthy price go up, the lengthy price will increase to a lesser diploma, and the time period construction turns into flatter. We present that the bond worth goes down much less relative to actual wages in a high-debt situation than in a low-debt situation. Subsequently, the detrimental impression on wealth within the high-debt situation is much less extreme than within the low-debt situation, which leads to the efficient labour elasticity being increased the upper legacy debt is. That is the revenue impact we determine on mixture provide. This revenue impact on each the demand facet and provide facet obstructs financial contractions from decreasing inflation, for causes shortly defined under.

When company debt stage is under a threshold, the normal Taylor precept holds: elevating the coverage price lowers present inflation. Nevertheless, we present that increased debt ranges result in smaller falls in costs, that means that financial coverage turns into much less efficient in controlling inflation. Historically, elevating the coverage price lowers mixture demand and causes costs to fall, i.e. the substitution impact that places downward strain on mixture demand and inflation. Nevertheless, through the revenue impact by nominal company debt, the mixture demand curve shifts much less to the left. The combination provide curve turns into extra elastic on account of the next efficient labour provide elasticity, and it strikes in the identical path as the mixture demand curve. Subsequently, in equilibrium, though output falls responsively, costs and inflation solely reply mildly. Apparently, when the company debt stage is above a threshold, the Taylor precept turns into inverted. Elevating the coverage price really will increase inflation as a result of the revenue impact dominates the substitution impact.

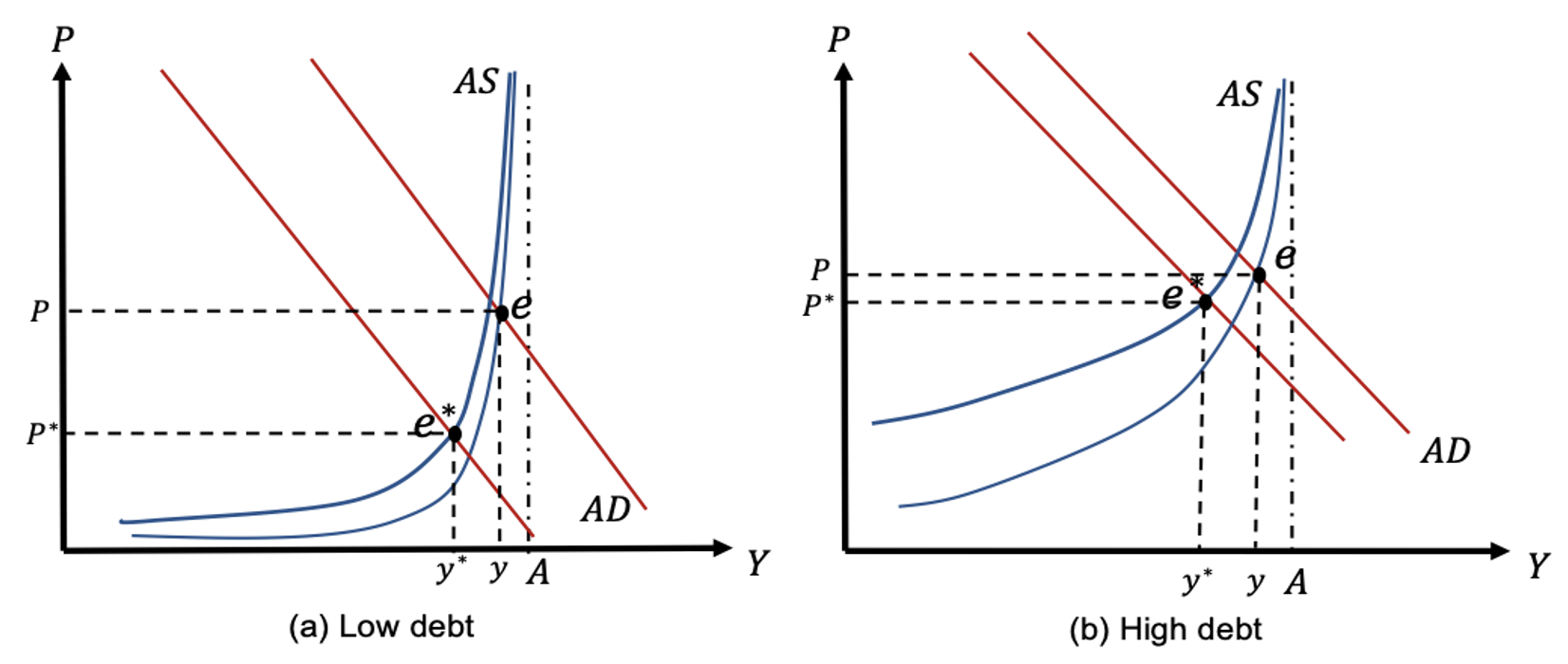

To strengthen this instinct, we use an mixture provide (AS) and mixture demand (AD) diagram for the products market as an example a low debt situation and a excessive debt situation with an increase within the coverage price (see Determine 2). Within the low-debt situation, the rise within the coverage price considerably reduces inflation, whereas within the high-debt situation, the rise within the coverage price solely reasonably reduces inflation, however output falls significantly. It is because with the next debt stage, the AD curve shifts much less to the left and the AS curve turns into extra elastic because of the revenue impact of debt. Certainly, if the debt stage is sufficiently excessive, the rise within the coverage price would even improve inflation, and the Taylor precept turns into inverted. Subsequently, the implication of Determine 2 is that with an ordinary Taylor rule, the decline in inflation can be a lot weaker and short-lived. If the Taylor rule places the next weight on output stabilisation, it may even amplify the inflationary strain, and output would extra shortly revert again to the earlier stage (the next subsection discusses this implication in higher element).

Determine 2 AS-AD diagram: An increase within the coverage price

Notes: The left diagram (a) illustrates a low debt situation. The suitable diagram (b) illustrates a excessive debt situation. Equilibrium e is the equilibrium earlier than the rise within the coverage price, and equilibrium e* is the equilibrium after the rise within the coverage price. The vertical line at A is the output when there isn’t a debt within the economic system.

In our mannequin, we have now assumed that no agency goes out of business. There are a number of causes for making this assumption. The primary is that insurance policies have been so expansionary, liquid financial savings amongst shoppers so excessive, and the labour market so tight that the overwhelming majority of companies now wouldn’t count on that they could change into bankrupt. As much as the purpose of chapter, the prior argument about labour utilization happening by much less in a legacy debt case stays true, however ought to chapter happen, labour demand would instantly fall completely to zero. The second cause is that, with the potential for chapter, the fundamental drawback of contractionary financial coverage in a world with excessive company debt is {that a} small improve in rates of interest might not restore inflation again to focus on, whereas a bigger improve in rates of interest would possibly trigger such giant bankruptcies as to convey a couple of recession. In the meanwhile, the financial authorities appear reluctant to implement a sufficiently contractionary financial coverage which may result in large-scale bankruptcies. As long as they’re extra terrified of bankruptcies and recession than they’re of continuous inflation, a mannequin with no chapter appears applicable.

Reassessing the trade-off between inflation and output stabilisation

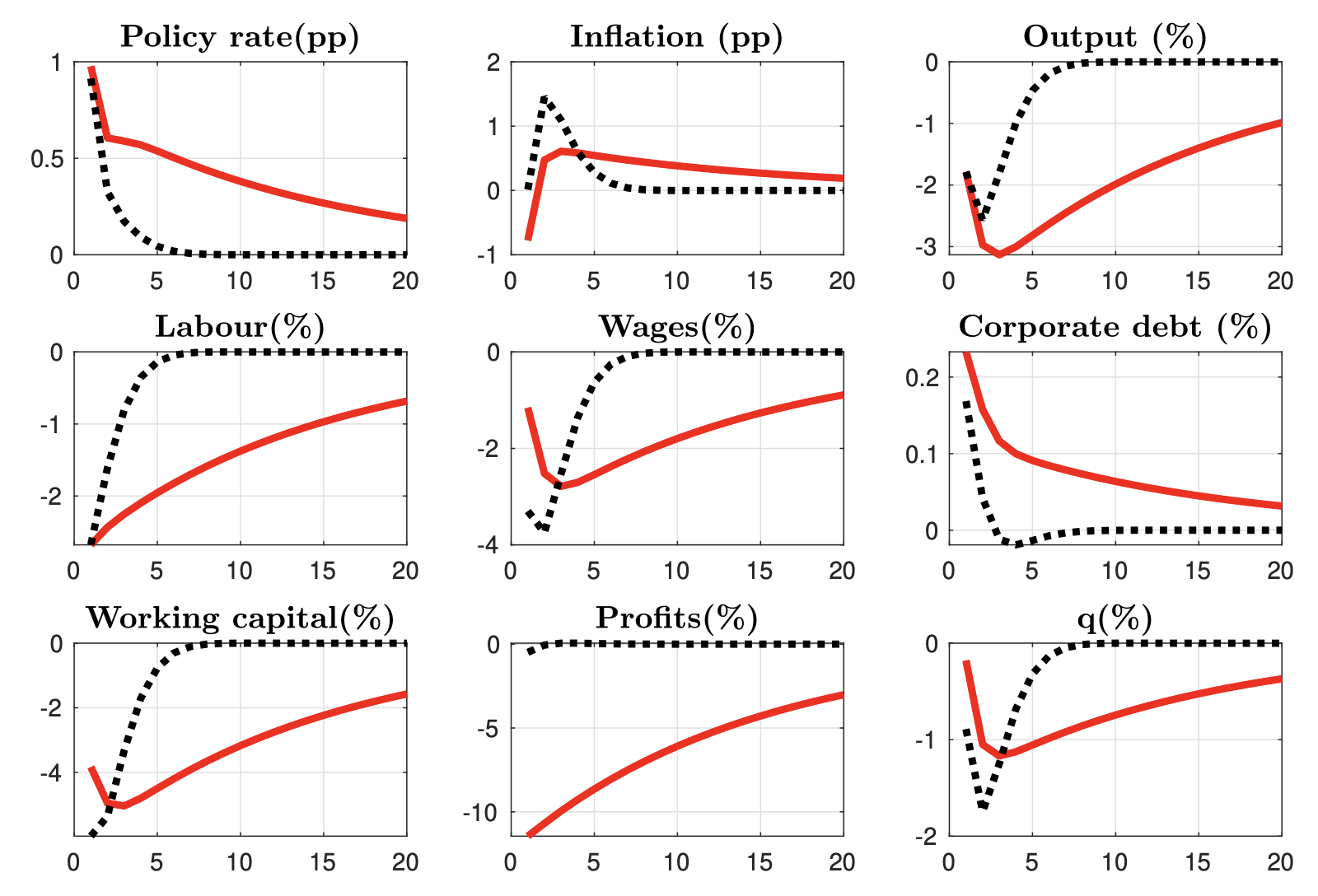

Determine 2 illustrates that at increased ranges of company debt, bigger reductions in output are wanted to acquire the identical discount in inflation. We develop this argument inside a New Keynesian DSGE mannequin and present the responses of a excessive debt economic system to a contractionary financial coverage shock with an ordinary benchmark Taylor rule and in addition an output stabilisation Taylor rule. The usual Taylor rule has inflation and output coefficients generally used within the literature (an inflation coefficient of 1.5 and output coefficient of 0.2), however the output stabilisation Taylor rule has the next output coefficient of 0.9, chosen in line with the excessive vary estimated within the literature, and advised by policymakers (e.g. Bernanke, 2015).

As Determine 3 reveals, after a contractionary financial coverage shock, in contrast with the benchmark Taylor rule, the output stabilisation Taylor rule may convey output again as much as the regular state swiftly, whereas with the benchmark Taylor rule, the lack of output and employment is larger and way more persistent. Nonetheless, the output stabilisation Taylor rule results in a a lot increased inflationary profile, and furthermore, the upper the debt stage is, the extra acute inflationary strain turns into. This coverage experiment underscores a higher trade-off between output and inflation stabilisation when there’s a giant quantity of company debt within the economic system, and thus, the absence of the ‘divine coincidence’ (Blanchard and Galí 2007).

Determine 3 Financial contraction with an ordinary Taylor Rule an output stabilisation Taylor Rule

Notes: The pink stable line is the benchmark Taylor rule and the dashed black line is the output stabilisation Taylor rule. The y-axis reveals the proportion change and the x-axis reveals the variety of intervals. q is the bond worth. Aside from inflation and the coverage price, all variables are in actual phrases.

Conclusion

Company debt has been on the rise globally for greater than a decade. The COVID-19 pandemic has coincided with an extra improve in company indebtedness with inflation having now risen. In Goodhart et al. (2021), we argue that top company debt ranges might render contractionary financial coverage much less efficient in controlling inflation. Apparently, when the extent of company debt is sufficiently excessive, a contractionary financial coverage even will increase inflation.

Certainly, this impact is harking back to the stagflation episode in 1972–73 after the oil shocks, the place contractionary coverage was related to cost-push inflation, puzzling economists on the time. Once more, the contemporaneous shifts of the AS and AD curves generate each output discount and inflation. Nevertheless, in our case the basic channel is through the elevated debt servicing prices of legacy debt and never through increased prices of manufacturing. The financial authority faces a way more troublesome trade-off between inflation stabilisation and output stabilisation when there’s a giant quantity of company debt within the economic system and huge scale of bankruptcies aren’t imminent. Below these circumstances, our work means that financial coverage is not going to be efficient in decreasing inflation gently in the direction of a delicate touchdown. Because of this central banks finally have to decide on between producing a recession, with important bankruptcies, or accepting persevering with stagflation. We consider that is additionally a coverage conundrum for the post-crisis situation, with high-debt zombie companies staying afloat with imminent agency defaults at document lows (e.g. Acharya et al. 2021, Caballero et al. 2008). Nonetheless, regardless that modelling the macroeconomic system with chapter is tougher, it could possibly be a helpful train for future analysis to look at the financial transmission mechanism when large-scale bankruptcies are attainable.

References

Acharya, V, M Crosignani, T Eisert and S Steffen (2021), “Zombie Lending: Theoretical, Worldwide, and Historic Views”, CEPR Dialogue Paper 16685.

Abraham, F, J J Cortina Lorente and S L Schmukler (2020), “Development of world company debt: Fundamental details and coverage challenges”, World Financial institution Coverage Analysis Working Paper 9394.

Bernanke, B S (2015), “The Taylor rule: A benchmark for financial coverage?”, Ben Bernanke’s Weblog, 28 April.

Blanchard, O and J Galì (2007), “Actual wage rigidities and the New Keynesian mannequin”, Journal of Cash, Credit score and Banking 39: 35–65.

Brunnermeier, Markus and Arvind Krishnamurthy (2020), ‘The macroeconomics of company debt’, The Overview of Company Finance Research 9(3), 656–665.

Caballero, R J, T Hoshi and A Okay Kashyap (2008), “Zombie lending and depressed restructuring in Japan”, American Financial Overview 98(5): 1943-77.

Christiano, L J, M Eichenbaum and C L Evans (2005), “Nominal rigidities and the dynamic results of a shock to financial coverage”, Journal of Political Financial system 113(1): 1–45.

Fisher, I (1910), Introduction to financial science, Macmillan.

Gomes, J, U Jermann and L Schmid (2016), “Sticky leverage”, American Financial Overview 106(12): 3800–3828.

Goodhart, C and M Pradhan (2020), The Nice Demographic Reversal, Springer Worldwide Publishing.

Goodhart, C, M U Peiris, D P Tsomocos and X Wang (2021), “Company legacy debt, inflation, and the efficacy of financial coverage”, Working Paper.

Jordà, O, M Kornejew, M Schularick and A M Taylor (2020), “Zombies at giant? Company debt overhang and the macroeconomy”, NBER Working Paper.

Ottonello, P and T Winberry (2020), “Monetary heterogeneity and the funding channel of financial coverage”, Econometrica 88(6): 2473–2502.

Mankiw, N G and S P Zeldes (1991), “The consumption of stockholders and nonstockholders”, Journal of Monetary Economics 29(1): 97–112.

Ravenna, F and C E Walsh (2006), “Optimum financial coverage with the associated fee channel”, Journal of Financial Economics 53(2): 199-216

Schularick, M and A M Taylor (2012), “Credit score booms gone bust: Financial coverage, leverage cycles, and monetary crises, 1870-2008”, American Financial Overview 102(2): 1029–61.

Toda, A A and Okay J Walsh (2020), “The fairness premium and the one p.c”, The Overview of Monetary Research 33(8): 3583–3623.

Endnotes

1 Company indebtedness within the euro space elevated by virtually 14% from an already excessive 93.3% in 2007. Sweden noticed a rise of 26.8% from 125.2%, whereas in Canada the rise was virtually 40%. This has additionally occurred in rising economies: China, Chile, Brazil, and Turkey have all seen greater than a 50% rise throughout this era. Hong Kong’s non-financial company debt-to-GDP ratio soared by over 77% to greater than 200%.

2 All through this column, ‘company debt’ refers back to the debt of the non-financial company sector.

3 Whereas a rising literature on company indebtedness focuses on the implications for agency funding and mixture demand (e.g. Gomes et al. 2016, Ottonello and Winberry 2020, Brunnermeier and Krishnamurthy 2020), much less consideration has been paid to how debt might hamper the transmission of contractionary financial coverage and its effectiveness in controlling inflation.

4 See Mankiw and Zeldes (1991) and Toda and Walsh (2020) amongst many others as examples of more moderen functions of this in addition to empirical proof.

5 Ravenna and Walsh (2006) present that the presence of a working capital or value channel alters the tradeoff between inflation and output stabilisation. We present that this tradeoff relies on the amount of company debt within the economic system.